Friday, March 19, 2021

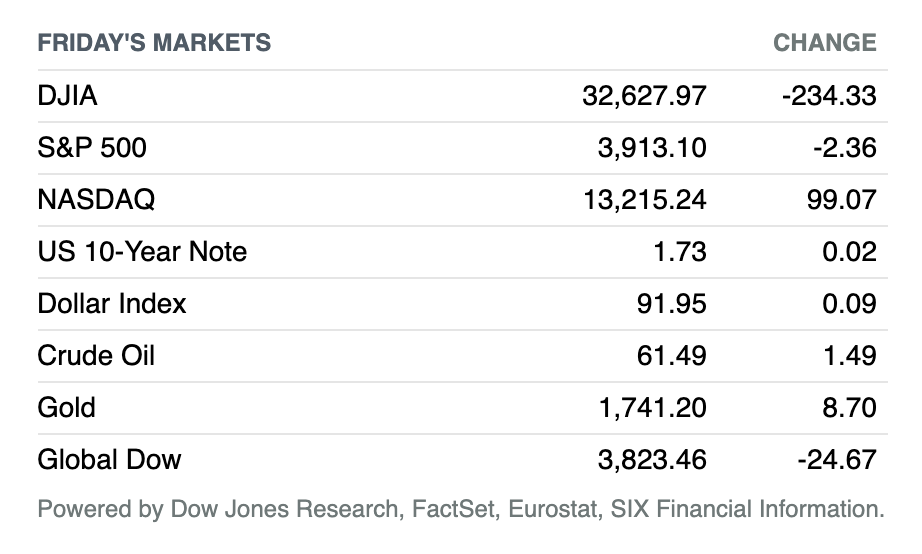

Dow Falls After Fed Decision on Bank Capital. Stocks finished mixed Friday, but the Dow Jones Industrial Average lost ground as a decision by the Federal Reserve not to extend a temporary rule relaxing bank capital requirements pressured the financial sector. The Dow lost around 234 points, or 0.7%, to close near 32,628. The S&P 500 fell around 2 points, or less than 0.1%, to 3913, while the tech-heavy Nasdaq Composite bounced back from earlier weakness to rise about 99 points, or 0.8%, to end near 13,215. Bank stocks fell, with JPMorgan Chase losing 1.6%, while Goldman Sachs shed 1.1%. For the week, the Dow fell 0.5%, while the S&P 500 and Nasdaq Composite each lost 0.8%.

Fed Forecasts Stronger Growth, Will Keep Rates Near Zero

The Fed said Wednesday that it would keep current policy unchanged but increased its forecasts for economic growth, prompting more officials to predict rate increases in 2023. In response to a question about winding down the central bank’s bond-buying program, Fed Chairman Powell said that it is “not yet” time to start considering tapering its purchases.

“When we see we’re on track, when we see actual data coming in that suggests we’re on track … then we’ll say so,” he continued. “And we’ll say so well in advance of any decision to actually taper.”

The central bank said in its latest statement that it would keep rates steady near zero, and reiterated it would keep buying $120 billion of Treasuries and mortgage-backed securities until “substantial further progress” is made toward the central bank’s goals of maximum employment. Officials also decided to make a small technical tweak to alleviate market pressures that had threatened to push short-term interest rates below zero, as Wells Fargo strategists pointed out, but didn’t move as dramatically as some on Wall Street had expected.

The Fed Will End Emergency Relief for Banks

The Federal Reserve said Friday that it wouldn’t extend regulatory relief designed to help large global banks manage their balance sheets during the pandemic.

Last April, the central bank loosened a bank-capital requirement called the supplementary leverage ratio, or SLR, to exclude Treasuries and reserves. In other words, for the past year, banks’ holdings of Treasuries and reserves—specifically, deposits at Fed banks—have been exempt from one form of bank-capital requirement. Those holdings will be included again, as originally scheduled, starting April 1.

Jobless Claims Rise While Manufacturing Index Shows Quickening Recovery

Investors got the latest indication Thursday that some segments of the U.S. economy continue to rally despite continuing weakness in the labor market.

First, the good news. The Philadelphia Fed’s manufacturing index shot to 51.8 in March from 23.1 in February, representing the highest level in 50 years. Economists polled by FactSet expected a much smaller improvement to 24.5. Like all diffusion indexes, the Philly Fed index measures breadth of improvement, but not depth, with readings above 50 representing expansion in the sector.

Now for the bad, if not surprising, news. Initial jobless claims remain high. The Labor Department said Thursday that 770,000 people filed for first-time unemployment insurance in the latest week, up from 712,000 a week earlier.

U.S. Retail Sales Dropped 3% in February Before New Round of Stimulus Checks

Sales at U.S. retailers fell 3% in February due to a lapse in government aid and unusually bad weather, but cash registers are expected to ring loudly again soon after Washington sent $1,400 stimulus checks to most Americans.

Sales had soared a revised 7.6% in January after the government sent out $600 stimulus checks before President Trump left office. It was the biggest increase since businesses exited a lockdown last May after the coronavirus pandemic first hit the economy.

EU Regulator Says AstraZeneca Vaccine Is ‘Safe and Effective’ After Blood Clot Probe

Europe’s drug regulator has concluded that the AstraZeneca Covid-19 vaccine is “safe and effective,” following its investigation into reports of blood clots in people that had received the shot.

European Medicines Agency Executive Director Emer Cooke said in a press briefing on Thursday that the benefits of the vaccine outweighed the possible risks. The watchdog said the vaccine is “not associated with an increase in the overall risk of blood clots,” in a separate statement.

Moderna Begins Trials of Covid-19 Vaccine for Children

The biotech company Moderna said Tuesday that it had begun dosing participants in a trial of its Covid-19 vaccine in children.

Moderna’s Covid-19 vaccine, called mRNA-1273, is currently authorized by the U.S. Food and Drug Administration for adults aged 18 and older, as is the Johnson & Johnson vaccine. The Pfizer vaccine is authorized for people aged 16 and older. No Covid-19 vaccine is currently authorized for use in children.

The Justice Department Is Looking Into Visa’s Debit-Card Practices

Visa is under investigation for potential anticompetitive practices in the debit-card market, according to a report in The Wall Street Journal.

The Justice Department is investigating whether Visa, the largest U.S. card network, has prevented merchants from routing debit transactions over lower-cost networks, according to the newspaper. The DOJ may be probing whether Visa is using anticompetitive practices to maintain market share, particularly for online transactions.

Housing Starts Sank in February, Falling Short of Projections

A gauge of new home construction fell further than expected in February, according to data released Wednesday. Industry experts say some of the decline can be attributed to adverse weather—but not all of it.

Housing starts fell to a seasonally adjusted annual rate of 1.42 million in February, according to the Census Bureau and the Department of Housing and Urban Development—a 10.3% decrease from January’s revised rate and a 9.3% decline from the same month last year. The results were well below consensus, which expected a rate of 1.57 million, according to FactSet.

Amazon to Roll Out Health Service Nationwide

Amazon is going full-bore into the healthcare delivery market, with potentially deep ramifications for telehealth providers, pharmacies, urgent-care services, and employers.

In a blog post Wednesday, Amazon announced that it plans to launch Amazon Care service across the U.S. this summer, offering access to medical care and advice on a 24/7/365 basis in all 50 states—to both Amazon staff and to employers across the country.

Samsung Warns of Global Chip Shortage, May Delay Smartphone Launch

South Korean technology giant Samsung Electronics raised concerns over the global chip shortage on Wednesday, warning of a “serious imbalance” in supply and demand.

The world’s biggest smartphone and memory chip maker may also delay the launch of a new Galaxy Note smartphone due to the shortage, its co-chief executive Koh Dong-jin said at the company’s annual shareholders meeting. Koh also said the chip crunch posed a “slight problem” for the company in the second quarter, according to several reports.