May 22, 2023

The Markets

Investors aren’t happy, but stocks are up.

If you ever participated in a fantasy football league, you may have experienced a run on a position during your draft. One person picks a kicker or defense mid-round and, suddenly, almost everyone rushes to follow suit. A similar occurrence may be happening in the United States stock market.

While major U.S. stock indices are in positive territory year-to-date, market gains have been concentrated in just a few companies’ stocks. Al Root of Barron’s explained:

“Today’s five biggest stocks…have a combined market cap of about $8.7 trillion, almost 25% of the S&P 500 [capitalization (cap)] and about 3.2 times the $2.7 trillion Russell cap…What’s more, those top five stocks have returned an average of 50% in 2023, accounting for roughly 80% of the S&P 500’s 8% gain. The median stock in the index has gained less than 2%, and less than half are trading above their 200-day moving averages…The top five stocks are also expensive: They trade for an average of 31 times estimated 2024 earnings, while the index trades at 17.4 times earnings.”

The fact that five stocks have been driving market performance may be hurting investor sentiment, according to sources cited by Barron’s. Sentiment also has been affected by concerns about inflation, tightening credit conditions, the possibility of recession, and the chance the U.S. may default on its debt. Investor sentiment is the way investors feel about an asset or financial market. When investors are feeling pessimistic about stocks, stock markets tend to fall. Similarly, when investors are optimistic, stock markets tend to rise.

Bank of America’s latest survey found that sentiment among global asset managers is the most bearish it has been this year. Almost two-thirds of participants think economic growth will slow this year, although a similar number anticipate a soft landing for the global economy, reported Ksenia Galouchko of Bloomberg.

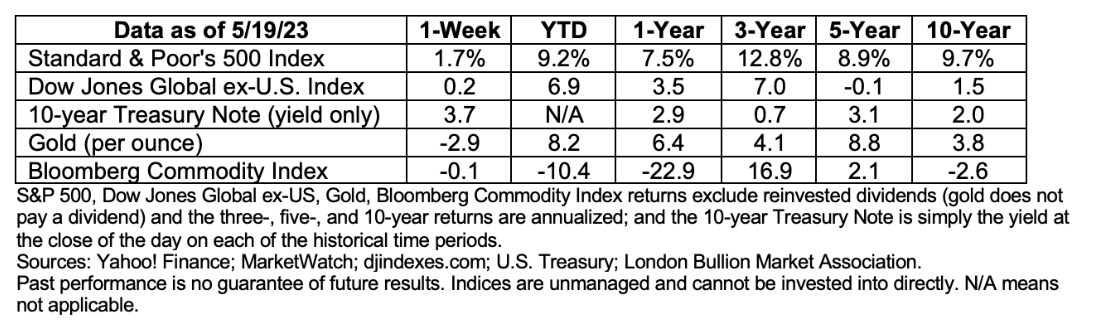

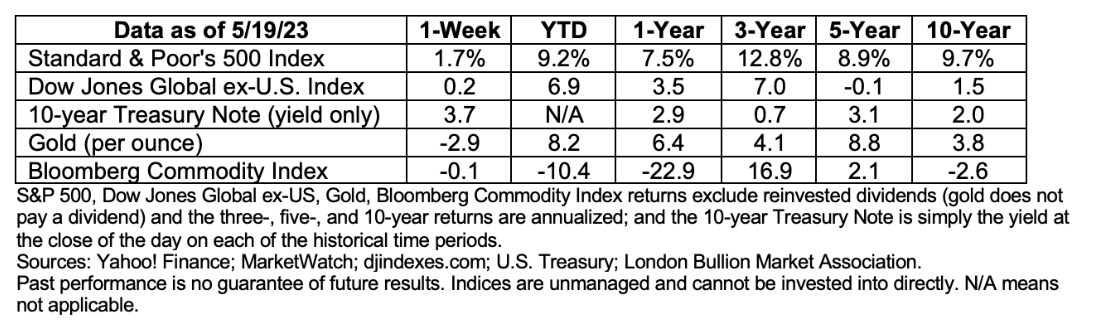

Last week, the Federal Reserve signaled the end of rate hikes was near, which pushed major U.S. stock indices higher. The indices gave back some gains on Friday after debt-ceiling talks faltered but finished the week higher overall. The yields on most maturities of U.S. Treasuries moved the week higher.

Weekly Focus – Think About It

“You’ll never find a rainbow if you’re looking down.”

—Charlie Chaplin, comic actor

Required Disclosures:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/the-5-stocks-that-rule-this-marketand-make-investors-nervous-be0668da (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/05-22-23_Barrons_The%205%20Stocks%20that%20Rule%20This%20Market%20and%20Make%20Investors%20Nervous_1.pdf)

https://www.bloomberg.com/news/articles/2023-05-16/bofa-survey-shows-investors-most-pessimistic-so-far-this-year (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/05-22-23_Bloomberg_Investors%20Most%20Pessimistic%20So%20Far%20This%20Year_2.pdf)

https://corporatefinanceinstitute.com/resources/capital-markets/market-sentiment/

https://www.cnbc.com/2023/05/19/fed-chair-powell-says-rates-may-not-have-to-rise-as-much-as-expected-to-curb-inflation.html

https://finance.yahoo.com/news/republican-debt-ceiling-negotiators-walk-155516086.html

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202305

https://oceanservice.noaa.gov/facts/ninonina.html

https://www.science.org/doi/10.1126/science.adf2983

https://www.bloomberg.com/news/articles/2023-05-18/economic-losses-from-extreme-weather-is-severely-underestimated (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/05-22-23_Bloomberg_El%20Ninos%20Causes%20Trillions%20in%20Lost%20Economic%20Growth_9.pdf)

https://www.goodreads.com/quotes/tag/optimism?page=3