If you’re feeling uncertain about the state of Social Security and how it fits into your retirement plan, you’re not alone. Headlines about potential shortfalls and changes to the system can create confusion and anxiety. Whether you’re already receiving benefits or looking ahead to retirement, it’s natural to have concerns about the reliability of Social Security as part of your financial future.

At Goodwin Investment Advisory, we’re here to provide clarity and help you understand what the future of Social Security might mean for your retirement. We understand your concerns and are here to guide you with clear, factual information and thoughtful planning. Together, we’ll address the questions weighing on your mind and create a strategy that integrates Social Security into your retirement plan with confidence and peace of mind. With the right guidance, you can feel better knowing your financial plan is built to handle potential changes while planning for long-term stability.

The Concern: Is Social Security running out of money? What is the real story?

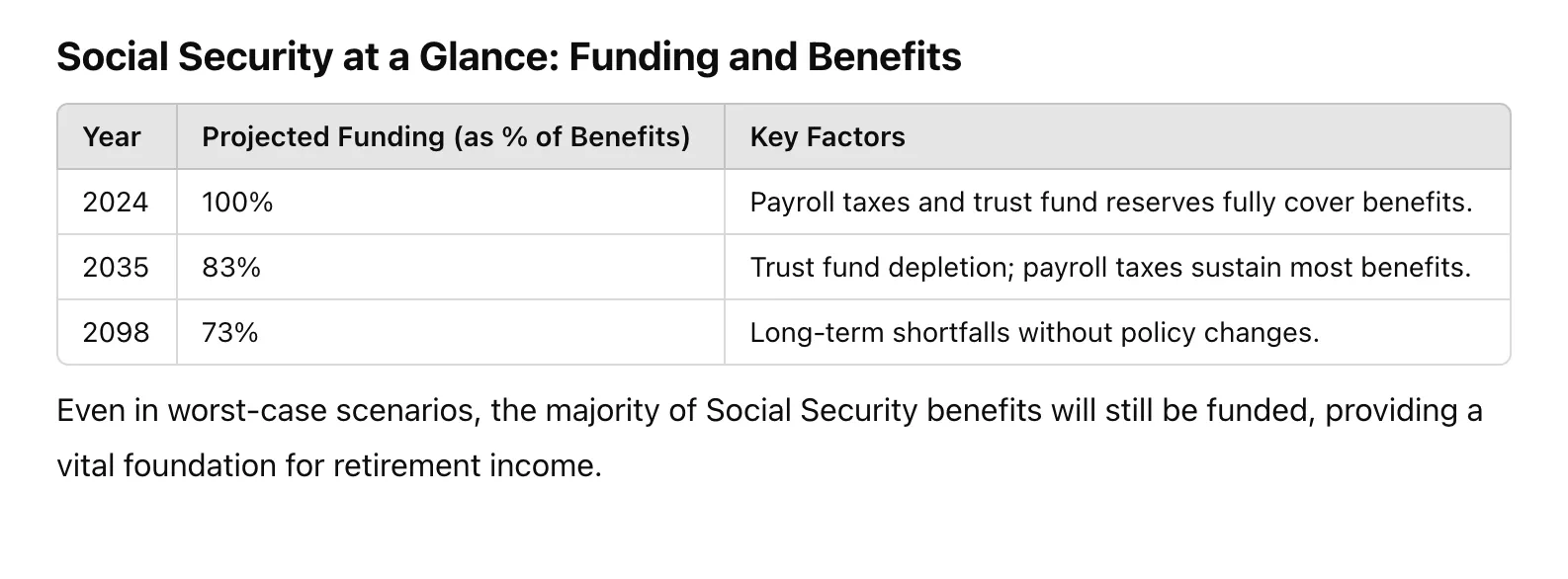

You’ve probably seen alarming reports about the Social Security trust fund potentially being depleted by 2035. It’s easy to assume this means Social Security will cease to exist. The media often highlights concerns about Social Security’s trust fund running out, leaving many people to assume the system is on the brink of collapse. But the truth is more reassuring; here’s the reality: it’s important to understand the mechanics of how benefits are funded:

- Ongoing payroll taxes provide stability:

Social Security is primarily funded by payroll taxes collected from workers and employers (6.2% each on wages up to $168,600 in 2025). These contributions account for most of the revenue used to pay benefits. - Trust fund reserves are supplemental:

The trust fund acts as a backup, covering gaps between payroll tax revenue and benefits. While current estimates project depletion by 2035, this doesn’t mean benefits will stop. Based on ongoing payroll taxes, Social Security will still be able to pay approximately 83% of scheduled benefits in 2035 and 73% by 2098. - Policymakers have tools to address shortfalls:

Potential solutions include raising payroll taxes, adjusting benefit formulas, increasing the retirement age, or a combination of these measures. Many changes could be phased in gradually, minimizing disruptions for current retirees.

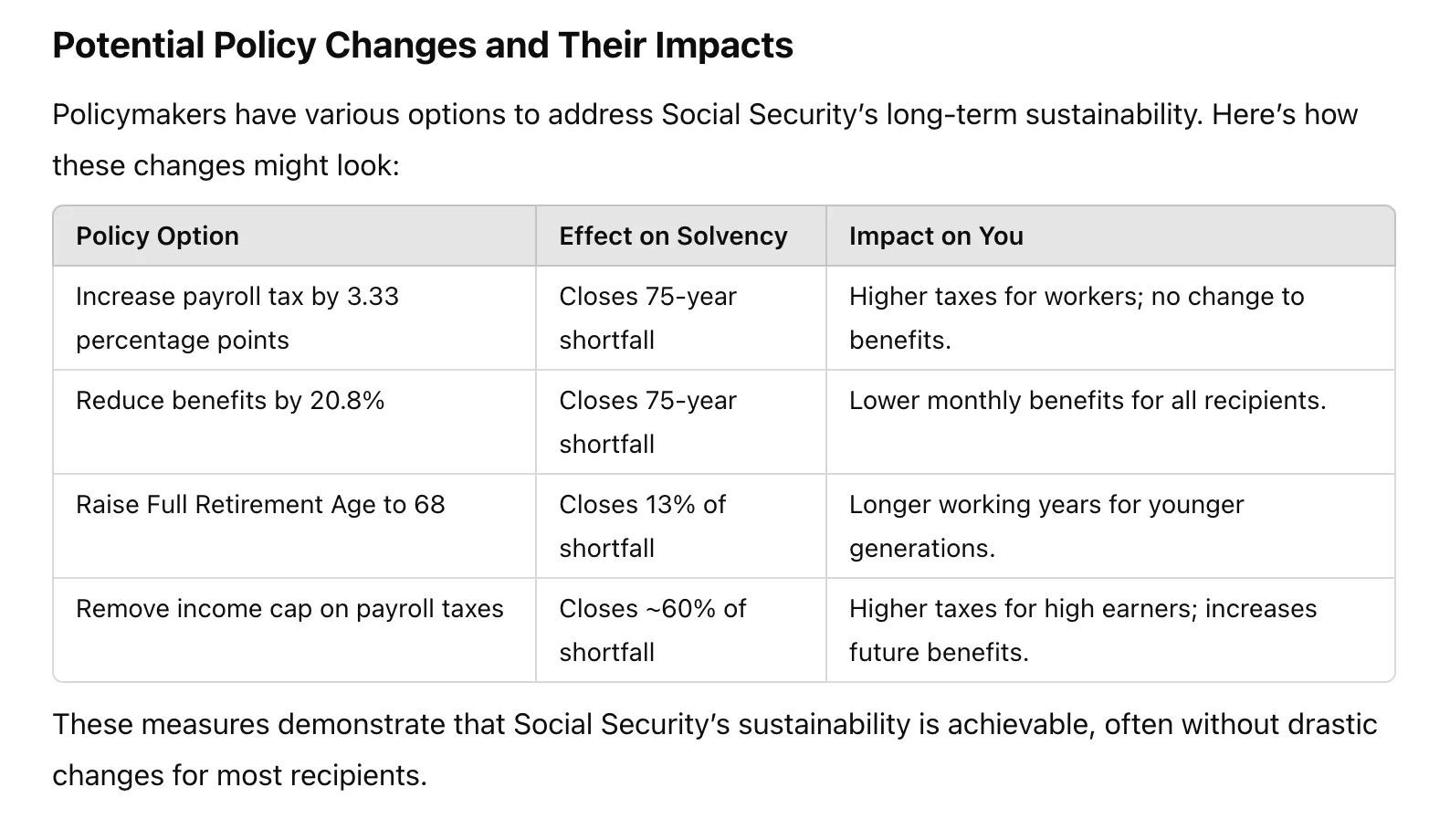

While a shortfall would require changes to the system, most benefits would still be funded, and policymakers have options to ensure its long-term sustainability. Here’s how these changes might look:

Potential changes and legislative solutions:

Policymakers have several tools at their disposal to address Social Security’s shortfall. Here are the most-discussed options:

1. Increasing payroll taxes

- Proposal: Raise the payroll tax rate from 12.4% (combined worker and employer) to 15.73%.

- Impact: This would fully close the 75-year shortfall. For a household earning $75,000, this would mean an additional $2,500 annually in payroll taxes.

- Trade-Off: Workers contribute more now to secure full benefits later.

2. Raising the wage cap

- Proposal: Tax all wages instead of limiting payroll taxes to the first $168,600 of income.

- Impact: Closing approximately 60% of the funding gap.

- Consideration: Higher-income earners would pay more but could see increased benefits based on the additional taxes paid.

3. Adjusting benefits

- Option A: Reduce benefits for all current and future recipients by 20.8%.

Impact: This would fully close the shortfall but reduce monthly income for retirees. - Option B: Gradually reduce benefits for higher-income earners while maintaining current levels for low-income beneficiaries.

Impact: Balances the system more equitably without affecting the most vulnerable.

4. Raising the Full Retirement Age (FRA)

- Proposal: Increase the FRA from 67 to 68 or 69.

- Impact: Encourages longer workforce participation and reduces the system’s costs. Closing up to 39% of the shortfall if raised to 69.

5. Adjusting Cost of Living Adjustments (COLAs)

- Option A: Use the Chained Consumer Price Index (CPI), which accounts for changing consumer spending patterns.

Impact: Closes 19% of the gap. - Option B: Tie COLAs to CPI-E, an index focused on senior expenses.

Impact: Adds to the shortfall but better reflects retirees’ cost increases.

6. Combined policy approaches

A blend of tax increases, benefit adjustments, and retirement age changes is likely the most politically viable path. For example:

- Raise the payroll tax rate modestly.

- Increase the wage cap.

- Gradually raise the FRA.

- Adjust COLAs for higher earners.

Visualizing the data: tools and calculators to help you understand the impact of these changes, you can use tools that model various scenarios for your financial plan:

Interactive tools

- Social Security quick calculator: SSA.gov

- Social Security policy simulator: CRFB Social Security Calculator

Example calculations

- Impact of Reduced Benefits:

A retiree currently receiving $2,000/month might see benefits reduced to $1,660 under a 20.8% cut. Over 20 years, this equates to $81,600 in reduced income. - Tax Increase Impact:

For an individual earning $150,000, raising the payroll tax by 1% would result in an additional $1,500 annually in taxes.

The Opportunity: How we bring clarity and stability and understanding Social Security’s role in your financial plan starts with clarity. By providing context and modeling scenarios, we can help you see the full picture and eliminate unnecessary worry.

- Clear Information: We break down the current state of Social Security, explain potential legislative changes, and show how these factors could impact your benefits.

- Tailored Scenarios: Using advanced planning tools, we model “what if” scenarios, such as reduced benefits or higher taxes, so you can see how your financial plan holds up under different conditions.

- Integrated Strategies: Social Security is one piece of the retirement puzzle. We ensure your benefits work seamlessly with your other income sources to provide long-term stability and peace of mind.

How we help you overcome worry and build confidence

Let’s address the fears directly:

- “What if my benefits are reduced?”

We model potential reductions and help you prepare for scenarios where benefits might be lower than expected. Many clients are relieved to see their plans remain solid, even under conservative assumptions. - “What if changes to Social Security happen right before I retire?”

We’ll craft a flexible strategy that can adapt to changes, helping you prepare no matter what legislation is passed. - “How do I maximize my Social Security benefits?”

We help you decide when and how to claim benefits based on your unique situation, your financial goals, longevity expectations, and other income sources hoping to optimize the amount you’ll receive over your lifetime.

The Plan: charting a path forward together

The Value of Planning for Social Security’s Future

While Social Security remains a critical component of most retirement plans, it’s just one piece of the puzzle. Understanding how potential changes might impact your financial future is essential. Here’s how we help you integrate Social Security into a comprehensive retirement plan:

- Maximizing benefits: Timing your Social Security claim is crucial. We analyze your unique situation to determine the optimal age to start benefits, maximizing your lifetime payout.

- Model scenarios: Together, we’ll look at various “what if” situations to understand how changes to Social Security might impact your plan.

- Integrating Social Security with tax strategies:

Social Security benefits are taxable under certain conditions. We collaborate with your CPA to ensure your benefits are part of a tax-efficient retirement strategy. - Create a holistic plan: Social Security is just one component. We’ll align your benefits with your investments, pensions, and other income sources to create a sustainable retirement strategy.

Why you’ll feel confident moving forward

Imagine having a plan that gives you clarity and peace of mind. Picture yourself retiring with confidence, knowing your Social Security benefits are working in harmony with your broader financial plan. That’s the power of having a trusted advisor by your side. At Goodwin Investment Advisory, we’ve helped countless clients navigate the complexities of Social Security and retirement planning. Our goal is to replace worry with understanding and empower you to make decisions that align with your goals.

Take the first step

If you’ve been losing sleep over Social Security or feeling overwhelmed by conflicting information, let’s start the conversation. Together, we aim to bring clarity, confidence, and stability to your financial future. Schedule a Call Today to begin building a retirement plan you can trust.

Key takeaways

- Social Security isn’t going away; it’s evolving.

- Understanding how it fits into your retirement plan can ease fears and provide clarity.

- With our guidance, you’ll feel confident and prepared, no matter what changes lie ahead.

Your future deserves careful planning, and we’re here to help you every step of the way.