Friday, May 13, 2022

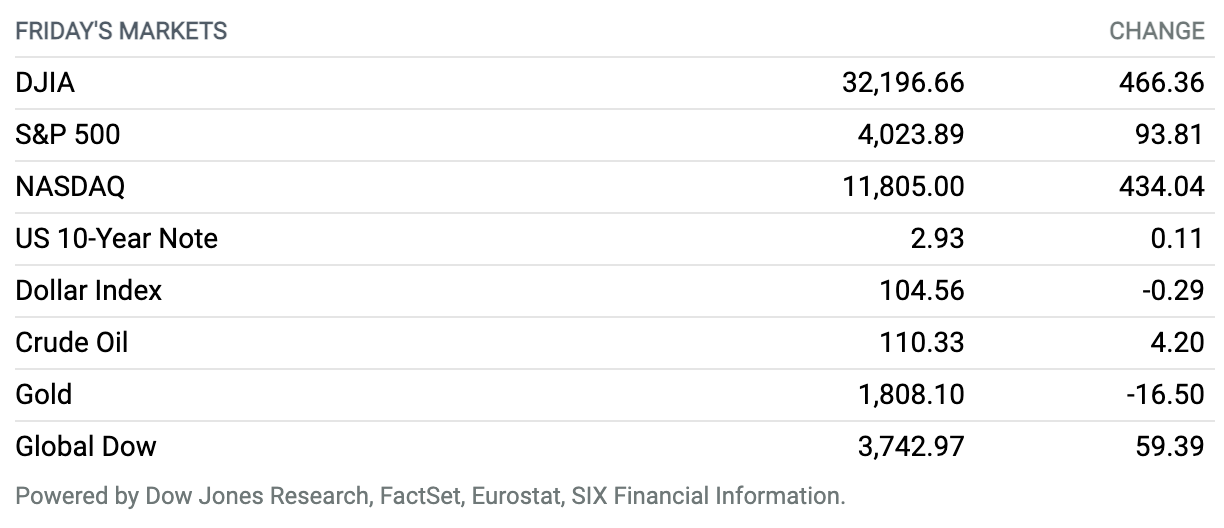

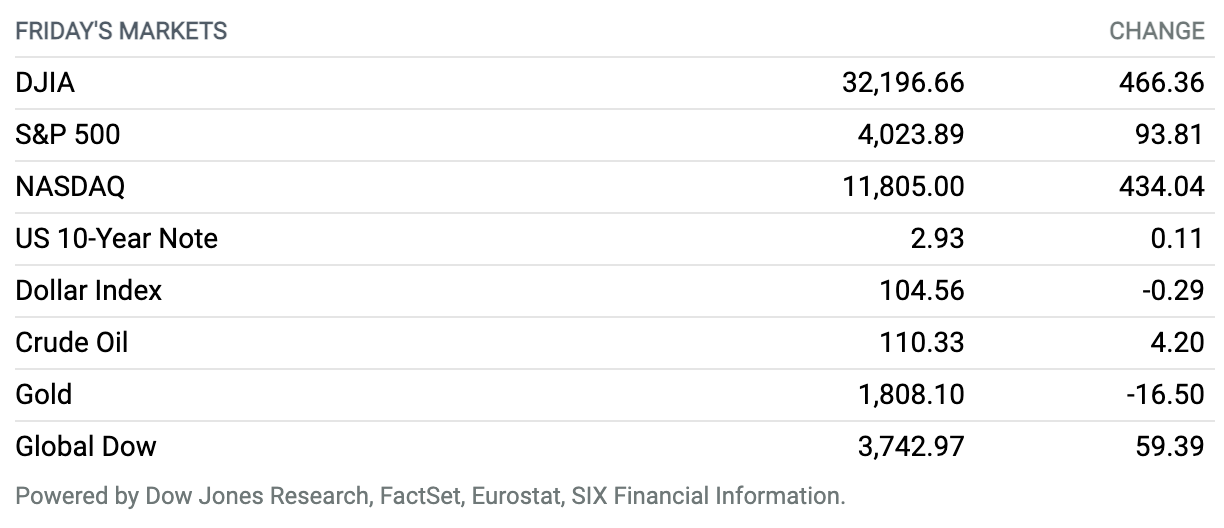

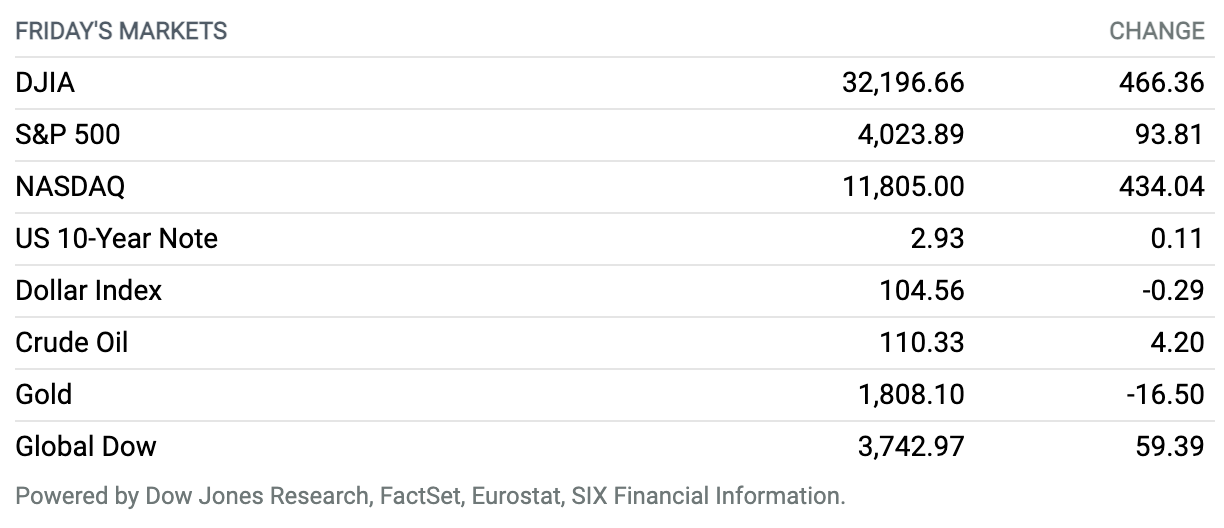

Stocks End Higher Friday, but Close the Week Down. U.S. stocks finished Friday’s session higher, but the Dow logged a seventh straight weekly loss. Investors remain worried about the Federal Reserve’s ability to tamp down high inflation without kicking the economy into a recession. The Dow Jones Industrial Average gained 466 points Friday, or 1.5%, ending near 32,197. The S&P 500 index gained 94 points, or 2.4%, to close at 4024. The Nasdaq Composite index jumped 434 points, or 3.8%, to finish the day at 11,805. The bounce heading into the weekend still wasn’t enough to erase sharp losses earlier in the week. The Dow ended the week 2.1% lower, tallying its sharpest seven-week percentage point plunge since April 24, 2020. The S&P 500 lost 2.4% for the week, and the Nasdaq shed 2.8% for the week.

Inflation Slowed in April. It’s Still Sky-High.

The consumer price index came off a run of 40-year highs last month as energy prices retreated from their own streak of monthly increases. Despite the cool-down, signs of hot inflation abound.

Overall consumer prices rose 0.3% last month, the Labor Department reported this week, a sharp drop from March’s 1.2% increase. For the year, prices rose at an 8.3% annual pace last month, down from a four-decade high 8.5% pace in March. Economists had expected prices to rise 0.2% in April and 8.1% over the year.

While a peak in headline inflation would be welcome—though it’s far from certain yet that it has peaked—it’s hard to look past energy and see an end to surging prices. While the energy index fell 2.7% in April after months of gains amid the Ukraine-Russia war, many other categories were up. Core CPI, which excludes the volatile energy and food segments, rose 0.6% in April following a 0.3% increase in March. There were also substantial increases in prices for shelter, food, airfares, and new vehicles.

Continue reading

Musk Tweets Cast Doubt on Twitter Buyout Bid

Tesla CEO Elon Musk sent Twitter on a roller-coaster ride Friday with a pair of tweets calling into question his bid to acquire the firm.

Musk said Friday his deal to buy Twitter was “temporarily on hold” pending a calculation related to the number of fake accounts on Twitter. Hours later, Musk tweeted again, saying, “Still committed to acquisition.”

Senate Bill Would Give Washington Huge Powers Over Crypto

Legislation expected to be released within the next few weeks would overhaul the way cryptocurrencies and digital assets are regulated and vest the Securities and Exchange Commission with significant oversight powers, according to a draft of the bill reviewed by Barron’s.

Some industry officials are already trying to change many of the proposals within the draft.

Continue reading

Binance Stops Terra Trading. Luna and Its Stablecoin Are Down for the Count.

The loss of stablecoin TerraUSD’s peg to the dollar has fueled a selloff in cryptocurrencies this week and led to enormous losses for a related token, Luna.

On Friday, the situation worsened as Binance—the world’s largest digital-asset exchange—suspended trading of both TerraUSD and Luna.

Continue reading

CEO Says Overall Consumer Demand Is Strong, but There Are Signs of Weakness

Main street consumer demand remains strong, but inflation is taking a bite out of spending power on the bottom end of the income distribution.

On Wall Street and in private markets, things are gloomier and the Federal Reserve’s policy tightening is to blame, according to the management at Compass Diversified Holdings, a collection of niche industrial and consumer businesses that resembles a publicly traded private-equity fund.

Continue reading

Crypto Hasn’t Been a Remedy for Russians Hoping to Evade Sanctions

Cryptocurrency is in a rough patch right now. But it’s failing in one good way, too—as a mechanism for Vladimir Putin’s Russia to evade war-related financial sanctions.

Speculation was rife that Russian oligarchs or defense contractors, severed from most of the fiat banking world, would regroup through anonymous, unregulated crypto transactions. That hasn’t happened in any critical mass. “It has demonstrably played out that crypto is not a sanctions-busting tool,” says Michael Mosier, a former acting director of the U.S. Treasury’s Financial Crimes Enforcement Network, now a senior advisor at Oliver Wyman.

Continue reading

Apple Is No Longer the World’s Most Valuable Company. This Company Is No. 1.

Oil is emerging as mightier than tech amid the turbulence that has defined financial markets over the past few months.

Saudi Aramco, the state-backed producer, has toppled Apple, the maker of iPhones and Mac computers, from its top spot as the world’s most valuable company.

Continue reading

United Airlines Reaches New Agreement With Pilots’ Union

United Airlines has reached an agreement in principle with its pilots’ union on new contract terms, making it the first major carrier to strike such a deal with that segment of its workforce.

“United Airlines was the only airline to work with our pilots’ union to reach an agreement during Covid,” wrote United CEO Scott Kirby in a LinkedIn post on Friday. “It’s not surprising that we are now the first airline to get an agreement in principle for an industry-leading new pilot contract.”

Continue reading

Twitter Fires 2 Top Executives and Implements a Hiring Freeze

Twitter has fired two senior executives and is pausing more hiring and backfills, the company confirmed this week.

Twitter confirmed that executives Kayvon Beykpour and Bruce Falck would be leaving the company. Jay Sullivan, current vice president of product, will be replacing both executives, serving as general manager of Blubird and interim general manager of Goldbird, a spokesperson said.

Continue reading

Colombia’s President Says He’s Betting on Green Hydrogen as Future Export

Colombia’s economy is thriving because of high prices for oil and coal, which make up more than half of its exports. Colombian President Ivan Duque predicted that the country also would become a powerhouse in producing green hydrogen by 2030.

This green fuel is made by converting water into hydrogen; the whole process is powered by renewable sources like solar and wind. Hydrogen is used to produce heat for industrial plants and to create fertilizer, and it’s expected to eventually be a significant source of fuel for power plants and transportation.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.