Nov 11, 2024

The Markets

Stock markets celebrated the results of the presidential election. Bond markets were less enthusiastic.

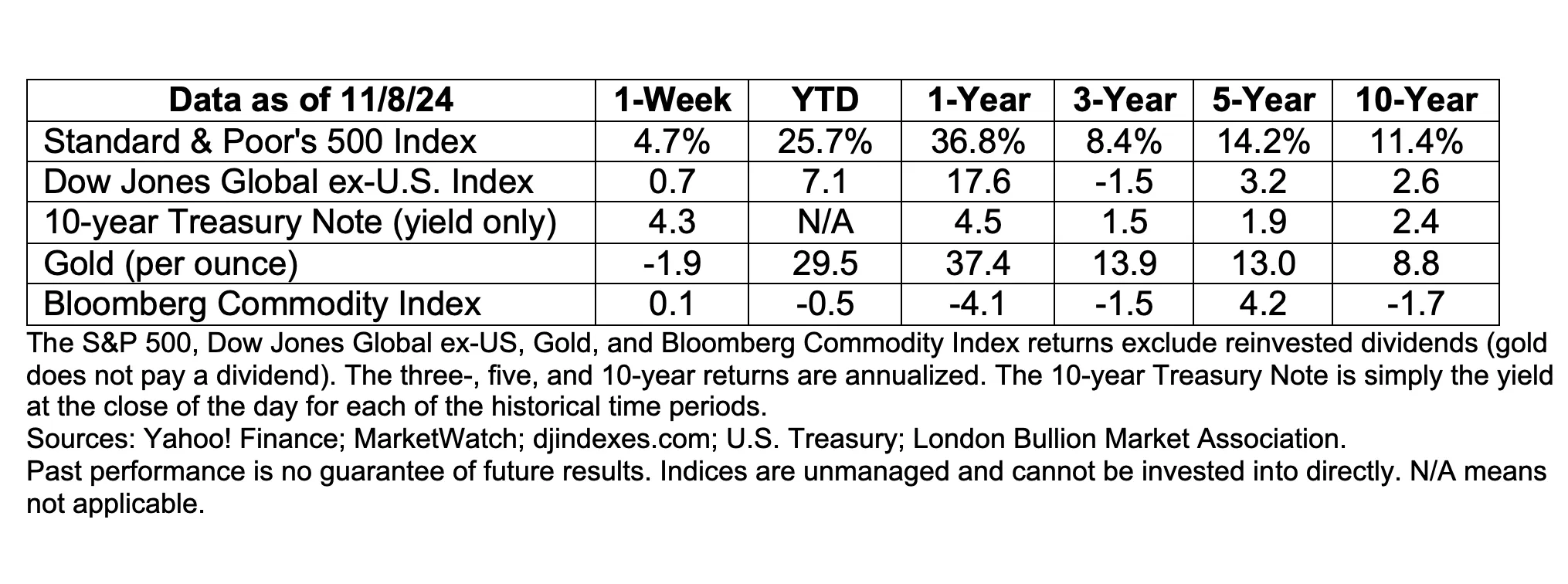

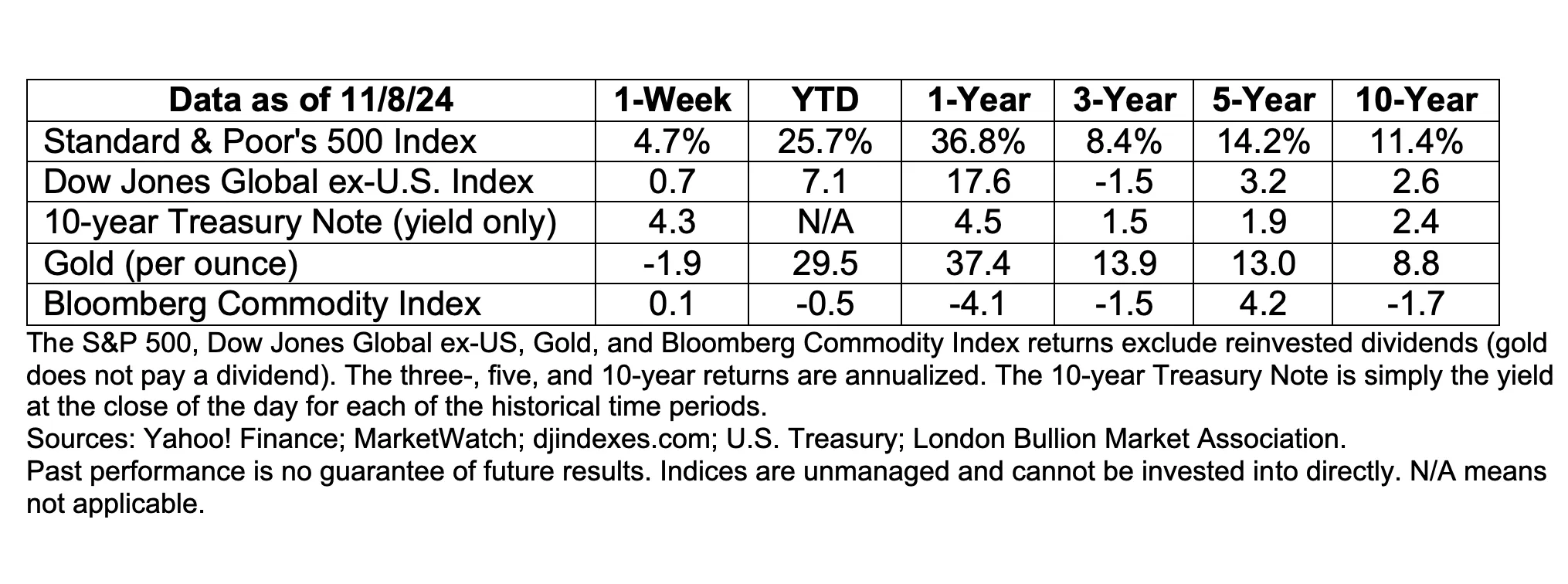

Last week, United States stock markets rallied, and the U.S. dollar gained against other currencies following the presidential election. The CBOE Volatility Index, Wall Street’s Fear gauge, also moved lower after concerns about a long wait for election results were quelled by a swift result, reported Alexandra Semenova of Bloomberg.

“…the [stock] markets roared in approval of this Trumpvember surprise…Yes, expect tax cuts, less regulation, fewer guardrails, and a government no longer picking winners and losers (except for tariffs), all reasons why investors perceive the incipient environment to be advantageous. And yet, with all the dancing, dancing, dancing in the streets, note that this new freedom could be accompanied by greater risk in the capital markets,” reported Andy Serwer of Barron’s.

The bond market’s response to the election was measured. The Federal Reserve (Fed) began lowering the federal funds rate in September. Typically, Fed rate cuts lead to lower borrowing costs for consumers and businesses, which supports economic growth. However, the yield on the 10-year U.S. Treasury, which is a benchmark for mortgage rates, corporate bonds, and other loan rates, has trended higher since September as strong economic data caused the market to rethink its expectations for future rate cuts.

Now, the bond market is evaluating future rate cuts in the context of the new administration’s policies. “…the outlook for further rate cuts has been clouded by expectations that key elements of Trump’s economic platform such as tax cuts and tariffs will lead to faster growth and higher consumer prices. That could make the Fed wary of risking an inflationary rebound by cutting rates too deeply next year,” reported Davide Barbuscia and Lewis Krauskopf of Reuters.

Markets are likely to remain volatile over the coming weeks as investors speculate about the impact of new policies on financial markets. Last week, major U.S. stock indices surged higher. Yields on U.S. Treasuries were mixed with yields moving lower on the shortest and longest maturities and rising for other maturities.

Disclosures and resources:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the “Enter the name of your commentary” please click here or write us at “Your Address Here”.

* To unsubscribe from the “Enter the name of your commentary” please reply to this email with “Unsubscribe” in the subject line or write us at “Your Address Here”.

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.