Friday, May 8, 2020

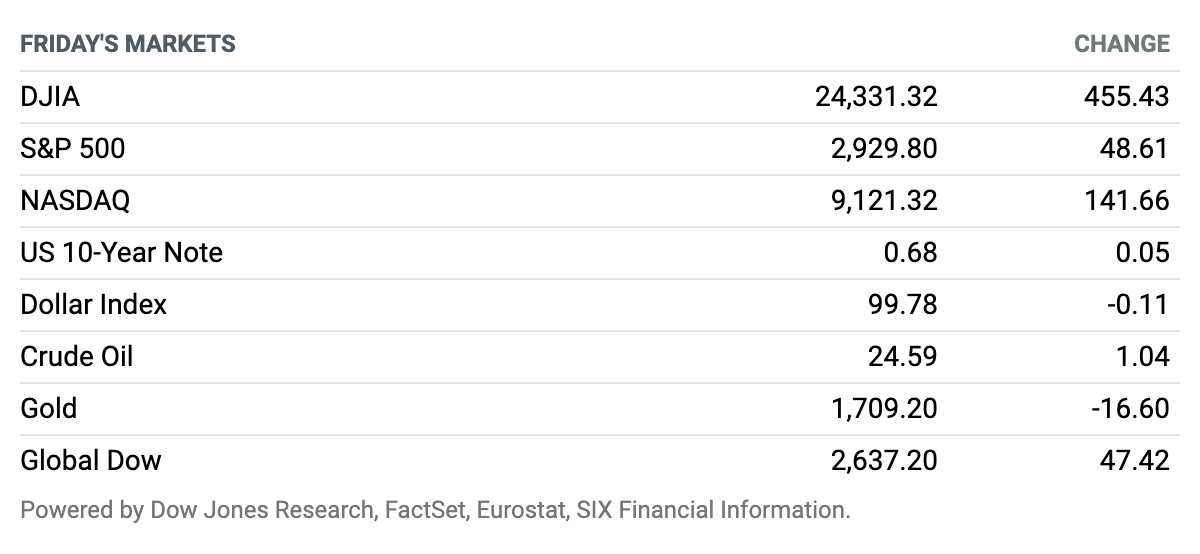

Looking ahead. The stock market continues to rally in the face of grim economic news. On Friday, data showed the U.S. unemployment rate soared to 14.7% in April as employers cut 20.5 million jobs during the month. Recent surveys of manufacturing, services, and business investment activity all showed tumbling figures. But U.S. stock indexes all closed the week with solid gains. As always, investors are looking to the future, and the economic data reflects conditions as they were last week, last month, or last quarter. Those focused on the recovery believe that the worst is already behind us and are moving to price in better data ahead. And trillions of dollars of monetary and fiscal policy stimulus have provided powerful tailwinds to both that recovery and risk assets, such as stocks. Regardless of the jobs data, the Dow Jones Industrial Average closed up 455 points, or 1.9%, on Friday. The S&P 500 rose 1.7% and the Nasdaq Composite gained 1.6%. The small-cap Russell 2000 index, more sensitive to upturns and plunges in the economy, added 3.5%.

The U.S. Lost 20.5 Million Jobs in April

The coronavirus pandemic claimed 20.5 million jobs in April as companies across America were forced to close and consumers stayed home to cap the disease’s spread.

The Labor Department said Friday that the job losses in April followed a downwardly revised loss of 870,000 in March. So far, about one in five workers are unemployed.

Investors knew this would be one of the worst jobs reports in history. The decline in nonfarm payrolls for April is about three times as bad as the jobs lost over the entire Great Recession, with the depth of the losses not seen since the Great Depression. But the headline number was about in line with the 21 million job losses economists predicted, and the unemployment rate—at least on the surface—looks not as bad as feared.

3.2 Million More Americans Claimed Jobless Benefits Last Week

The coronavirus pandemic claimed an additional 3.2 million jobs last week, the fewest since lockdowns began in earnest but a number that remains historically high as layoffs continue across the economy.

Thursday’s figures bring the total number of first-time claims for unemployment insurance to more than 33.5 million since mid-March. The Labor Department last week reported an increase of 3.8 million initial claims on a seasonally adjusted basis.

Neiman Marcus’s Bankruptcy Just Pushed Retailer Defaults to an All-Time High

Neiman Marcus Group has filed for bankruptcy in a restructuring that will transfer majority ownership of the retailer to its creditors. Its filing, announced Thursday, has pushed the default rate for retailers to an all-time high, as the coronavirus pandemic further destabilizes the sector.

The Dallas-based department store has secured $675 million of “debtor-in-possession financing,” or loans meant to fund its operations as it goes through the bankruptcy process. Creditors have also committed $750 million in exit funding, a sum that includes a full refinancing of the debtor-in-possession financing.

J. Crew Is the First Major Retailer to File for Bankruptcy Because of Coronavirus

Crew has reached a deal with its lenders to restructure its debt, becoming the first major retailer to file for bankruptcy because of the coronavirus recession.

The privately owned retailer filed for Chapter 11 bankruptcy early Monday to carry out the restructuring agreement with lenders and equity investors. J. Crew will convert about $1.65 billion of debt into equity. It has obtained $400 million of debtor-in-possession financing and committed financing to exit bankruptcy from its lenders.

Uber Says Business Is Recovering. And That’s All Investors Needed to Hear.

Shares of Uber Technologies traded higher late Thursday and on Friday after the company reported first-quarter results that showed weakness in its core ride-hailing business, but a surge in its Uber Eats food delivery segment.

The quarterly results quickly took a back seat to commentary from Uber’s management team, which said on a conference call with investors that the rides business was starting to recover from the Covid-19 shutdowns. Uber shares, which initially fell on the earnings report, shot higher on the rebound news.

Disney’s Quarterly Profit Tumbles 93%

Walt Disney’s latest earnings, released Tuesday, showed a company taking pressure from all sides. The coronavirus pandemic and associated physical-distancing measures have made it nearly impossible for the company to continue operating several of its core businesses. Add to that a planned investment year for its splashy new streaming initiatives, and Disney’s earnings were hit hard, down a whopping 93% from a year ago. The current quarter could be even uglier. Meanwhile, the company said it was cancelling its next dividend payment to conserve cash.

In its most recent quarter, the second of Disney’s fiscal 2020, the company earned 26 cents in earnings per share—versus analysts’ 68-cent consensus estimate and down from $3.55 in the same period a year ago. Adjusted for non-recurring costs including amortization of intangible assets, Disney’s earnings came in at 60 cents per share. That compares with Wall Street’s expected 93 cents.

Japanese Regulator Grants Special Approval for Gilead’s Covid-19 Drug

Japan’s drug regulator issued a special approval on Thursday, allowing the Gilead Sciences antiviral remdesivir to be used to treat Covid-19 patients in the country.

The approval came less than a week after the U.S. Food and Drug Administration issued its own emergency use authorization for remdesivir in Covid-19 patients. Japan acted extraordinarily quickly: Gilead submitted its application with the regulator only on Monday.

GM Reports Better-Than-Expected Earnings

General Motors said Wednesday morning that it earned 62 cents a share from $32.7 billion in sales in the first quarter. Analysts were looking for 40 cents a share from $32.1 billion in sales.

Expectations are a funny thing, however. Earnings estimates have fallen from about $1.20 a share over the past three months as the coronavirus problem grew. And earnings were down from $1.41 a share in the first quarter of 2019. Still, the results qualify as very good. North American operating profits actually increased in 2020 compared with 2019.

Warren Buffett Jettisons Airline Stocks

Warren Buffett has bailed on airlines, sending the stocks into another tailspin.

Buffett said Saturday that he had sold his entire stake in U.S. airline stocks through his holding company Berkshire Hathaway. Buffett held stakes of roughly 8% and 10% in the four largest U.S. carriers: American Airlines Group, Delta Air Lines, United Airlines, and Southwest Airlines.

Liberty Global and Telefónica Plan $38 Billion Telecom Merger in U.K.

The U.S.’s Liberty Global and Spain’s Telefónica on Thursday agreed to merge their British operations Virgin Media and O2 in a £31.4 billion ($38.45 billion) deal that will dramatically reshape the United Kingdom’s telecom market and intensify the battle with BT Group.

The new 50-50 joint venture will have £11 billion in combined revenue and 46 million customer accounts across mobile, broadband, and pay-TV platforms. Mike Fries, CEO of Liberty Global and José María Álvarez-Pallete López, chairman and CEO of Telefónica, said the two companies plan to invest £10 billion in the U.K. over the next five years.