April 10, 2023

The Markets

Ambiguous images.

Some illustrations are optical illusions. When two people view the picture, they may see completely different images. A good example is Rubin’s Vase. One viewer may see a vase, while another sees two faces.

Current economic conditions can be interpreted in different ways, too. Recent economic data and a possible credit crunch, resulting from upheaval in the banking sector, suggest growth is slowing. After viewing the data, some say we’re heading for a soft landing, and others say a recession is coming. Here is the recent data:

- Consumer spending. This is the main driver of economic growth in the United States. While Americans are still buying, the pace of spending slowed in February, according to a late-March report from the Bureau of Economic Analysis. Less spending means lower demand for goods and services – and that effects production.

- Production of goods and services. Last week, the Institute for Supply Management reported that activity in the manufacturing sector – automakers, food producers, pharmaceutical companies and other companies that make products – shrank for the fifth consecutive month. Activity in the services sector – airlines, banks, building maintenance and other companies that provide services – continued to expand but at a slower pace.

- Employment. The employment report indicated the labor market in the U.S. remained resilient and jobs growth was solid in March. It’s notable that there were fewer job openings and more Americans returned to the workforce. The unemployment rate remained steady at 3.5 percent. In addition, average hourly earnings edged higher, according to the U.S. Bureau of Labor Statistics.

Randall Forsyth of Barron’s reported, “The solid employment report for March further raises the odds that the U.S. economy is headed for a proverbial soft landing.” Not everyone agrees.

Economist and former Treasury Secretary Lawrence Summers gives more weight to manufacturing and services data than employment data. He also pointed to the Dallas Federal Reserve’s Banking Conditions Survey, which showed lending volumes declined sharply in March. Summers told Bloomberg’s Wall Street Week with David Westin:

“Employment and unemployment are lagging indicators of what’s happening in the real economy…There is some substantial amount of constriction in credit. If you looked at the forward-looking numbers this week from the PMI surveys, those numbers were quite weak…Recession probabilities are going up at this point. The Fed has a very, very difficult decision ahead of it.”

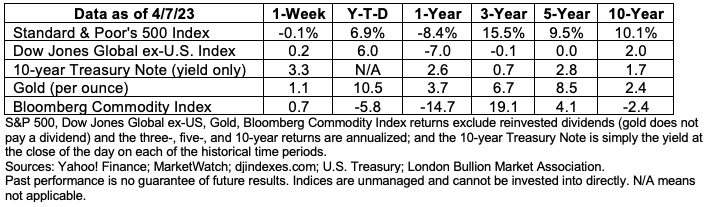

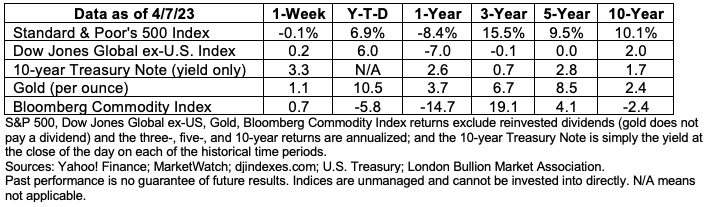

Major U.S. stock indices finished the week with mixed results, reported Carleton English of Barron’s. In the Treasury market, yields on many shorter-maturity increased, while yields on longer-maturities fell.

INVESTORS VS. THE FEDERAL RESERVE. In the 1970s, Martin Zweig cautioned investors: Don’t fight the Fed. He believed there was a correlation between Federal Reserve monetary policy and the direction of stock markets, reported Steve Sosnick of Barron’s. Here’s generally how it worked:

- The Fed makes more money available – pursuing loose or expansionary monetary policy – during economic downturns or recessions. It adjusts the money supply by moving the federal funds rate lower so companies can borrow inexpensively and hire workers. In turn, workers spend more, and the economy grows. Stock markets tend to rise when the Fed is pursuing loose monetary policy.

- The Fed makes less money available – pursuing tight or restrictive monetary policy – during periods when the economy is overheating, and inflation swings higher. It adjusts the money supply by moving the federal funds rate higher, making borrowing more expensive for companies, which can lead to layoffs. Workers have less to spend, and the economy slows or enters a recession. Stock markets tend to fall when the Fed is pursuing tight monetary policy.

Ultimately, Zweig’s advice meant that investors should be more aggressive when the Fed was pursuing loose monetary policy, and more conservative when it was pursuing tight monetary policy. Will Daniel of Fortune reported:

“Investors understood this dynamic during the recovery from the bursting of the U.S. housing bubble, buying stocks in droves while the Fed held interest rates near zero…The central bank’s loose policies helped bring about the second longest bull market in the S&P 500’s history, between Mar. 9, 2009, and the COVID-19–induced bear market of 2020…”

Today, the Federal Reserve is pursuing tight monetary policy, and has indicated that lower rates are not on the table for 2023. Investors seem to think otherwise, though. The Fed raised the federal funds rate in March, but not all Treasury yields followed suit. Yields on longer-dated Treasuries moved lower, suggesting investors think rate cuts are ahead.

Who’s right? Stay tuned. (And remember that many factors influence financial market performance. Fed policy is just one of them.)

Weekly Focus – Think About It

“One of my fondest sayings is fail, fast, forward. Recognize you’ve failed, try to do it fast, learn from it, build on it, and move forward. Embrace failure, have it be part of your persona.”

—Carol Bartz, former CEO and president

Required Disclosures:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://en.wikipedia.org/wiki/Rubin_vase

https://www.bea.gov/sites/default/files/2023-03/pi0223.pdf

https://www.prnewswire.com/news-releases/manufacturing-pmi-at-46-3-march-2023-manufacturing-ism-report-on-business-301787309.html

https://www.prnewswire.com/news-releases/services-pmi-at-51-2-march-2023-services-ism-report-on-business-301789944.html

https://www.bls.gov/news.release/empsit.a.htm

https://www.barrons.com/articles/fed-inflation-economy-jobs-report-rate-hikes-a43e0d82 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-10-23_Barrons_A%20Solid%20Jobs%20Report%20Suggests%20One%20More%20Fed%20Rate%20Hike%20in%20May_6.pdf)

https://www.bloomberg.com/news/videos/2023-04-07/-the-fed-needs-to-engage-in-some-serious-soul-searching-video [The Fed Needs To Engage In Some Serious Sole Searching. 0:43]

https://www.dallasfed.org/research/surveys/bcs/2023/bcs2302

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-fed-dividends-97aaef90?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-10-23_Barrons_Tired%20of%20Waiting%20for%20the%20Fed%20to%20Pivot_9.pdf)

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023

https://www.barrons.com/articles/fed-interest-rates-investing-mantras-51662006600 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-10-23_Barrons_The%20Fed%20is%20Hawkish_11.pdf)

https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Monetary-Policy

https://www.yahoo.com/video/don-t-fight-fed-wall-165947003.html

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf (Figure 2)

https://madison.com/uw–madison-2012-spring-commencement-carol-bartz-address/youtube_17568e79-9672-57a7-a13e-f5ff3de2ffaa.html [12:40]