Friday, October 29, 2021

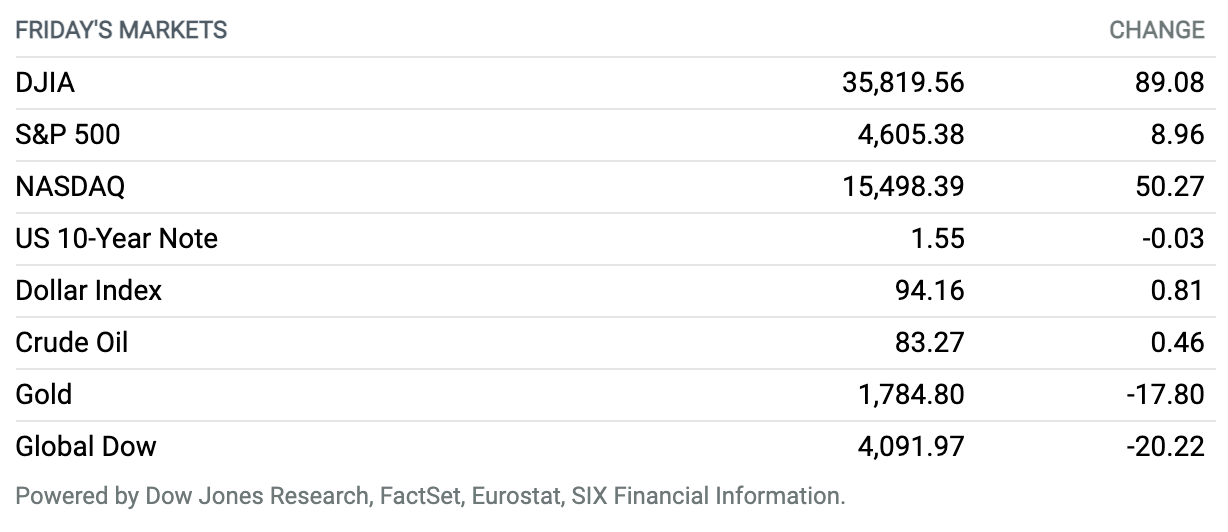

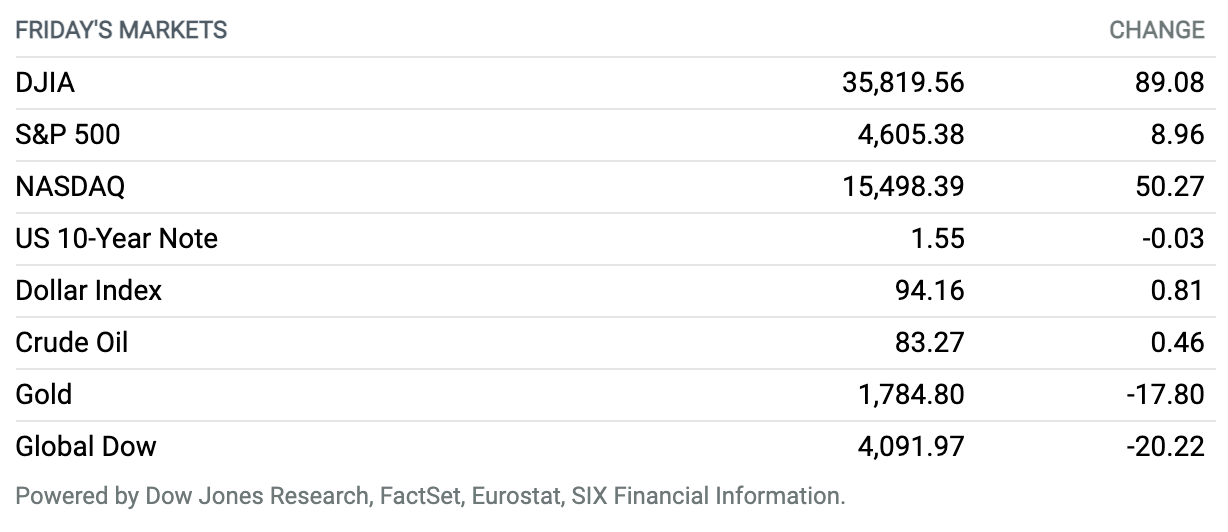

Major Indexes Reach Records as Stocks Rise Slightly to End Upbeat Month. Major stock indexes ended at records Friday, rising slightly to close out a strong October performance amid a solid corporate earnings season. The Dow Jones Industrial Average rose 89 points, or 0.3%, to end at 35,820, while the S&P 500 gained nine points, or 0.2%, to close at 4605. The Nasdaq Composite rose 50 points, or 0.3%, to finish at 15,498. The Dow saw a 5.8% rise in October, while the S&P 500 advanced 6.9% and the Nasdaq rallied 7.3%.

Apple and Amazon Were Slammed By Shortages

First, it was car companies. Then it was industrials. Now, Apple and Amazon.com are getting hit by global supply-chain woes that only seem to get worse. And if big tech isn’t immune, then shortages are likely to be a growing risk for companies this earnings season and beyond.

Few were expecting quarters this bad from the two tech titans. Apple CEO Tim Cook said supply-chain problems cost the company $6 billion in quarterly sales as he explained why Apple missed revenue estimates. Amazon, meanwhile, missed earnings estimates and CFO Brian Olsavsky said wage growth and inflation added $2 billion in costs to his company’s quarterly results.

Inflation, supply-chain delays, and lost revenue sound awful, but they are no surprise for anyone who has been watching earnings from auto companies and industrials.

Continue reading

President Biden Unveils $1.75 Trillion Social Spending Plan. He’s ‘Confident’ It Will Pass.

The White House rolled out details Thursday of a new $1.75 trillion framework for President Joe Biden’s social spending bill.

In a statement, the White House said Biden was “confident this is a framework that can pass both houses of Congress.”

Continue reading

GDP Was Even Worse Than Expected. Consumers Have Grown Skittish.

The U.S. economy grew at an annual rate of 2% in the third quarter, the slowest pace since the recovery began as consumers pulled back, prices continued to rise, and government spending fell.

In its report this week, the Bureau of Economic Analysis said economic growth in the September quarter reflected the continued economic impact of the Covid-19 pandemic, with a resurgence of infections prompting new restrictions and delays in the reopening of establishments in some parts of the country. The report is the first estimate on quarterly GDP, and the number is likely to be revised in the coming months.

Continue reading

U.S. Buys 50 Million Child-Sized Pfizer Doses

Pfizer and its partner BioNTech said this week that they had sold 50 million child-sized doses of their Covid-19 vaccine to the U.S. government.

The deal comes less than a week before the vaccine advisory committee to the Centers for Disease Control and Prevention is set to discuss which children should receive the vaccine.

Continue reading

Exxon and Chevron Are Flush With Cash Again. What They Plan to Do.

Eighteen months after Covid-19 left their balance sheets in disarray, Exxon Mobil and Chevron are awash in cash. The question now is what they will do with their new bounty.

It seems likely that the two oil heavyweights will embark on a campaign of growing dividends and buybacks, as well as more spending on a few key projects.

Continue reading

Better Batteries Are the Key to an EV Future

There’s nothing standing in the way of the world’s auto makers and an electric-vehicle future except the batteries to power tens of millions of cars. The auto industry is betting that’s a problem money can solve.

Consider Ford Motor, which recently announced the largest single investment plan in its century-plus history. Ford and its partners are planning to spend $11.4 billion to build manufacturing facilities in coming years that will do for Kentucky and Tennessee what Henry Ford did for Dearborn, Mich., in 1917, when he developed his Rouge Plant on the banks of the Rouge River near Detroit.

Continue reading

Microsoft Takes Title of Most Valued Publicly Traded Company From Apple

Microsoft has inched past Apple to become the world’s most valuable publicly traded company.

The shift caps a week when the software giant was buoyed by stronger-than-expected earnings, driven by strength in its cloud business. Apple, meanwhile, is grappling with supply constraints that resulted in disappointing iPhone sales in the quarter.

Continue reading

Holiday Sales Expected to Set Records, Rise as Much as 10.5%: National Retail Federation

This holiday season is poised to shatter previous retail sales records as consumer spending is expected to grow up to $850 billion, according to forecasts by the National Retail Federation.

“We are predicting the highest holiday retail sales season on record,” said Matthew Shay, NRF president and CEO.

Continue reading

The New Frontier of Digital Assets Is Called DeFi. It’s Wilder Than Ever.

Inspired by the hit Netflix series, the Squid Game token is the latest entrant into the crypto world. But if you want to trade the Squid token, you’ll have to venture onto an exchange called PancakeSwap. Coinbase Global, Robinhood Markets, and the other major exchanges don’t list Squid Game. PancakeSwap is the only place where it trades, and you can’t buy it with cash—you’d have to swap it for another token, called Wrapped BNB.

Welcome to decentralized finance, or DeFi—the new frontier of crypto and one of its fastest-growing areas.

Continue reading

Merck’s Covid Antiviral Isn’t Just a Quick Win. It Could Lift Revenues for Years.

Merck‘s new Covid-19 antiviral therapy molnupiravir won’t just provide a short-term revenue boost to the pharmaceutical giant, according to an emerging consensus following the company’s earnings call this week.

It could lift revenue over the long term, helping wean Merck off its reliance on its cancer therapy Keytruda. Sales of the blockbuster drug, which loses patent protection late this decade, accounted for 34% of Merck’s third-quarter earnings.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.