Friday, March 4, 2022

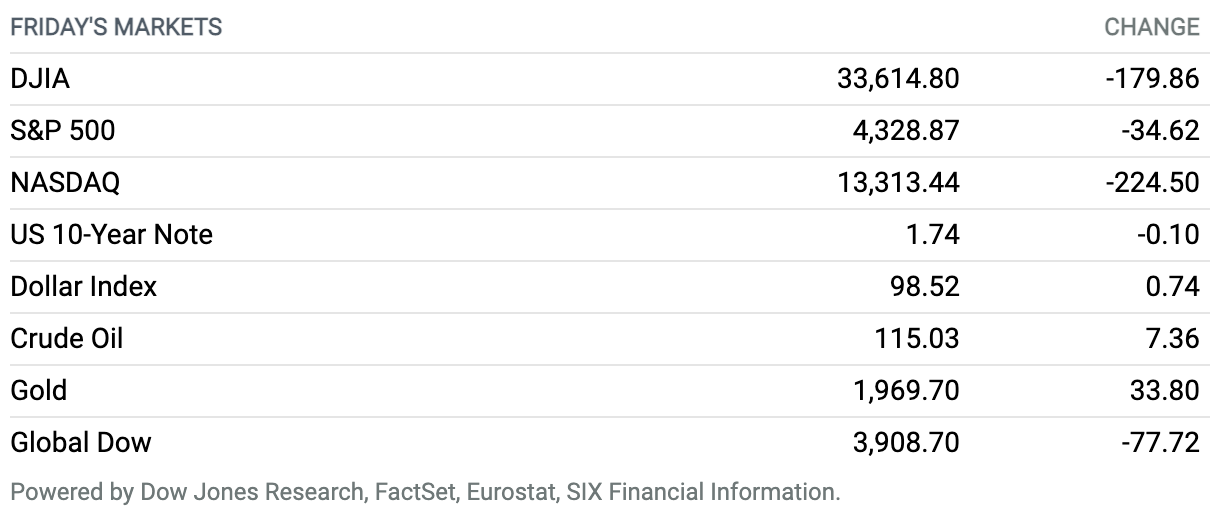

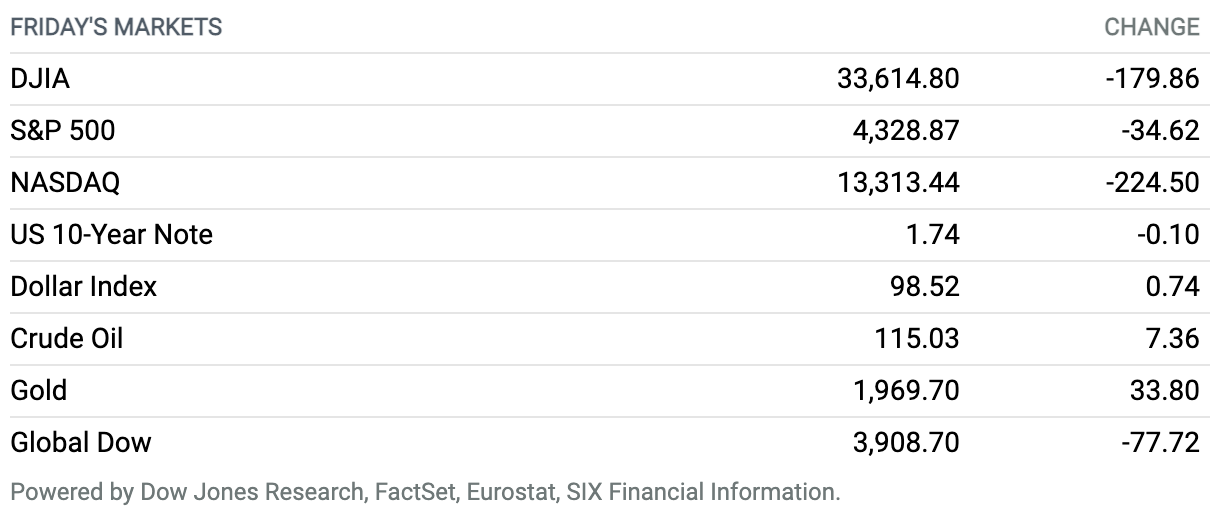

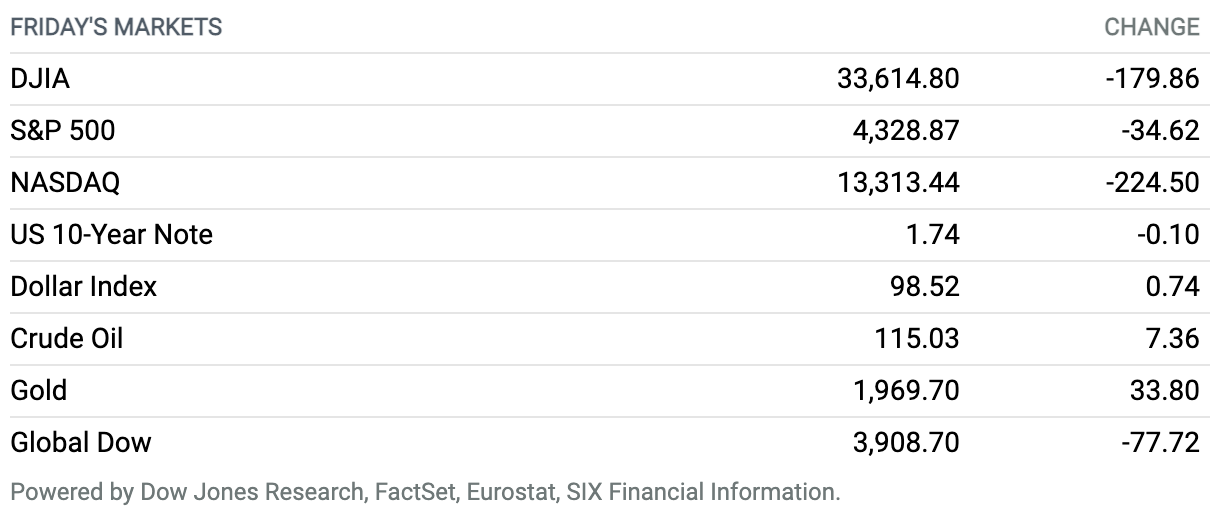

U.S. Stocks End Sharply Lower Friday, Capping Rough Week. The Dow Jones Industrial Average finished 180 points lower Friday, ending another turbulent week on Wall Street as Russia expanded its war in Ukraine and a fire ignited Friday at Europe’s largest nuclear power plant. The Dow shed 0.5% on Friday to close at 33,615, but lost 1.3% for the week, booking four straight weeks of declines. The S&P 500 index fell 35 points, or 0.8%, on Friday to close at 4329, for a loss of 1.3% on the week. The Nasdaq Composite index dropped nearly 225 points, or 1.7%, on Friday to close at 13,313. The Nasdaq lost 2.8% for the week, its worst weekly percentage decline in about six weeks.

Microsoft, FedEx Join Airbnb in Suspending Russia Services

Microsoft is suspending all new sales of products and services in Russia, the company said Friday. The tech giant joins home-rental company Airbnb, FedEx, and Volkswagen as the latest Western companies to suspend operations in Russia following President Vladimir Putin’s invasion of Ukraine.

“We are horrified, angered, and saddened by the images and news coming from the war in Ukraine and condemn this unjustified, unprovoked, and unlawful invasion by Russia,” Microsoft President Brad Smith wrote in a blog post.

FedEx said it is temporarily suspending all services in Russia and Belarus. The company had previously halted shipments to Russia and Ukraine. Airbnb late Thursday said it would suspend its operations in Russia and Belarus.

Continue reading

Fed’s Powell Leans Toward Quarter-Point Rate Hike, Thinks ‘Soft Landing’ Likely

Federal Reserve Chairman Jerome Powell said this week that he is leaning toward a quarter-point rate increase in March to combat inflation, even after Russia’s recent invasion of Ukraine sent global financial markets into a tailspin.

Powell addressed inflation that had surged to its quickest pace since the early 1980s as he spoke to the House Financial Services Committee for his semiannual testimony. “I’m inclined to support a 25-basis-point rate hike,” he said. “It’s too soon to say for sure, but for now, I would say we will proceed carefully along the lines of [the] plan” that central bankers had developed before the Ukraine invasion.

‘Mind-Boggling’ Volatility in Oil Markets Continues

Turbulent trading in crude oil showed little sign of abating on Friday, as the latest news from the Russian invasion of Ukraine continues to roil markets.

The past few days have seen the fastest rise in oil prices in more than a decade. Futures contracts for West Texas Intermediate crude topped $116 a barrel in Thursday intraday trading, a level that U.S. prices haven’t closed at since 2008.

Continue reading

Hiring Took Off in February

The U.S. economy created 678,000 jobs in February, marking a surge in job growth as the Omicron coronavirus variant eased and the services sector continued to rebound.

The strong month comes after the economy gained 481,000 jobs in January, more than previously reported, the Labor Department said Friday. And it far surpassed the 440,000 new jobs economists were expecting for last month.

Continue reading

Exxon Mobil Plans to Double Earnings by 2027

Exxon Mobil said it plans to double its earnings potential by 2027 at a time when energy giants find themselves buoyed by sky-high oil prices.

The company projected savings of $9 billion a year by 2023 compared with 2019 levels at its annual investor day—which, alongside structural changes, should boost earnings and cash flow.

Continue reading

As Covid Cases Fall, Biden Says It’s Time to Return to Normal Life

President Joe Biden signaled a shift to a new phase of the Covid-19 pandemic in his State of the Union address this week, arguing that it is time for Americans to return to normal life.

“Thanks to the progress we have made this past year, Covid-19 need no longer control our lives,” Biden said.

Continue reading

Mortgage Rates Fell Again. How Russia’s War Affects the Housing Market.

Mortgage rates fell for a second consecutive week after Russia’s invasions of Ukraine triggered a flight to safer assets that sent Treasury yields lower.

The average rate on a 30-year fixed mortgage was 3.76% for the week ending Thursday, Freddie Mac said. Last week, the rate fell 0.3 percentage point to 3.89%, down from its 2022 peak of 3.92%.

Continue reading

Apple Sets March 8 Date For ‘Peek Performance’ Product Launch Event

Apple this week announced a virtual product launch event to be held on March 8, at 10 a.m. Pacific. The invitation headline reads “Peek Performance.”

The March event reportedly is likely to feature a new 5G version of the iPhone SE line of entry-level smartphones, as well an updated iPad Air, and the release of version 15.4 of the iPhone OS. The updated OS reportedly will include new emojis, Face ID support for masks (perhaps a little late at this point with mask mandates disappearing in many places), and other new features.

Continue reading

Russian Billionaire Roman Abramovich Seeks to Sell Chelsea Football Club

Russian oligarch Roman Abramovich is seeking to sell the Chelsea Football Club, the team confirmed this week.

The move comes as Western sanctions against Russia and its elites have escalated, creating a chokehold on the Russian financial system.

Continue reading

At Ford, the Chip Shortage Isn’t Getting Any Better. There Are More Output Cuts.

The semiconductor shortage that is constraining global auto production is like a nagging cough–it just won’t go away. Ford Motor is now taking more downtime because of a lack of chips.

The chip shortage “continues to affect Ford’s North American plants, along with automakers and other industries around the world,” a Ford spokesman told Barron’s. “Behind the scenes, we have teams working on how to maximize production, with a continued commitment to building every high-demand vehicle for our customers with the quality they expect.”

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.