Sept 09, 2024

The Markets

Investing in September can be like biting into a jelly doughnut and finding boiled cabbage—full of unwelcome surprises.

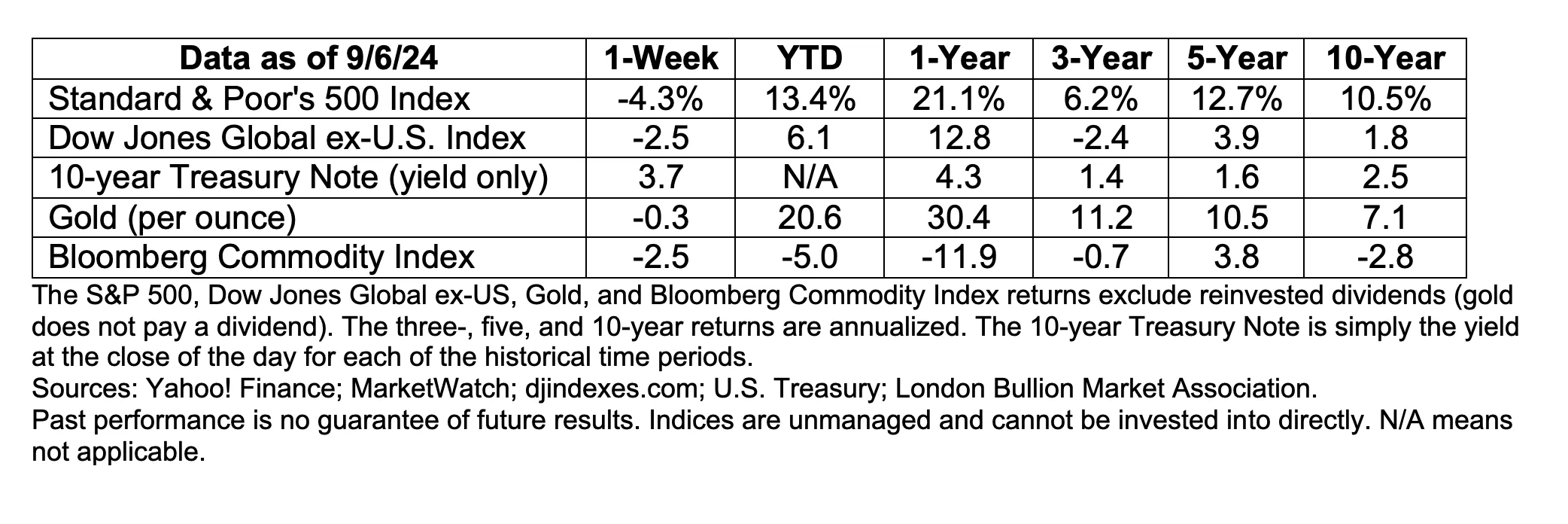

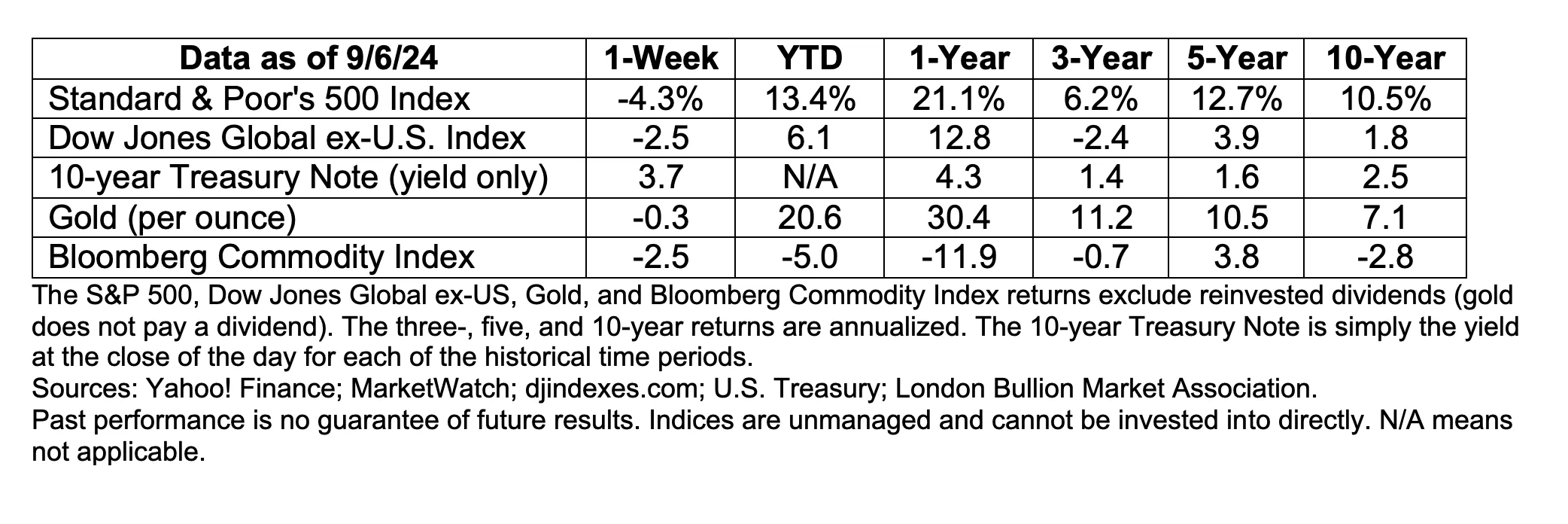

“History suggests September is the worst month of the year in terms of stock-market performance,” reported Isabel Wang of Morningstar. The Standard & Poor’s (S&P) 500 Index “has generated an average monthly decline of 1.2%…dating back to 1928, according to Dow Jones Market Data.”

One reason for the sharp stock market decline last week appeared to be concerns that the Federal Reserve may have waited too long to lower rates. During the week, economic data continued to present a mixed picture of the U.S. economy. The employment report released on Friday showed the United States added about 142,000 jobs in August—a significant increase from July—and that average hourly earnings were up 3.8 percent year over year. In addition, the unemployment rate ticked lower to 4.2 percent.

However, the report wasn’t quite as rosy as those numbers suggest. Fewer jobs were created than economists had predicted and “downward revisions from the two previous months suggest that the labor market is cooling faster than the initial data may indicate,” reported Lauren Kaori Gurley and Rachel Siegel of The Washington Post.

The information has some pundits speculating that Fed officials may opt for a larger rate cut than originally anticipated at the Fed meeting in September, according to CME FedWatch. On Friday, Federal Reserve Governor Christopher Waller said he support a September rate cut and was “open-minded about the size and pace of those reductions,” reported Ann Saphir of Reuters.

In recent weeks, investors have been feeling quite bullish, according to the AAII Sentiment Survey. During the last two weeks of August, more than 50 percent of survey participants indicated they expected the stock market to rise over the subsequent six months. The level of optimism among survey participants came close to the survey’s all-time high (52.9 percent on December 20, 2023) and remained well above the historical average of 37.5 percent.

Last week, investor sentiment shifted. Fewer participants were bullish – and fewer participants were bearish. The number of respondents who were neutral increased, which means they think stock prices will remain relatively unchanged over the next six months.

By the end of last week, major U.S. stock indices had moved lower, while bond markets rallied. U.S. Treasury yields fell across the yield curve and finished the week with the yield on the benchmark 10-year U.S. Treasury above the yield on the 2-year U.S. Treasury for the first time since July 2022, reported Connor Smith of Barron’s.

When markets are volatile, as they were last week, it’s normal for investors to worry. Before making any changes in response to short-term market fluctuations, remember that historical performance supports the idea that staying invested is a sound way to pursue long-term financial goals. If you have any questions about recent market volatility or your investments, please get in touch.

Weekly Focus – Think About It

“The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.”

—Marcel Proust, novelist

Disclosures and resources:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Enter the name of your commentary” please click here or write us at “Your Address Here”.

* To unsubscribe from the “Enter the name of your commentary” please reply to this email with “Unsubscribe” in the subject line or write us at “Your Address Here”.