Friday, November 12, 2021

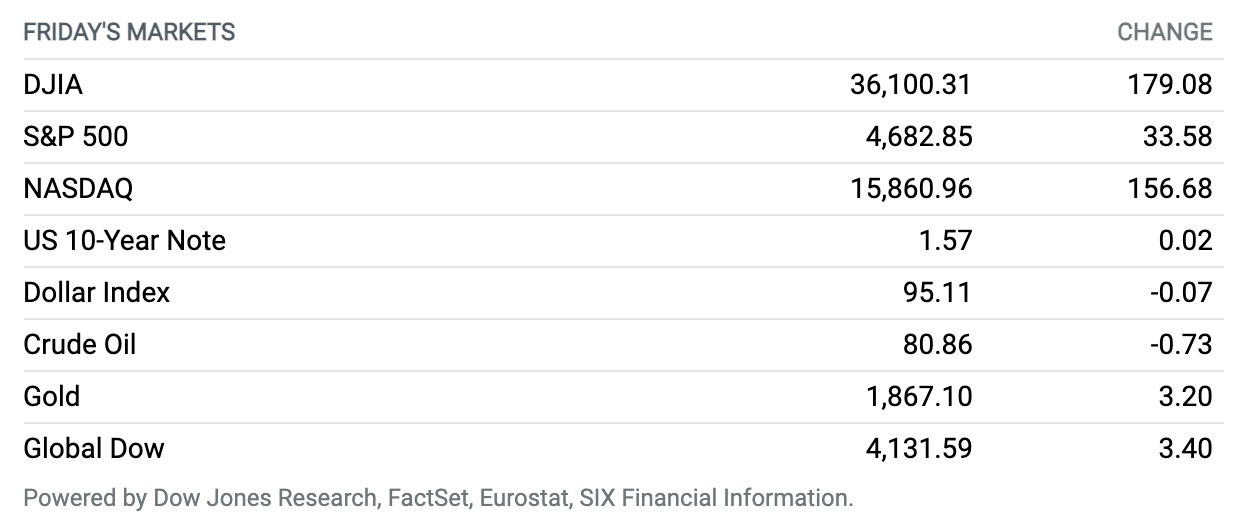

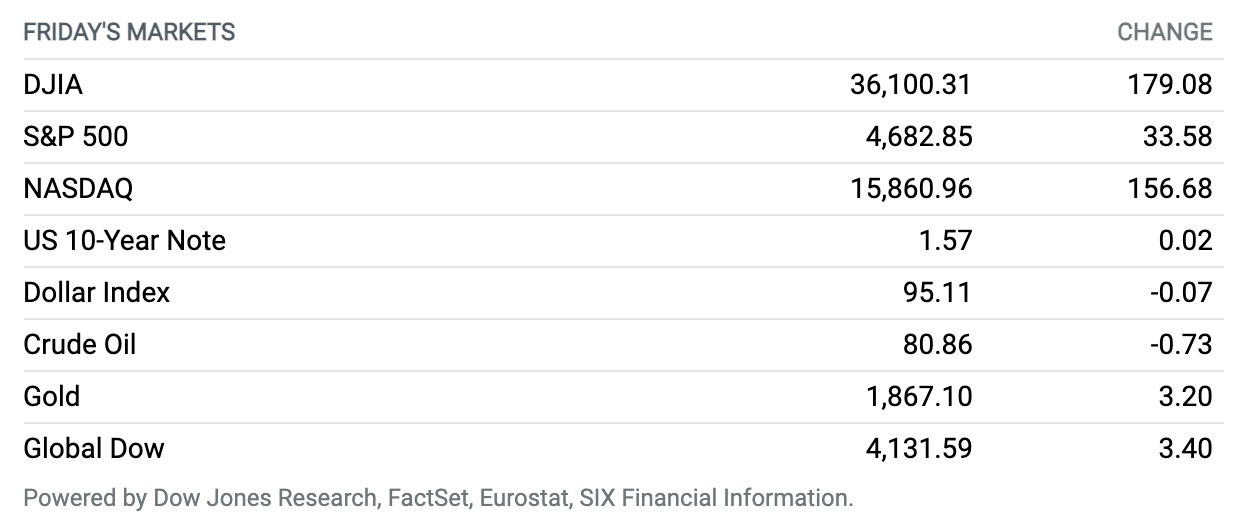

Stocks End Higher, but Snap Run of 5 Straight Weekly Gains. Stocks closed higher Friday but lost ground for the week, snapping a run of five straight weekly gains for major indexes. The Dow Jones Industrial Average rose 179 points, or 0.5%, to finish at 36,100, while the S&P 500 gained 34 points, or 0.7%, to end near 4683. The Nasdaq Composite advanced around 157 points to 15,861, a gain of 1%. For the week, the Dow gave up 0.6%, while the S&P 500 lost 0.3%, and the Nasdaq shed 0.7%.

Powell or Brainard as Fed Chief? Biden to Make a Pick Soon.

President Joe Biden is getting closer to announcing his nominee for Federal Reserve chair. The field of contenders has narrowed.

Biden is said to be considering whether to keep Jerome Powell as chief of the U.S. central bank, or to nominate Fed Gov. Lael Brainard to replace him. While the president still has time for Congress to confirm his nominee before Powell’s four-year term ends in February, the timeline likely was accelerated by a series of recent Fed resignations.

The president met with both Powell and Brainard last week. He hopes to make the announcement “fairly quickly,” he told Capitol Hill reporters earlier this month. Some analysts believe he will disclose the nomination before Thanksgiving.

Continue reading

Johnson & Johnson Plans to Split

Johnson & Johnson announced plans on Friday to separate its consumer-health division from the rest of the company, spelling the end of the last great pharmaceutical conglomerate.

The split will create one of the world’s larger consumer-healthcare companies, while the stay-behind company will still be the largest healthcare company in the world. The news comes two months before a planned CEO transition, when longtime Johnson & Johnson executive Joaquin Duato is set to succeed Alex Gorsky in the top post.

Continue reading

General Electric Dropped a Bombshell. It Will Split Into Three Firms.

General Electric‘s years-long transformation is taking another huge step forward.

On Tuesday, the company announced plans to split into three companies: one focused on healthcare, another devoted to energy and power, and the third dealing with aviation. The heathcare spinoff is slated for 2023, and GE plans to retain a 19.9% stake. The spinoff of the power business is planned for 2024.

Continue reading

Elon Musk Just Sold More Tesla Stock—in a Very Elon Musk Kind of Way

Filings with the Securities and Exchange Commission revealed early Friday more stock sales by Tesla CEO Elon Musk. The slow, somewhat strange process of selling 10% of his stake seems to be progressing—albeit at a snail’s pace.

Musk sold another 634,000 shares worth about $656 million on Thursday, according to Friday’s SEC filings. Typically, sellers who are required to file have a couple of days to file the reports.

Continue reading

Inflation Strikes Everywhere. But Central Banks Don’t Face the Same Dilemma.

The pace of inflation in the U.S., at an annual rate of 6.2%, is now far above what it is in Europe (4.1%), which in turn is a multiple of the Chinese inflation rate (1.5%).

But beyond the headline numbers that reflect different economic structures, problems, and cycles, the world’s three major economic powers all have to deal with the unexpected—and unexpectedly lasting—spike in prices that came with the Covid-19 pandemic recovery.

Continue reading

Tesla Wins Approval to Sell Power in Texas. It Says a Lot About the Company’s Ambitions.

Tesla is constantly expanding its ambitions, and its latest move is particularly eye-opening. The company was just approved for a new kind of business—selling power in Texas.

The company applied to the Texas’ Public Utilities Commission in August to provide power to households in the state. It’s one of several companies that are looking to expand operations in Texas following a major storm in February that caused severe blackouts, pushed power prices higher, and led to more than 200 deaths.

Continue reading

High Energy Prices Are Rippling Through the Economy

The latest government inflation figures show that prices are rising fast, and much of the momentum is coming from energy. The trends are already hitting businesses in several industries and will continue rippling through the economy.

This week, the Bureau of Labor Statistics released the monthly producer price index, which measures prices of goods and services as they make their way through the supply chain. The report showed that the PPI rose 0.6% in October on a month-over-month basis, and 8.6% on a year-over-year basis, in line with economists’ expectations.

Continue reading

Online Sales Are Up at the Start of the Holiday Season. Shoppers Find Shortages.

The online holiday shopping season is off to a modest start, with sales up 8% in October to $72.4 billion from the same month last year, according to new data from Adobe.

For the year to date, Americans have spent $680 million online, up 9% from a year ago and 57% above the 2019 level, according to Adobe, which provides widely used e-commerce and analytics software. Adobe has projected a 10% increase in U.S. retail sales for the final two months of the year.

Continue reading

SEC Says No to a Spot Bitcoin ETF Because the Market Can Still Be Manipulated

The Securities and Exchange Commission on Friday rejected an application by fund sponsor VanEck to launch a Bitcoin Trust ETF that aimed to own the cryptocurrency directly.

In a 51-page ruling, the SEC said that exchange company CBOE Global Markets, which aimed to list the ETF, failed to prove that the Bitcoin spot market wasn’t subject to manipulation or fraud, or that it could be monitored adequately with a surveillance-sharing agreement with the exchange.

Continue reading

Elon Musk on Rivian: The True Test of Success Is High-Volume Production

Tesla CEO Elon Musk threw a very small amount of shade at the electric-vehicle contender Rivian, noting that while the newly public truck maker achieved a sky-high valuation in its recent IPO, that isn’t the true test of success.

Musk wished Rivian well on its journey toward profitability but said the only American car maker to reach high-volume production and positive cash flow in the past century is Tesla.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.