Friday, June 11, 2021

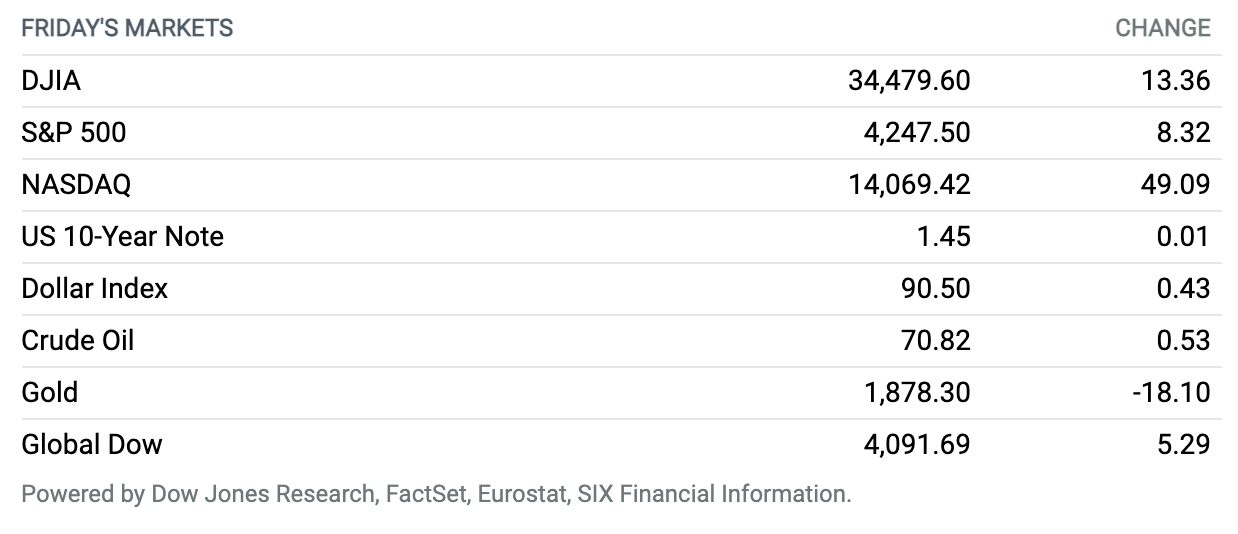

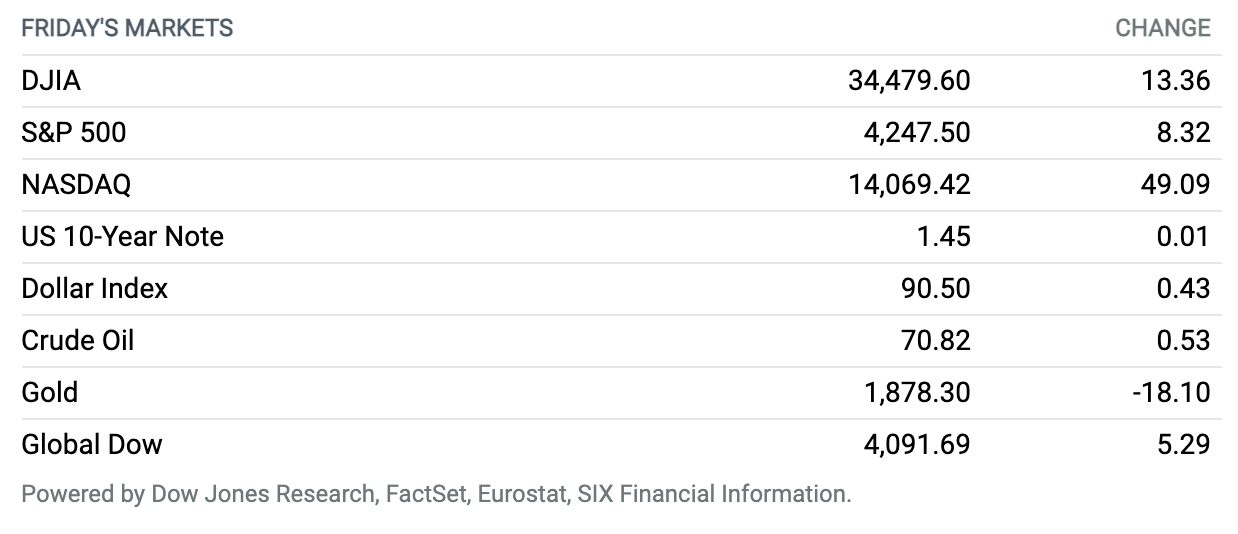

S&P 500 Ends Week at Record as Investors Brush Off Inflation Rise. Stocks ended a choppy session in positive territory Friday, with the S&P 500 logging its second consecutive record close a day after a hotter-than-expected rise in the May consumer-price index. The Dow Jones Industrial Average rose 13 points, or less than 0.1%, to close near 34,480. The S&P 500 rose 8 points, or 0.2%, to end near 4247, while the Nasdaq Composite gained 49 points, or 0.4%, to finish near 14,069. The Dow lost ground for the week, however, falling by about 0.8%, while the S&P 500’s record push left it up just 0.4%. The Nasdaq Composite booked a weekly gain of 1.9%, outpacing its peers as Treasury yields fell.

Inflation Climbed More Than Expected in May as the Transitory Debate Heats Up

Consumer prices rose at a faster-than-expected pace in May, extending a streak of rising price inflation as the economy reopens and demand outpaces supply.

The latest inflation report continues the debate over whether rising inflation is transitory, as Federal Reserve officials say, or something more lasting. It is clear that shortages from chips to labor are driving prices higher while reopening bursts are helping pandemic-beleaguered sectors ramp back up and raise airfares, hotel rates, and clothing prices. But there are signs of stickier pricing pressures that investors shouldn’t ignore.

“The April inflation spike may have been dismissed as a one-off, but there is no such thing as a two-off,” says Jefferies economist Aneta Markowska. “The report showed broad-based and persistent strength,” she says, adding that the fact that consumption is still holding up well in the face of such rapid price increases suggests businesses are enjoying a great deal of pricing power. “This isn’t just cost-push inflation, this is demand-pull inflation,” says Markowska, “which should raise some eyebrows at the Fed.”

Continue reading ›

House Bill Would Force Tech Giants to Sell Some Operations: Report

A bipartisan group of House members plans to propose legislation that could force the breakup of tech giants Amazon.com, Apple, Alphabet, and Facebook.

According to a report from The Wall Street Journal, a House bill called the Ending Platform Monopolies Act would make it illegal for very large platform companies to own certain kinds of related businesses. The bill specifically targets companies with a market cap of more than $600 billion, more than 500,000 monthly active users, and that are viewed as a “critical trading partner,” according to the report, which cites people familiar with the matter and documents viewed by the newspaper. Microsoft apparently doesn’t meet that definition and was not mentioned in the report, while the four other tech giants were. No other companies would be covered under the terms of the proposed legislation, the Journal reported.

Continue reading ›

Biogen’s Alzheimer’s Drug Is Approved by the FDA. The Price? $56,000 a Year.

The U.S. Food and Drug Administration said on Monday that it had approved Biogen ‘s Alzheimer’s disease therapy aducanumab, a decision that will have an enormous impact on patients, biotech and pharmaceutical stocks, and the entire field of drug development.

The FDA granted the approval under its accelerated approval program, by which it can approve drugs for serious illnesses based on data that the agency believes suggest a likely clinical benefit.

Continue reading ›

A Third Expert Quits FDA Panel Over Approval of Biogen Alzheimer’s Drug

Members of an outside expert panel that told the U.S. Food and Drug Administration last fall that Biogen‘s Alzheimer’s drug hadn’t been proven to work are pushing back against the agency’s decision to approve it anyway.

Three members of a key FDA advisory committee resigned this week in the wake of the approval. And a former member told Barron’s that the decision “threatens the integrity of the review process.” The committee determined last November that the company hadn’t demonstrated the effectiveness of the therapy.

Continue reading ›

Biden Drops Plan to Ban TikTok, WeChat

President Joe Biden on Wednesday revoked executive orders from his predecessor Donald Trump seeking to ban Chinese-owned mobile apps TikTok and WeChat over national security concerns, the White House said.

A White House statement said that instead of banning the popular apps, the Biden administration would carry out a “criteria-based decision framework and rigorous, evidence-based analysis to address the risks” from internet applications controlled by foreign entities.

Continue reading ›

Gary Gensler Indicates That the SEC Has Meme-Stock Trading and Bitcoin in Its Sights

The frenzied trading in meme stocks and the speculation in cryptocurrencies appear to have landed in the crosshairs of the new chief of the Securities and Exchange Commission.

Gary Gensler, the SEC chairman, has not said explicitly that the regulator is targeting any particular company or product. But in comments this week he has begun laying down markers on these issues.

Continue reading ›

Johnson & Johnson Can’t Use 60 Million Covid Doses Because of Possible Contamination

Johnson & Johnson faces dumping as many 60 million doses of its Covid-19 vaccine after the Food and Drug Administration decided they might have been contaminated at the Emergent BioSolutions plant where they were made, the New York Times reported on Friday.

The FDA will let Johnson & Johnson distribute 10 million doses in the U.S. and other countries with a warning about quality-control problems at the Emergent plant during manufacturing, the Times reported. In a statement on Friday, the agency said it is authorizing two batches of the vaccine but has determined that other batches “aren’t suitable for use.”

Continue reading ›

GameStop’s New Chairman Tells Shareholders to ‘Buckle Up’

GameStop answered one of the key questions that have been puzzling investors, naming a new chief executive and finance chief as it disclosed its results for the fiscal first quarter on Wednesday.

Matt Furlong, who oversaw Amazon.com’s Australia business, starts as CEO on June 21. Mike Recupero, who was most recently Amazon’s chief financial officer for the North American Consumer business, starts as CFO on July 12.

Continue reading ›

Fastly Outage Takes Down The New York Times, Amazon, and Other Popular Sites

The internet is alive and well, though that wasn’t so clear early on Tuesday, when an outage at the content-delivery network Fastly triggered outages for popular websites like Amazon.com, Reddit, CNN, and The New York Times.

Unlike other internet-related issues such as the Solar Winds cyberattack and the recent spate of ransomware incidents, the Fastly outage was an old-school software glitch. A spokesman for Fastly said in a statement that “this was a technical issue triggered by a service configuration, and is not related to a cyber attack.”

Continue reading ›

Google to Change Ad Business Model in Antitrust Settlement

Google will change its business model and pay a fine equivalent to almost $270 million to resolve a landmark antitrust case in France, where regulators alleged that the tech giant abused its dominance in online advertising.

L’Autorité de la concurrence, the French competition regulator, said on Monday that it had fined Google €220 million, or about $268 million, for abusing its dominance in the online advertising market for publishers of websites and mobile applications. In addition to paying the fine, the regulator said it accepted commitments from Google to overhaul its business practices, including improving the way its Google Ad Manager services work with third-parties, and ending provisions that favor the tech giant.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.