Friday, July 31, 2020

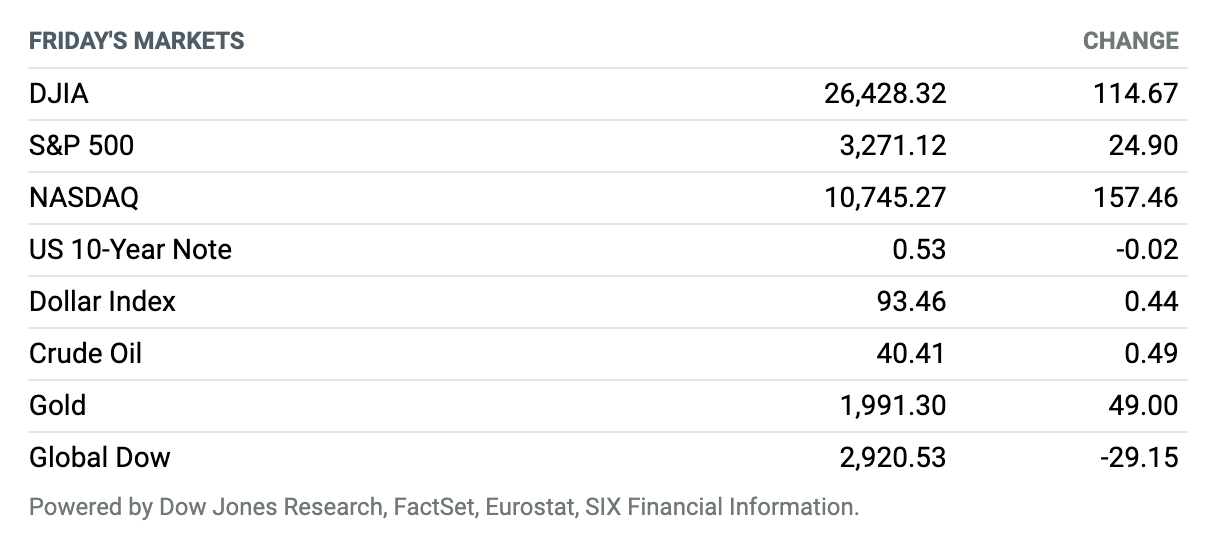

Tech Earnings Lift Market. Stocks ended slightly higher Friday, with the S&P 500 and Dow Jones Industrial Average erasing earlier losses in late trade as shares of Apple built on gains to rally more than 10% after it and other tech giants delivered blowout earnings results the previous evening. The Dow ended with a gain of around 115 points, or 0.4%, near 26,428, according to preliminary figures, while the S&P 500 advanced around 25 points, or 0.8%, to close near 3271. The tech-heavy Nasdaq Composite jumped around 157 points to finish near 10,745, a gain of 1.5%. For the month, the Dow rose 2.4%, while the S&P 500 advanced 5.5%, and the Nasdaq Composite gained 6.8%.

U.S. Economy Shrank at Fastest Pace Ever in 2nd Quarter

The U.S. economy shrank 32.9% on an annualized basis in the second quarter—the worst decline on record as the coronavirus pandemic forced businesses to close, consumers to stay home, and layoffs to skyrocket.

The decline, while staggering, wasn’t quite as bad as economists feared. Those polled by FactSet expected a sharper fall of 34.6%. And the contraction isn’t as bad as it looks given that gross domestic product is calculated on an annualized basis and the shutdowns lasted a month, not a year. Investors can divide the figure by four for a rough translation of the annual number back to a quarterly figure, leaving the second-quarter decline on a quarterly basis at something like 9%.

Americans Slowed Spending as Income Fell in June. That’s Before Covid Cases Spiked Anew.

Personal income fell and spending slowed in June even before coronavirus cases began to surge again in July and prompt an increase in layoffs.

The Bureau of Economic Analysis said Friday that income across American households declined 1.1% in June from May, slightly worse than the 0.8% rate of decline economists polled by FactSet predicted. That’s as government aid payments (the one-time checks) fell from May, partially offset by increases in compensation as businesses reopened and rehired.

Apple Reports Strong Earnings, Announces Stock Split

Apple late Thursday posted second-quarter results that crushed Street estimates, and announced a 4-for-1 stock split.

Apple reported revenue for its fiscal third quarter ended June 30 of $59.7 billion, up 11% from a year ago, and well ahead of the Wall Street analyst consensus at $52.1 billion. Profits were $2.58 a share, soaring past the Street consensus at $2.09.

Amazon Crushes Earnings Estimates

With a huge boost from the accelerated adoption of e-commerce amid the Covid-19 pandemic, Amazon. com posted second-quarter financial results that dramatically beat Wall Street’s estimates and the company’s own guidance.

For the quarter, Amazon reported sales of $88.9 billion, well ahead of the company’s own guidance range of $75 billion to $81 billion. Profits were $5.2 billion, or $10.30 a share, about five time the Wall Street analyst consensus at $2.09 a share. Operating income was $5.8 billion, far above the company’s expectations for a break-even quarter.

The Fed Says It Will Keep Easy Money Flowing

The Federal Reserve reiterated Wednesday that investors can count on interest rates being at or near zero in the coming years as the central bank works to support the U.S. economy through the coronavirus pandemic.

In its statement following a two-day meeting that concluded Wednesday, the Fed’s policy-setting arm, the Federal Open Market Committee, said economic activity and employment have “picked up somewhat in recent months” following sharp declines but “remain well below their levels at the beginning of the year.”

Uptick in Jobless Claims Adds to Signs of Stalling Rebound

Initial claims for unemployment insurance rose for the second consecutive week, the latest sign that the labor-market rebound has stalled after steadily declining since layoffs peaked in March.

In the week ending July 25, right as enhanced unemployment benefits were to expire for many Americans, the Labor Department said first-time jobless claims came in at a seasonally adjusted 1.43 million, up 12,000 from the prior week’s revised level.

Exxon Misses Expectations and Says It Won’t Take on More Debt

Initial claims for unemployment insurance rose for the second consecutive week, the latest sign that the labor-market rebound has stalled after steadily declining since layoffs peaked in March.

In the week ending July 25, right as enhanced unemployment benefits were to expire for many Americans, the Labor Department said first-time jobless claims came in at a seasonally adjusted 1.43 million, up 12,000 from the prior week’s revised level.

Exxon Misses Expectations and Says It Won’t Take on More Debt

Exxon Mobil missed analysts’ earnings expectation in the second quarter, posting a wider-than-expected loss as Covid-19 lockdowns and global oil oversupply hurt results.

Exxon reported on Friday an adjusted loss of 70 cents a share, versus analysts’ consensus expectation for a 62-cent loss. Its revenue of $32.6 billion also missed expectations for $38.2 billion. Shares traded lower on Friday.

Chevron Misses Earnings Expectations Amid Large Write-Downs

Chevron missed analysts’ earnings expectations for the second quarter after posting an $8.3 billion loss and writing down the entire value of its Venezuelan operations. The stock was trading down 1.4% in premarket action on Friday.

The company posted an adjusted loss of $3 billion, or $1.59 per share, versus analysts expectation for a 93-cent loss. Its revenue of $13.5 billion also missed expectations for $21.9 billion.

Pandemic Forces CES 2021 to Go Virtual. Cancel the Flight to Vegas.

After more than half a century of live events, the January 2021 version of CES, the giant consumer-electronics trade show, will be held online rather than in Las Vegas.

The Consumer Technology Association, which hosts the show, decided it would not be safe to hold the event in person. The news no doubt comes as a major disappointment for the already battered Las Vegas tourism industry.

The Fed Is Extending the Application Window for Seven of Its Programs

The Federal Reserve announced on Tuesday that it would keep seven of its emergency pandemic lending facilities open to applications for an additional three months.

It was previously planning on a Sept. 30 closing date for the seven facilities, meaning that companies or banks that want access to Fed liquidity would need to apply by that date. The extension means that they can now apply through Dec. 31. The decision will not expand the amount of liquidity that will be provided under the facilities, however, nor will it extend the length of the loans provided.