Friday, November 6, 2020

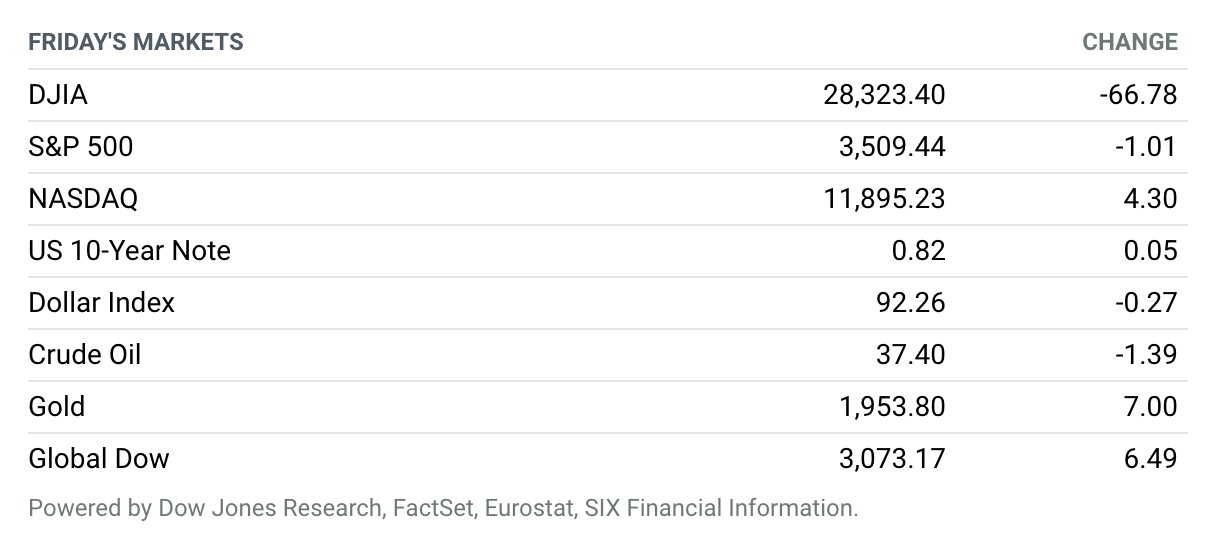

Stocks Log Best Election Week Since 1932. U.S. stocks’ recent winning streak paused on Friday, but the S&P 500 still posted its second-best performance for any presidential election week on record, and its best since the 1932 election. The Dow Jones Industrial Average advanced nearly 6.9% for the week, the S&P 500 gained 7.3% and the Nasdaq Composite rallied 9%. All three experienced their strongest week of gains since April. The rally stalled on Friday as investors weighed uncertainty over control of the Senate and rising coronavirus case counts against better-than-expected jobs data and increasing clarity about the likely outcome of the presidential race. The Dow industrials fell 66.8 points, or 0.2%, to 28,323.40. The S&P 500 was nearly unchanged, falling 1 point to 3509.44, and the Nasdaq Composite was up 4.3 points, less than 0.1%, to 11,895.23. Figures released early Friday showed former Vice President Joe Biden has pulled into the lead in Pennsylvania. A win for Biden there, if it happens, would give him the 270 electoral-college votes he needs to succeed President Donald Trump. Yet it looked increasingly likely that Senate control would be decided by two January runoff elections in Georgia, according to the Associated Press.

Unemployment Rate Falls to 6.9% as Hiring Picks Up

Hiring climbed more than expected last month, taking the unemployment rate below 7% as the economy continued to recover from the depths of the pandemic slowdown.

U.S. businesses added a seasonally adjusted 638,000 jobs in October, the Labor Department said Friday, considerably more than the 530,000 expected by economists polled by the Wall Street Journal. That reading was slightly lower than the September gain, which was revised higher to 672,000 from the 661,000 initially reported.

The unemployment rate declined a full percentage point to 6.9% as the number of unemployed fell by 1.5 million to 11.1 million. Both measures remain near twice their prepandemic levels, the Labor Department noted, when they were 3.5% and 5.8 million, respectively. The labor force participation rate ticked up to 61.7% in October as the recovery pulled more people back into the job market.

In Latest Policy Meeting, the Federal Reserve Doesn’t Change Much

The Federal Reserve’s Open Markets Committee on Thursday signaled that it would keep interest rates near zero and continue to buy bonds at its current pace.

The Fed’s statement following its latest policy meeting was little changed from the statement it published following its October meeting. Earlier this year, the central bank scaled up its purchases of Treasuries and mortgage-backed securities in response to the coronavirus pandemic. It also cut rates to near zero and introduced several new programs to buy or help banks finance holdings of corporate bonds, commercial paper, municipal bonds, asset-backed securities, and other debt.

U.S. Jobless Claims Fall Slightly in Late October but Remain Extremely High

New applications for unemployment benefits fell slightly in late October, but they are declining only very slowly and signal ongoing stress in the U.S. labor market.

Initial jobless claims filed through state programs fell by 7,000 to 751,000 in the seven days ended Oct. 31, the government said Thursday. Economists polled by MarketWatch had forecast a bigger decline to 728,000. New claims had also totaled 751,000 in the prior week, but they were revised up to 758,000. So basically there was no change.

Manufacturing Continues ‘to Exceed Expectations’ in Bright Sign for U.S. Economy

The ISM PMI—a gauge of the health of the U.S. industrial economy—hit 59.3 for October, much better than the reading of 56 that economists were expecting. The U.S. manufacturing recovery, which began in May, picked up steam in October.

It was a pretty good reading across the board. The new orders index came in at 67.9 compared with 60.2 in September. The employment index registered 53.2 compared with 49.6 in September. People are going back to work.

Ant Group’s $34B IPO Is Suspended After a Meeting With Regulators

Ant Group’s planned $34.4 billion initial public offering, which was expected to be the biggest ever, has been suspended.

The payments unit of Alibaba Group Holding said in a statement Tuesday that its listing on Shanghai’s Star market might not meet listing qualifications or disclosure requirements. The suspension came after Chinese regulators met with Jack Ma, Ant’s controlling shareholder, and other executives, which led to undisclosed “material matters,” the statement said.

Airbnb Plans to Go Public in December. It Would Be the Year’s Third-Biggest IPO.

The IPO market is on hold pending the results of the U.S. presidential election. But one high-profile company still plans to go public.

Airbnb is expected to make its IPO filing public next week and launch its offering in December, Barron’s has learned. The home-sharing platform is slated to price its deal and launch a roadshow next month.

Uber, Lyft Drive Away With Election Win in the Golden State

California voters widely approved Proposition 22, a measure that allows gig-economy companies such as Uber and Lyft to continue to classify drivers as contractors rather than employees. Prop 22 essentially reverses a measure approved last year by the state legislature, called Assembly Bill 5, or AB5, that was aimed at forcing ride-hailing and food-delivery app companies to classify drivers as employees.

Interestingly, the one part of the state where the measure was opposed was Silicon Valley—voters in Santa Clara and San Mateo counties narrowly opposed the measure, and it was defeated by nearly 60% to 40% in San Francisco, the home to the five companies that sponsored the measure: Uber, Lyft, DoorDash, Postmates, and Instacart. The five companies combined spent about $200 million on the “Yes on 22” campaign, the most ever on a ballot proposition campaign in the state’s history. The measure had support from the state Republican Party and some county GOP groups, while the opposition was largely led by labor unions.

GM’s Earnings Were Twice as Good as They Were Supposed to Be

Iconic U.S. automaker General Motors on Thursday reported third-quarter earnings of $2.83 a share on $35.5 billion in sales. Wall Street was looking for $1.38 in per-share earnings from $35.4 billion in sales. GM nearly doubled earnings expectations.

Results are a huge step up from the dreadful, pandemic-plagued second quarter when GM eked out only $16.8 billion in sales. What’s more, GM earnings are up year over year. The company earned $1.72 in the third quarter of 2019. Growth has returned much faster than analysts expected.

Twitter’s Board Stands Behind Jack Dorsey

Twitter said in a filing with the Securities and Exchange Commission late Monday that the company’s board of directors had reviewed CEO Jack Dorsey’s leadership and will allow him to remain as top boss.

The board’s review of Dorsey’s leadership was triggered by activist investor Elliot Management, which earlier this year made a bid to boot the CEO from the company after building up a $1 billion stake. Elliot’s issues with Twitter under Dorsey were that it lagged behind rivals Snap and Facebook on product innovation, its stock hasn’t performed well, and Dorsey has a commitment to running Square, where he is also CEO. He also had planned to spend several months in Africa.

Bayer Posts $3 Billion Loss and Says Roundup Settlement Costs to Rise

Bayer, the German chemicals and drugs giant, on Tuesday posted a third-quarter loss and said its Roundup settlement would now cost a further $750 million.

The Frankfurt-listed company reported a net loss of €2.74 billion ($3.2 billion) in the three months ending Sept. 30, after taking impairment charges of €9.3 billion on assets in its agriculture—Crop Science—unit. Group sales fell 5.1% to €8.51 billion, missing the FactSet consensus of €9.2 billion, but the company stuck to its full-year guidance.