Friday, May 7, 2021

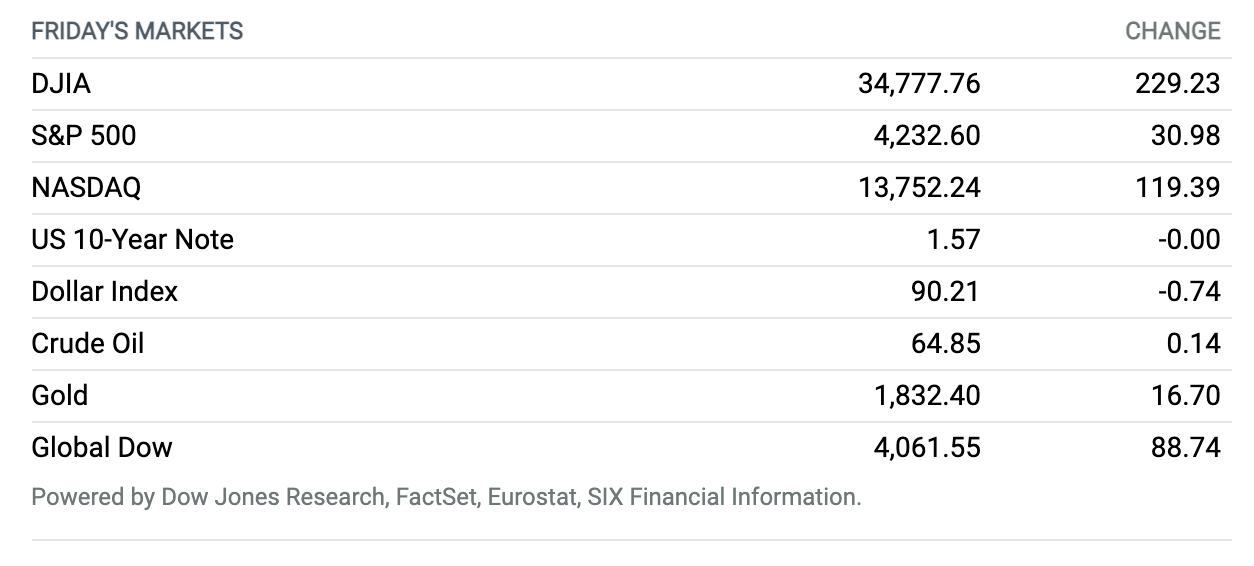

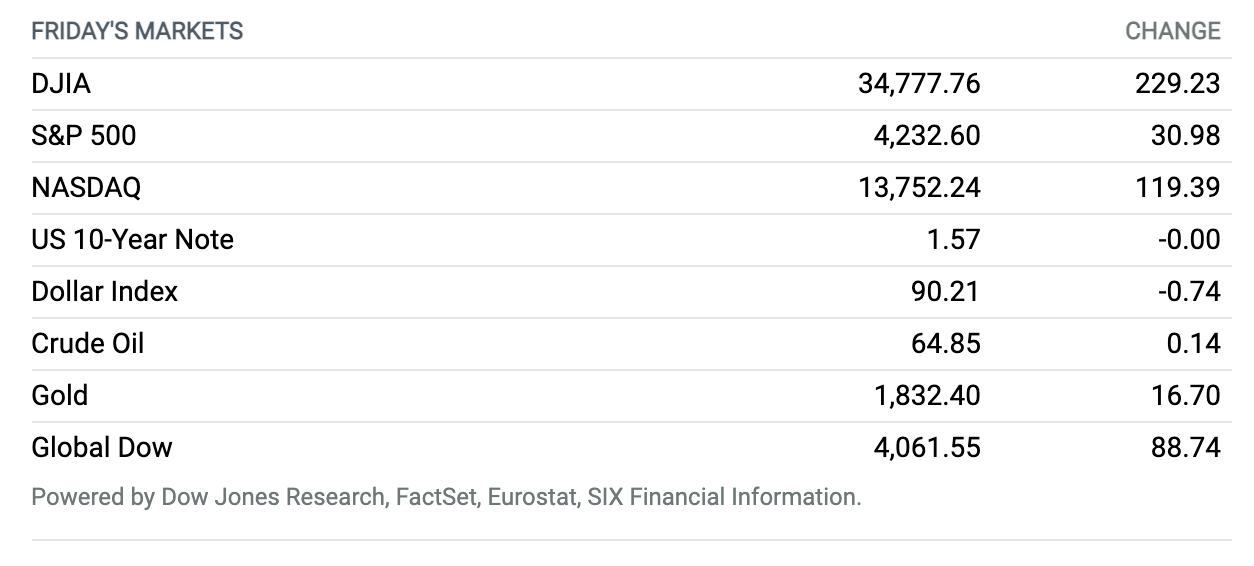

Stocks Rise After Weak Jobs Report. U.S. stocks climbed on Friday to clinch weekly gains for the S&P 500 and Dow Jones Industrial Average following a weaker-than-expected jobs report in April. The S&P 500 rose 0.7% to around 4233, a closing record. The Dow Jones Industrial Average climbed 0.7% to end around 34,778. The Nasdaq Composite added 0.9% to finish near 13,752. For the week, the S&P rose 1.2%, the Dow gained 2.7%, and the Nasdaq fell 1.5%. The U.S. economy added 266,000 in jobs, falling short of MarketWatch-polled estimates for a million gains. Investors suggested the bullish response to disappointing economic data reflected hopes that it may push back the timing for tapering the Federal Reserve’s asset purchases and plan for rate hikes, moves that could weigh on the buoyant mood on Wall Street.

Jobs Growth Falls Way Below Estimates as Labor Shortage Complicates Fed Policy

Hiring unexpectedly sputtered in April as wages jumped, raising questions about U.S. economic momentum.

Nonfarm payrolls grew by 266,000 last month, the Labor Department said Friday. That was far short of the 975,000 increase economists polled by FactSet predicted, representing the slowest pace of hiring since January. The disappointing reading came alongside a downward revision to March payrolls, to an increase of 770,000 from an originally reported 916,000.

Employers across the country have been struggling with supply-chain problems that are leading to big backlogs and price increases. Demand is rising, many companies say, as Americans get vaccinated and pandemic restrictions continue to lift. While shortages in lumber, steel, and other materials aren’t new, a labor shortage has emerged as a headwind for companies across the economy as enhanced unemployment benefits extend until September and many workers contend with continuing childcare disruptions and health concerns.

Continue reading ›

Trump Will Remain Off Facebook, for Now.

A body funded by Facebook to arbitrate content decisions issued its first major ruling early Wednesday, saying the social network’s ban on former President Donald Trump‘s account was fair, but describing his indefinite suspension as inappropriate.

Facebook’s Oversight Board said that the former president’s posts on the platform after the Jan. 6 riot at the U.S. Capitol, as Congress was certified the 2020 election, violated the company’s rules.

Continue reading ›

Greg Abel, Warren Buffett’s Heir Apparent, Led Berkshire Hathaway’s Renewable-Energy Push

Greg Abel, the likely successor to Warren Buffett as Berkshire Hathaway CEO, is a low-key Canadian who orchestrated the company’s big move into renewable energy as the head of Berkshire’s large utility business.

Abel, 58 years old, was CEO of Berkshire Hathaway Energy, a diversified utility business that is 91% owned by Berkshire Hathaway, from 2008 to 2018, when he was named a Berkshire Hathaway vice chairman with responsibility for the conglomerate’s sprawling noninsurance businesses. He remains chairman of the utility unit.

Buffett praised Abel at Berkshire’s annual meeting Saturday, saying, he “does a much better job at doing that than I was doing previously.”

Continue reading ›

Peloton Recalls Its Treadmills

Peloton Interactive on Wednesday announced recalls of both its treadmill models and temporarily halted sales of the higher-priced one.

The U.S. Consumer Product Safety Commission said one recall, for the Peloton Tread+, followed the death of one child and more than 70 other reported incidents. The lower-priced Peloton Tread, which hasn’t been released widely in the U.S., was recalled due to risks of injury related to its touch screen inadvertently detaching.

Continue reading ›

Pfizer and BioNTech Ask FDA for Full Approval of Covid-19 Vaccine

Pfizer and BioNTech said early Friday they have begun submitting an application to the U.S. Food and Drug Administration for full approval of their Covid-19 vaccine.

The vaccine received emergency use authorization from the FDA in December, allowing its use under a special mechanism the agency can employ during public health emergencies. But it hasn’t received FDA approval, the normal milestone that drugs and vaccines must achieve before being prescribed to the public in the U.S.

Continue reading ›

Moderna Reports First Profitable Quarter, but Now It Faces Patent Worries

Moderna reported its first profitable quarter, turning in a result that beat Wall Street’s expectations, but the shares sold off Wednesday and Thursday amid concern over proposals to temporarily waive intellectual-property protections for Covid-19 vaccines.

Moderna reporting diluted earnings of $2.84 per share for the first quarter of the year, above the FactSet consensus estimate of $2.39 per share. Moderna lost $0.69 per share in the fourth quarter of 2020, and had never previously recorded a profitable quarter.

Continue reading ›

Budweiser Brewer AB InBev Names U.S. Boss as New CEO

Carlos Brito, who transformed Anheuser-Busch InBev into the world’s largest brewer through a series of high-profile deals, is to step down as chief executive of the group, ending an almost two-decade reign at the company.

The brewer of Budweiser, Stella Artois, and Corona said on Thursday that the board had unanimously elected Michel Doukeris, president of the group’s North America business, to take over from Brito on Jul. 1. Brito leaves after 15 years as chief executive of the group and 32 years with the company.

Continue reading ›

GM’s Earnings Were Stellar. Semiconductors Are the Problem.

General Motors’ earnings are a story of the semiconductor shortage.

The company obliterated Wall Street’s expectations for its earnings, but it didn’t raise its full-year financial forecasts, despite the outperformance. That is the latest proof that the lack of chips still looms over GM and the entire auto industry.

Continue reading ›

Verizon Is Finally Selling Yahoo and AOL. What That Means for the Company.

Verizon Communications kicked off the week by confirming numerous reports that it would shed its media assets—for about half of what it paid for them over the past six years. Lately, the telecom giant’s strategy, investment priorities, and messaging to investors have been all about its network infrastructure and technology as the wireless industry enters the 5G era. A collection of middling online brands and advertising businesses didn’t quite fit into that. It was only a matter of time before Verizon bid them farewell.

The company will receive $4.25 billion in cash and $750 million in preferred interest from funds associated with private-equity giant Apollo Global Management for a 90% stake in Verizon Media—which implies a total valuation of about $5.6 billion. That unit is comprised of brands like Yahoo, AOL, TechCrunch, and Engadget, with a combined 900 million monthly active users, Verizon says. It also includes an advertising-technology platform and a handful of subscription services.

Continue reading ›

David Swensen Dies at 67. How Yale’s Investing Chief Was Widely Imitated.

David Swensen, the chief investment officer of the Yale University endowment whose early embrace of alternative assets was widely imitated among endowment and pension funds, has died of cancer. He was 67.

Swensen, who created what became known as the Yale Model of Investing, was the most influential endowment manager because of Yale’s successful move into alternatives like private equity and venture capital and for mentoring such leading endowment managers as Andy Golden of Princeton University and Paula Volent at Bowdoin College.

Continue reading ›