June 20, 2023

The Markets

Rebalancing ahead!

There is one decision all investors should make: how to allocate the money they’re investing. Asset allocation decisions are usually based on a myriad of factors: expected returns, potential volatility, and appetite for risk, among others.

Periodically rebalancing a portfolio’s allocation is a critical step, too, because it keeps portfolios from having too much or too little risk. For example, if a portfolio allocation of 60 percent stocks and 40 percent bonds is the goal, and stock market gains increase the portfolio’s exposure to stocks, then it may be time to rebalance the portfolio. Rebalancing means selling assets that have performed well and buying assets that have not performed as well to return the portfolio to the desired allocation.

Asset managers of all sizes rebalance their portfolios – and that could put a stutter in the step of the current market rally, reported Denitsa Tsekova of Bloomberg.

“Equities have outperformed bonds so far this quarter, leaving portfolio managers needing to cut their stocks exposure to meet their long-term targets…The pension and sovereign wealth funds that form the backbone of the investing community typically rebalance their market exposures every quarter to achieve a mix of 60% stocks and 40% bonds or a similar exposure. So far this quarter MSCI’s all-country stock index is up 5% while the Bloomberg global-aggregate bond index is down 1.3%.”

While rebalancing may affect stock markets, the current rally has gained momentum in recent weeks. In May, just 23 percent of the stocks in the Standard & Poor’s 500 Index outperformed the Index, reported Lauren Foster of Barron’s. In June, the rally broadened as companies in more sectors of the S&P 500 posted gains. In addition, the Russell 2000 Index, which reflects the performance of smaller companies, gained seven percent through mid-June, reported Joe Rennison of The New York Times.

Last week, major U.S. stock indices faltered on Friday after Federal Reserve (Fed) officials suggested more rate hikes could be ahead despite the Fed’s decision to pause in June. Regardless, the indices finished the week higher overall, reported Brian Evans and Alex Harring of CNBC. U.S. Treasuries delivered mixed performance.

Weekly Focus – Think About It

“Arching under the night sky inky/ with black expansiveness, we point/ to the planets we know, we/ pin quick wishes on stars. From earth,/ we read the sky as if it is an unerring book/ of the universe, expert and evident.”

—Ada Limón, U.S. Poet Laureate (The full poem, In Praise of Mystery: A Poem for Europa, will travel to space, engraved on NASA’s Europa Clipper spacecraft)

Required Disclosures:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

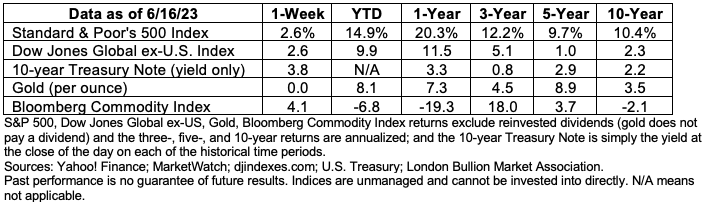

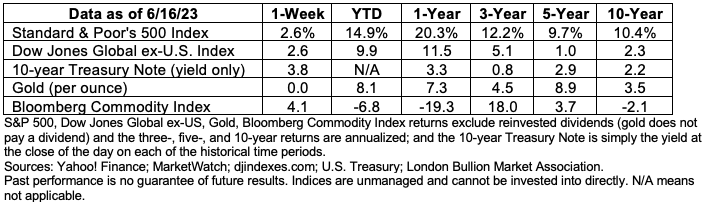

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.investor.gov/introduction-investing/getting-started/asset-allocation#:~:text=Asset%20allocation%20involves%20dividing%20your,your%20ability%20to%20tolerate%20risk

https://www.bloomberg.com/news/articles/2023-06-15/jpmorgan-says-stocks-to-suffer-150-billion-rebalancing-sales (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-19-23_Bloomberg_JPMorgan%20Says%20Stocks%20to%20Suffer_2.pdf)

https://www.barrons.com/articles/stock-market-breadth-nvidia-amd-microsoft-funds-be13a201 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-19-23_Barrons_The%20Stock%20Market%20is%20Suffering%20from%20Bad%20Breadth_3.pdf)

https://www.nytimes.com/2023/06/16/business/stocks-bull-bear-forecast.html (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-19-23_New%20York%20Times_Market%20Rally%20Intensifies%20Debate%20Over%20What%20Will%20Come%20Next_4.pdf)

https://www.cnbc.com/2023/06/15/stock-market-today-live-updates.html

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202306

https://www.cnbc.com/2022/02/15/virgin-galactic-stock-rises-as-ticket-sales-reopen-150000-deposit.html

https://www.bloomberg.com/news/articles/2023-06-15/branson-s-virgin-galactic-spce-sets-june-date-for-first-commercial-spaceflight (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-19-23_Bloomberg_Richard%20Bransons%20Virgin%20Galactic%20Sets%20June%20Date_8.pdf)

https://www.gozerog.com/the-zero-g-experience/

https://www.weforum.org/videos/this-carbon-neutral-spaceship-could-take-you-to-the-edge-of-space

https://www.kennedyspacecenter.com/explore-attractions/all-attractions/astronaut-training-experience

https://www.architecturaldigest.com/story/worlds-first-space-hotel-open-2027

https://www.nbcnews.com/news/latino/us-poet-laureate-ada-limon-poem-nasa-spacecraft-travel-space-rcna87507