Friday, November 13, 2020

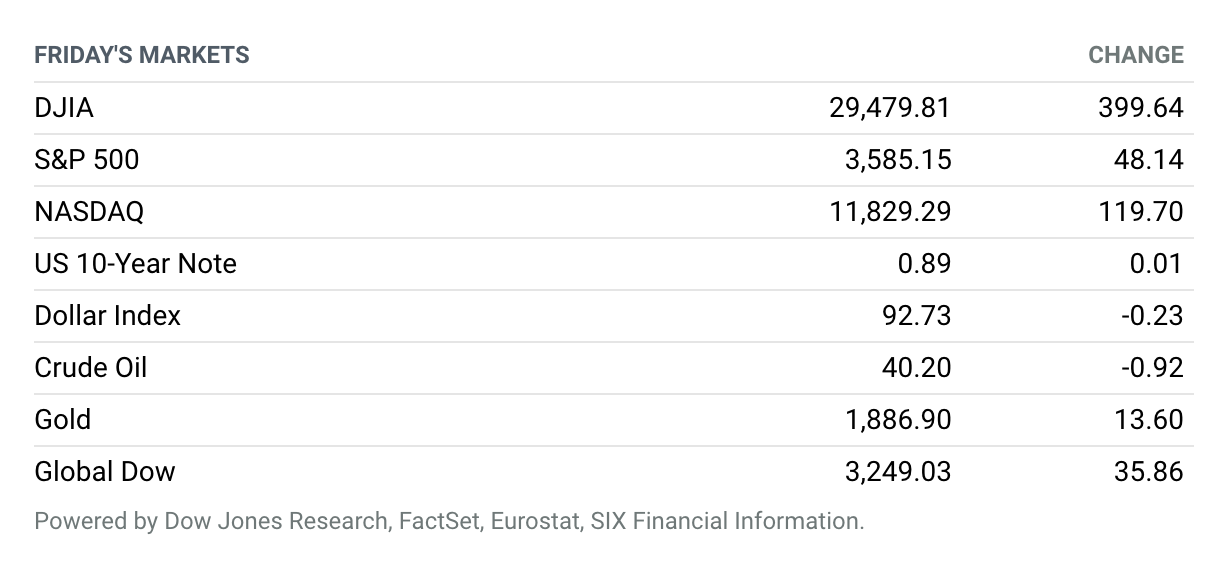

Vaccine Optimism Lifts Stocks. Stocks scored gains Friday, with the S&P 500 closing at a record as investors cheered progress toward a Covid-19 vaccine, while seeming to look past a continued rise in new cases of the illness. The Dow Jones Industrial Average rose about 400 points, or 1.4%, to close near 29,480, while the S&P 500 gained around 48 points, or 1.4%, to finish near 3585, topping its previous record close from Sept. 2. The Nasdaq Composite rose around 120 points, or 1%, to finish near 11,829. Stocks were on the rise this week after Pfizer and BioNTech on Monday announced their Covid-19 vaccine candidate was more than 90% effective in preventing the disease in a trial. The news sparked a rotation away from highflying tech and internet shares that were seen as beneficiaries of the pandemic into cyclical and small-cap shares that were left behind by 2020’s stock-market gains. The tech-heavy Nasdaq saw a weekly fall of 0.6%, while the more cyclically oriented Dow rose 4.1%. The S&P 500 saw a weekly gain of 2.2%.

Pfizer Says Early Results Show Effectiveness of Covid-19 Vaccine

The first evidence of strong effectiveness in the pivotal trial of the Covid-19 vaccine developed by Pfizer and BioNTech came at a lucky time for hunkered-down humans, as well as for those two companies’ investors. The timing of the Monday announcement was less opportune for rival vaccine developers and for President Donald Trump.

If a final readout merits emergency authorization, the Pfizer team aims to make 50 million doses by year-end. Participants in other vaccine trials may be tempted to jump ship before the studies reach conclusive results.

As for the president, he failed in his politically tinged push for a pre-election vaccine. To get a more sound reading on the vaccine’s effectiveness, Pfizer and BioNTech say they waited for more Covid cases to accrue than they had originally planned. They said that the delay was blessed by the U.S. Food and Drug Administration, an agency whose scientists had been squeezed by the Trump White House to hastily approve Covid remedies.

The FDA Authorizes Eli Lilly’s Covid Antibody Drug. What That Means for Revenue.

Eli Lilly received government authorization Monday night to sell an antibody treatment for Covid-19 patients. It is just the first of several such infusions from Lilly and rivals including Regeneron Pharmaceuticals that will become bridging remedies while the world waits to get vaccinated. Sales of the $1,250 treatments will also help Lilly bridge gaps that Covid opened in its revenue this year.

Covid cases are surging again and clinical trials have shown that the artificial antibodies help keep patients with moderate cases of the illness out of the hospital, if the infusions are given within 10 days of diagnosis. President Donald Trump got Regeneron’s antibodies after he came down with Covid. But the antibodies haven’t worked well for sicker patients already hospitalized.

EU Hits Amazon With Antitrust Charges and Opens New Probe on E-Commerce Practices

The European Commission on Tuesday said it was bringing formal charges against Amazon for “illegally distorting competition” through its use of data on independent vendors who sell on Amazon’s marketplace. The watchdog separately started a second probe into the online retail giant’s e-commerce practices.

Margrethe Vestager, the Commission vice president overseeing the EU’s competition watchdog, said in a press conference that Amazon uses data on 800,000 vendors selling more than 1 billion products in order to identify best-selling items and then copy them.

The 737 MAX Is Coming Back. Here’s What It Means for Boeing.

Boeing’s grounded 737 MAX jet could be recertified to fly commercially as soon as next week. That timeline is according to news reports citing an internal email from FAA director Steve Dickson. Boeing wasn’t immediately available to comment, but the company’s chief regulator confirmed that recertification is likely soon.

“The Federal Aviation Administration is in the final stages of reviewing the proposed changes to the Boeing 737 MAX,” an FAA spokesman said via email. “We expect that this process will be finished in the coming days, once the agency is satisfied that Boeing has addressed the safety issues that played a role in the tragic loss of 346 lives aboard Lion Air Flight 610 and Ethiopian Airlines Flight 302.”

Jobless Claims Continue to Fall

Last week saw 709,000 Americans file initial claims for unemployment benefits, according to data from the Labor Department.

New claims for the week ended Nov. 7 marked a 48,000 drop from the prior week’s 757,000 new claims, showing that the economy is improving, albeit at a slow pace. Since the coronavirus pandemic crippled parts of the U.S. economy in March, initial claims have consistently been above prepandemic highs.

Overall Consumer Prices Were Unchanged in October

Consumer prices were flat last month, continuing a downward trend as inflation remains subdued amid the coronavirus recession.

The consumer price index was unchanged in October on a seasonally adjusted basis, slowing from a 0.2% increase in September, the Labor Department said Thursday. The reading was below the 0.1% increase economists polled by the Wall Street Journal had expected.

DoorDash’s IPO Filing Shows It Has Already Turned a Profit

DoorDash on Friday filed for an initial public offering, revealing a company with huge size and astonishing growth that has already reached profitability.

The food delivery company plans to list on the New York Stock Exchange under the symbol DASH. The filing does not say how many shares the company plans to sell or at what price. Goldman Sachs and J.P. Morgan will lead the underwriting group. Morgan Stanley notably is not involved in the offering.

Disney Lost Less Money Than Expected. Disney+ Stole the Show.

Walt Disney managed to lose less money than expected in its most recent quarter and continued to show rapid subscriber growth at its still-unprofitable streaming segment.

Disney reported a loss of 39 cents per share in its fiscal 2020 fourth quarter—which corresponds to the calendar third quarter—or 20 cents per share when adjusted for one-time factors. Those are much better than Wall Street’s forecasted losses of 90 cents per share, or 73 cents after adjustments. It compares with a $2.61 per-share loss in the previous quarter, and a 58-cent profit in the year-earlier period.

TikTok Avoids Shutdown for Now

TikTok stars will dance another day. A deadline set by the Trump administration that would have forced Chinese parent ByteDance to divest its popular social media app came and went on Thursday.

The Wall Street Journal reported that the U.S. Commerce Department, citing a preliminary injunction, did not enforce the ban. President Donald Trump signed an executive order in August pushing for the company to sell to a U.S. firm or be banned due to national security concerns.

Apple Unveils First Macs Powered by M1 Chip

Apple on Tuesday unveiled new versions of the 13-inch MacBook Air, the 13-inch MacBook Pro, and the Mac Mini, the company’s first computers powered by the M1, a new Apple-designed system-on-a-chip, as Apple’s long relationship with chip giant Intel fades away. The company didn’t announce any updates to its iMac line of desktop computers.

The new MacBook Pro will be priced starting at $1,299, or $1,199 for educational buyers. The M1-based Air will be priced starting at $999, or $899 for educational buyers, unchanged from the current version. The new Mini, which as usual ships without a screen or keyboard, will be priced at $699, $100 lower than the previous generation of the device.