Nov 18, 2024

The Markets

The United States stock market changed course.

Last week, the strength of the United States economy slowed investors’ roll. Federal Reserve (Fed) Chair Jerome Powell told business leaders in Dallas, Texas, that the performance of the United States economy has been “remarkably good,” better than any major economy in the world, which gives the Fed “the ability to approach our decisions carefully.”

Powell’s comments caused investors to reassess the likely pace of rate cuts. As they did, the probability of a December rate cut fell sharply, according to the CME FedWatch Tool.

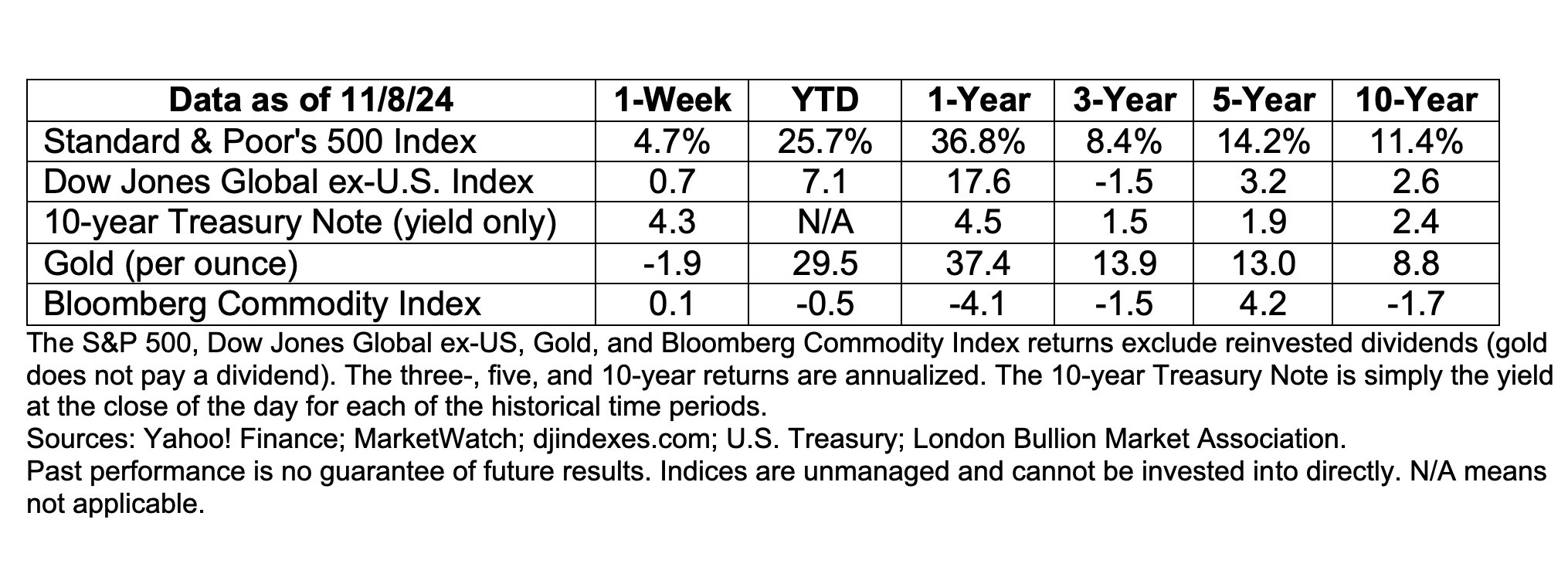

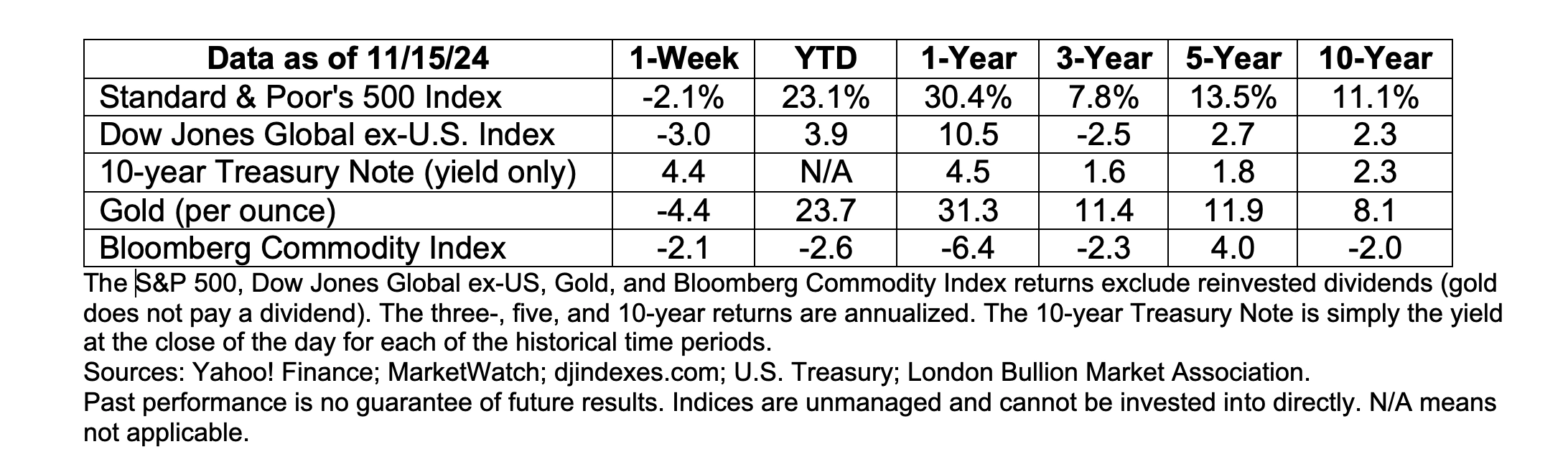

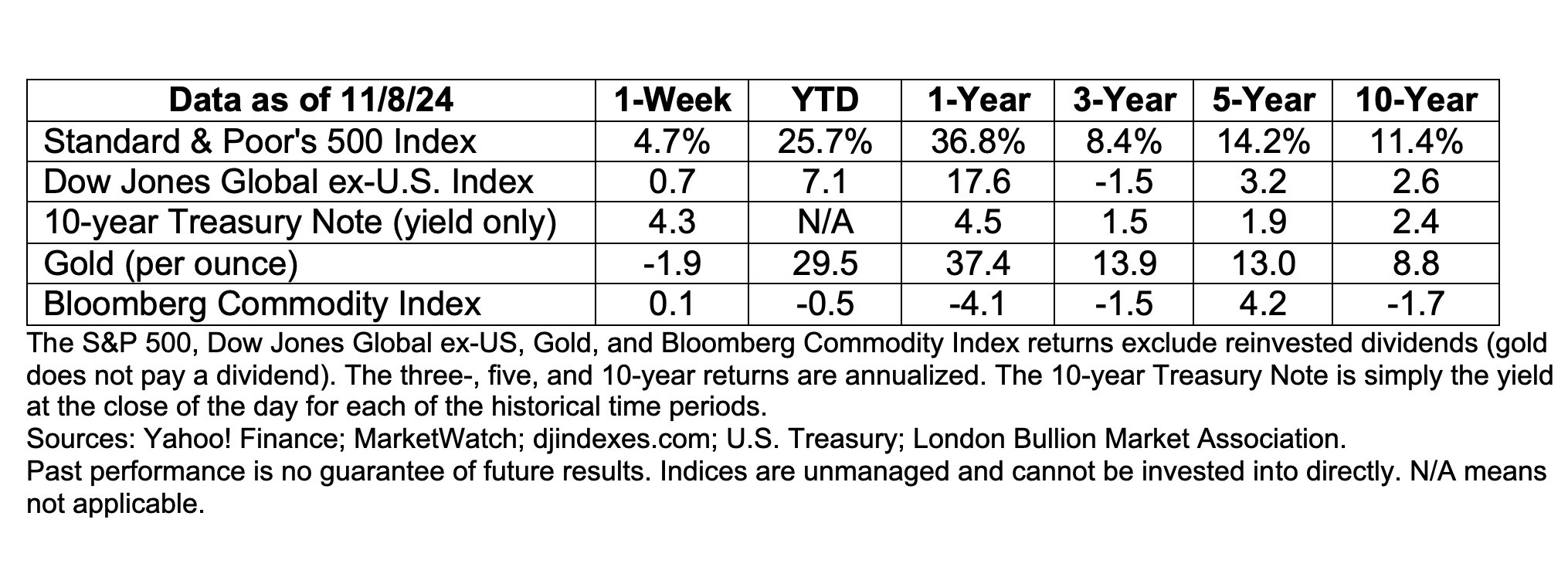

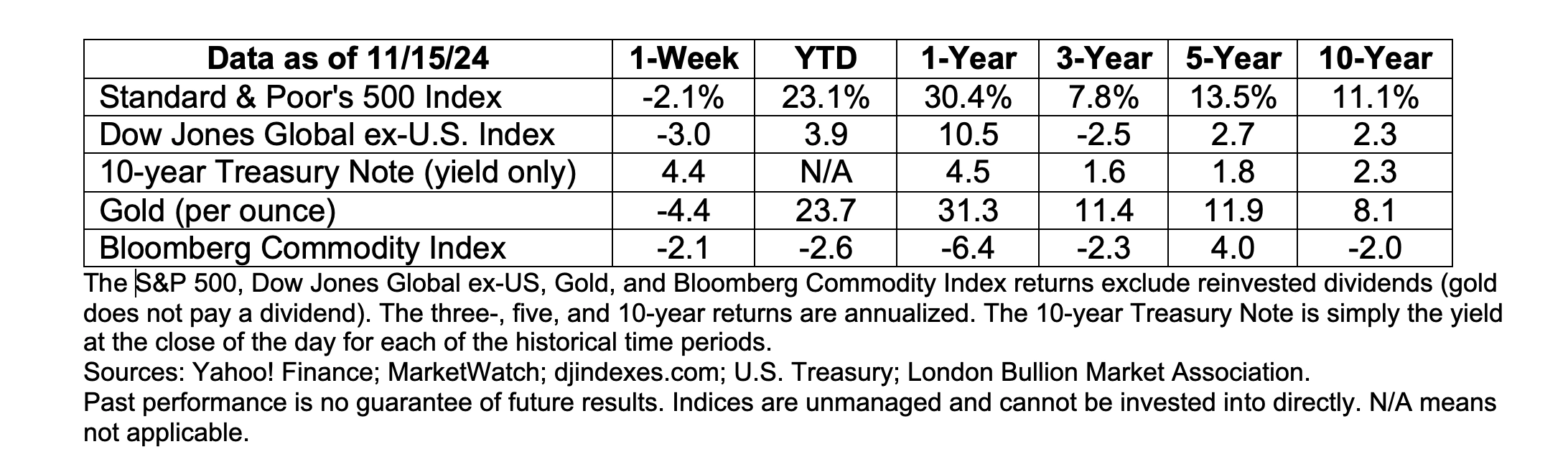

The likelihood that the Fed may lower rates more slowly than expected roiled markets. Lu Wang, Isabelle Lee, and Emily Graffeo of Bloomberg reported, “With the world’s most important central banker in no hurry to ease monetary policy thanks to a still-robust labor market and strong economic data, bond yields once again rose and dragged stocks lower in their wake. Down 2 [percent] over five sessions, the S&P 500 erased half of its trough-to-peak gains since the election. Combined with losses in corporate credit and commodities, the week rounded out a pan-asset retreat that by one measure was the worst in 13 months.”

Investors’ changing outlook was shaped by other factors, too. These included:

- Elevated stock valuations. Bella Albrecht of Morningstar reported, “The U.S. stock market is trading at an 11 [percent] premium to its fair value estimate.” The data reflected share prices on November 13, which was midway through last week.

- The risk of inflation rising again. Many economists believe the incoming administration’s spending and tax policies have the potential to reignite inflation, which could lead the Fed to reassess monetary policy.

- A disrupting cabinet nomination. Robert F. Kennedy Jr. to lead the Department of Health and Human Services rattled healthcare and consumer staples sectors of the market. “Shares of biotechnology and pharmaceutical companies fell, with the S&P 500 Pharmaceuticals index down about 2 [percent]. Shares of packaged food and beverage giants…also declined,” reported Samuel Indyk and Ludwig Burger of Reuters.

By the end of the week, major U.S. stock indices were down. U.S. bond markets continued to be wary of tariffs and inflation, lifting the yield on the benchmark 10-year U.S. Treasury to 4.5 percent. By week’s end, though, the 10-year Treasury yield had settled at 4.3 percent, reported Liz Capo McCormick of Bloomberg.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through “Your B/D Name Here”, Member FINRA/SIPC.

Disclosures and resources:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Enter the name of your commentary” please click here or write us at “Your Address Here”.

* To unsubscribe from the “Enter the name of your commentary” please reply to this email with “Unsubscribe” in the subject line or write us at “Your Address Here”.