Friday, November 26, 2021

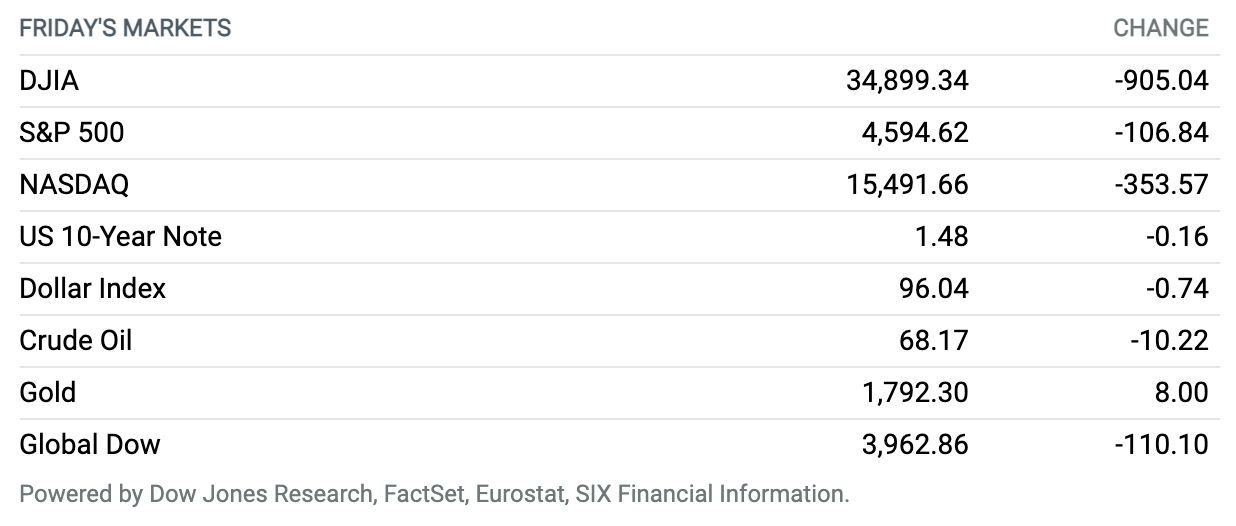

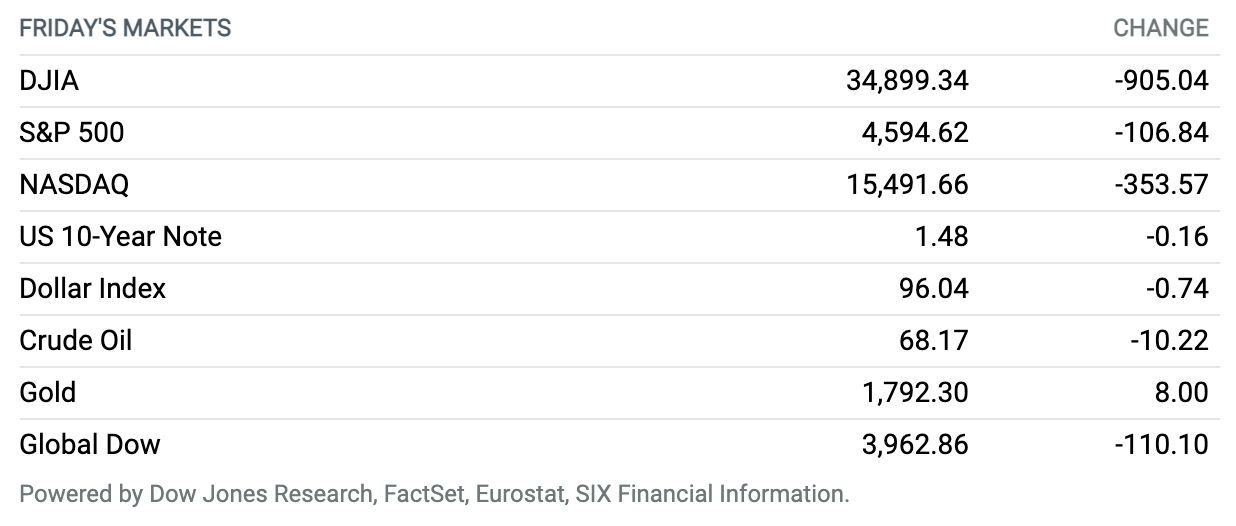

Stocks Suffer Worst Black Friday on Record as Covid Fears Slam Markets. Stocks, oil prices, and bond yields plunged Friday as fears surrounding a new, heavily mutated variant of Covid-19 slammed investor sentiment and ratcheted up volatility. The Dow Jones Industrial Average had its worst day of the year, falling 905 points, or 2.5%, in holiday-shortened trading. The S&P 500 ended 2.3% lower, while the Nasdaq Composite declined 2.2%. This was the worst Black Friday on record for all three indexes. A new, heavily-mutated variant of Covid-19 known as B.1.1.529, identified in southern Africa, has sparked fears of the pandemic getting worse, with the prospect of new travel and social restrictions looming large. A global resurgence of Covid-19 threatens to reverse the progress of economic recovery and has rocked markets.

A New Covid Variant Is Triggering Travel Restrictions Worldwide. What to Know.

Starting on Monday, the U.S. will restrict travel for non-U.S. citizens from South Africa and seven other countries, according to media reports citing senior officials from the Biden administration.

The White House did not immediately respond to a request for comment.

The other affected countries are Botswana, Zimbabwe, Namibia, Lesotho, Eswatini, Mozambique, and Malawi, according to media reports. The decision comes less than three weeks after the U.S. lifted pandemic travel restrictions on visitors from more than 30 countries.

Continue reading

WHO Names Coronavirus Variant From Africa ‘Omicron,’ Says It’s ‘Variant of Concern’

The World Health Organization’s technical advisory group said Friday it has assigned the B.1.1.529 variant of the coronavirus that causes Covid-19 the Greek letter omicron and said it has been designated a “variant of concern.”

Earlier reports suggested the variant would be assigned the letter nu. The variant was first reported in southern Africa, and there are concerns it may be more transmissible than the original virus and more lethal.

Continue reading

Black Friday E-Commerce Sales Expected to Approach $9 Billion

Adobe Analytics forecasts Black Friday e-commerce sales between $8.8 billion and $9.6 billion, though the group says the pull of major shopping days is starting to fall.

Shoppers spent $5.1 billion on Thanksgiving Day, the low end of the expected range of $5.1 billion to $5.4 billion. Still, shoppers spent an average of $3.5 million per minute.

Continue reading

Powell’s Nomination for a Second Term as Fed Chair Is a Bid for Continuity as Inflation Surges

The decision Monday to keep Powell for another four-year term follows months of speculation that Biden could replace the Fed chair, appointed by former President Donald Trump, before his term expires in February.

While progressives within the Democratic party’s ranks pushed for Fed Governor Lael Brainard, a candidate they viewed as more aligned with their priorities, Biden opted for continuity as the U.S. economy continues to recover from the pandemic. The president nominated Brainard to be vice chair.

Continue reading

The U.S. Oil Move Was Big. OPEC’s Response Could Be Bigger.

Oil diplomacy took a new turn on Tuesday as the U.S. announced a coordinated release of strategic reserves with five other countries, meant to cause oil prices to fall. It was a bold gambit, one that appears to have worked in the short-term—oil fell more than 10% over the past three weeks in anticipation of the move. But the next move is OPEC’s. The group plans to meet by videoconference with allies like Russia on Dec. 2, and its decisions there could showcase the amount of power the cartel has over the price of oil, and its limits.

OPEC clearly has more power than the U.S. and other big oil consumers to set the terms of the market. Unlike the U.S., which oversees but doesn’t control domestic oil production, OPEC members have much wider influence over their production levels. Reserve releases are also finite events, limited by the depths of the reserves themselves—U.S. reserves are only enough to satisfy about a month’s worth of domestic demand.

Continue reading

Jobless Claims in U.S. Drop to Lowest Level Since 1969

The number of Americans filing for first-time unemployment benefits last week dropped to the lowest level since November 1969.

Initial jobless claims for the week ended Nov. 20, dropped by 71,000 to a seasonally adjusted 199,000, according to data released by the Labor Department on Wednesday. The figure is the lowest level for initial claims since Nov. 15, 1969, when it was 197,000.

Continue reading

New-Home Sales Rose but Still Missed Expectations. Prices Hit a New Record.

New-home sales increased slightly in October but fell below forecasts. The miss comes as the cost to buy a new home continues to increase.

The Census Bureau said Wednesday that new single-family homes in October were sold at a seasonally adjusted annual rate of 745,000. That’s up 0.4% from September’s downwardly revised rate of 742,000 but far short of consensus expectations from FactSet that called for a rate of 800,000. July and August’s new-home sales figures were also reduced.

Continue reading

Jamie Dimon ‘Regrets’ Joke That JPMorgan Will Outlive China’s Communist Party

JPMorgan Chase CEO Jamie Dimon said Wednesday said that he “regrets” a joke he made the day before about the bank outliving the Chinese Communist Party.

“I regret and should not have made that comment. I was trying to emphasize the strength and longevity of our company,” the U.S. banker said in a statement released by JPMorgan.

Continue reading

Ericsson Paying $6.2 Billion to Buy Vonage

Vonage, the cloud-based telecom company, agreed to be acquired by Ericsson for $21 a share in cash. The companies, in a statement Monday, said the deal had an enterprise value of $6.2 billion.

Ericsson said the acquisition builds upon its “stated intent to expand globally in wireless enterprise, offering existing customers an increased share of a market valued at $700 billion by 2030.”

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.