Friday, May 28, 2021

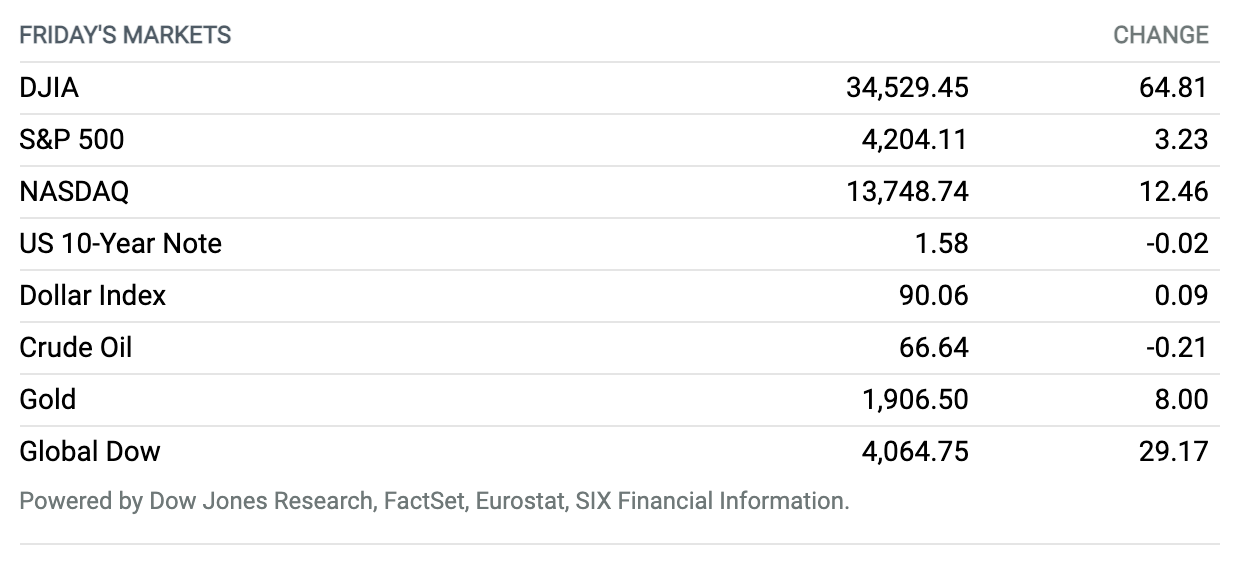

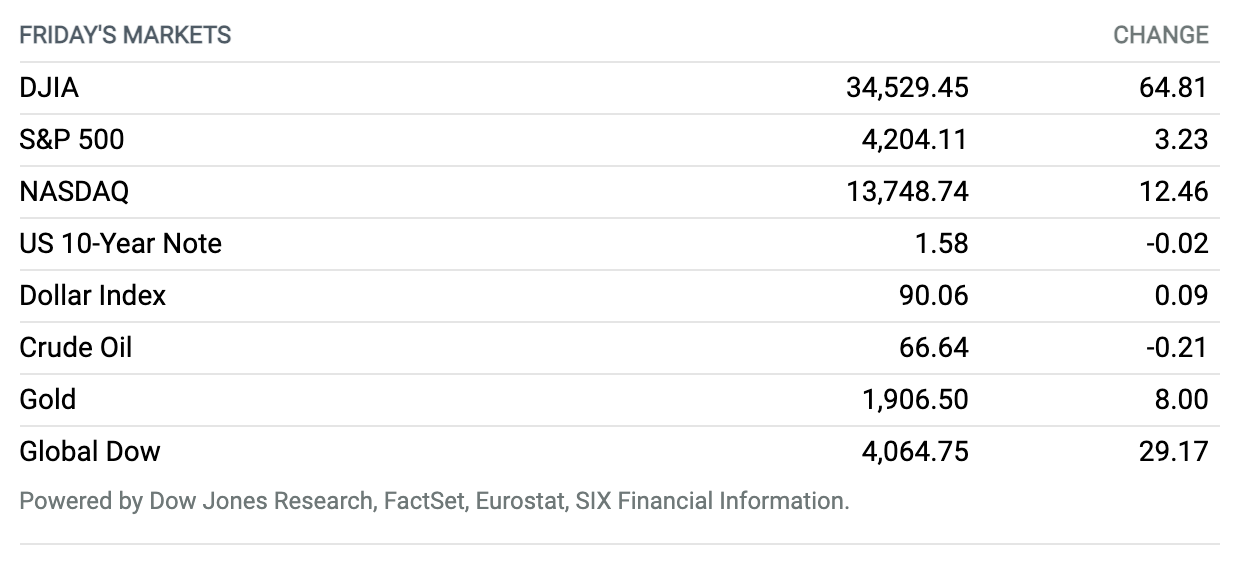

Stocks End May on an Up Note. The Dow and S&P 500 on Friday booked gains for the day, week, and month ahead of Memorial Day weekend. Jitters about inflation have been a key feature of trading sentiment in May, and investors wrapped up the month with the Federal Reserve’s preferred measure of inflation affirming rising pricing pressures. The Dow Jones Industrial Average closed out the session up 0.2% at 34,529, and logged a weekly gain of 0.9% and a monthly advance of 1.9%. The S&P 500 index closed the session up less than 0.1% and notched a 1.2% weekly gain and a 0.6% gain in May. The Nasdaq Composite Index meanwhile, closed less than 0.1% higher on Friday but clinched a weekly gain of 2.1%, while producing a monthly loss of 1.5%, representing its first monthly slide in seven months.

Biden’s $6 Trillion Budget Is Here

President Joe Biden unveiled his first budget to Congress on Friday, asking for $6 trillion in spending for 2022, escalating to $8.2 trillion in 2031. It’s an ambitious 10-year plan to increase government spending by trillions of dollars, while raising a host of new taxes, in a bid to remake the U.S. economy.

At 72 pages, plus a 1,422-page appendix and 246-page analysis, the president’s budget presents a blueprint for his economic and social agenda. It assumes that Congress passes Biden’s two big legislative initiatives: the American Jobs Plan and the American Families Plan. Amid the tables, charts, and forecasts are also plenty of political aspirations—from revitalizing manufacturing and the “care economy” to free college tuition, expanded child tax credits, and green energy.

Near term, the president is asking for an 8.6% increase in military and discretionary spending to $1.5 trillion for fiscal 2022. The rest of the budget goes to nondiscretionary spending like Medicare and Social Security, along with emergency programs for Covid-19 relief. The long-term goal is to spend more than $4 trillion on infrastructure and social programs, much of it outlined in the aforementioned legislative plans.

Continue reading ›

Treasury Yields Are Hardly Budging After Strong Inflation Data. Here’s Why.

Inflation data Friday morning confirmed what investors expected—consumer prices are rising as the U.S. economy reopens. Bond yields barely responded, stirring a debate about how far yields may rise from here.

The latest report on April inflation came in mostly in line with economist forecasts, with the personal consumption expenditures price index rising 0.6% in April from the month before, and 3.6% from last year. That matters because that metric is the Fed’s preferred gauge of inflation (rather than the consumer-price index), and far exceeds the central bank’s long-term target of 2%.

Continue reading ›

Boeing Halts 787 Dreamliner Deliveries Due to Production Problems

Boeing has halted deliveries of its 787 Dreamliners, adding fresh delays for customers following a recent five-month suspension in handing over the aircraft due to production problems, people familiar with the matter said.

Federal air-safety regulators have requested more information about Boeing’s proposed solution to address the previously identified quality lapses, these people said.

Continue reading ›

Signs of Recovery Dot Latest Data on Layoffs, Durable Goods, and Inflation

A slew of economic data Thursday reflected another pandemic low in layoffs, underlying strength in manufacturing, and an increase in the Fed’s favorite inflation gauge.

Among the data, initial jobless claims continued to trend lower in the latest week, with 406,000 Americans filing, down 38,000 from an unrevised 444,000 in the previous week. It was the lowest level for first-time claims since March 14, 2020. The four-week moving average slid 46,000 to 458,750—its lowest reading since March 14 of last year.

Continue reading ›

Exxon Board Will Seat at Least Two Activist Candidates

It would be considered a triumph of David over Goliath—if Goliath weren’t over the hill and David didn’t seem to have Goliaths of his own in his corner.

We’re speaking, of course, of the proxy battle between activist investor Engine No. 1 and Exxon Mobil. Engine No. 1 pushed to add four new members to Exxon’s board. An early tally of the vote has given the activists at least two of those directors on the board.

Continue reading ›

Shell Ordered to Cut Emissions in Landmark Dutch Climate Case

It would be considered a triumph of David over Goliath—if Goliath weren’t over the hill and David didn’t seem to have Goliaths of his own in his corner.

We’re speaking, of course, of the proxy battle between activist investor Engine No. 1 and Exxon Mobil. Engine No. 1 pushed to add four new members to Exxon’s board. An early tally of the vote has given the activists at least two of those directors on the board.

Continue reading ›

Shell Ordered to Cut Emissions in Landmark Dutch Climate Case

A Dutch court ordered oil giant Shell on Wednesday to slash its greenhouse gas emissions in a landmark victory for climate activists with implications for energy firms worldwide.

Shell must reduce its carbon emissions by 45 percent by 2030 as it is contributing to the “dire” effects of climate change, the district court in The Hague ruled.

Continue reading ›

Amazon to Buy MGM. Why It Won’t Change Much in the Streaming Wars.

James Bond, meet your new boss. Bezos. Jeff Bezos.

Amazon’s $8.45 billion purchase of privately held MGM Holdings—announced Wednesday—carries a big price tag, and it’s a big deal for fans of James Bond. But in the costly world of streaming, $8 billion has actually become a fairly small sum. Ultimately, the transaction won’t change much in the competitive market for subscription video services.

Continue reading ›

Ford Drops Another EV Bombshell

Ford Motor surprised investors yet again on Wednesday, this time by announcing a major increase in its spending on vehicle electrification.

Ford is now planning to spend $30 billion on vehicle electrification by 2025, up from a previously stated goal of $22 billion in EV spending, according to Ford. A Ford spokesman tells Barron’s the incremental $8 billion will support Ford’s battery production plans.

Continue reading ›

D.C. Attorney General Sues Amazon Over Online Pricing Policies

Washington, D.C. Attorney General Karl Racine has filed an antitrust lawsuit against Amazon.com, saying the company illegally controls online retail prices on its platform to eliminate competition from other sites.

The lawsuit, filed in Washington, D.C., Superior Court, says the “most favored nation” clauses Amazon imposes on businesses selling on its online marketplaces forbid them from offering items for lower prices elsewhere, including their own websites, The Wall Street Journal reported.

Continue reading ›

Moderna to Seek Approval for Covid-19 Vaccine for Adolescents

The biotech Moderna said early Tuesday that its Covid-19 vaccine had performed well in a trial in adolescents, and that the company will request emergency authorization for the vaccine in that age group early next month.

Moderna’s Covid-19 vaccine is currently authorized only for people aged 18 and up in the U.S., though the U.S. Food and Drug Administration expanded the authorization of Pfizer’s Covid-19 vaccine on May 10 to include people as young as 12.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.