Friday, July 30, 2021

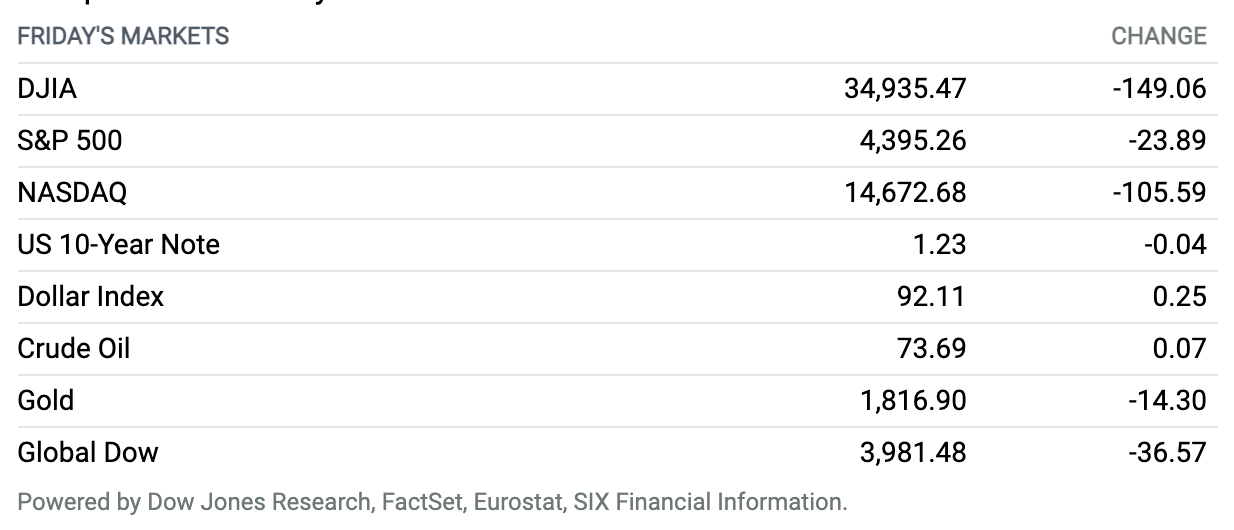

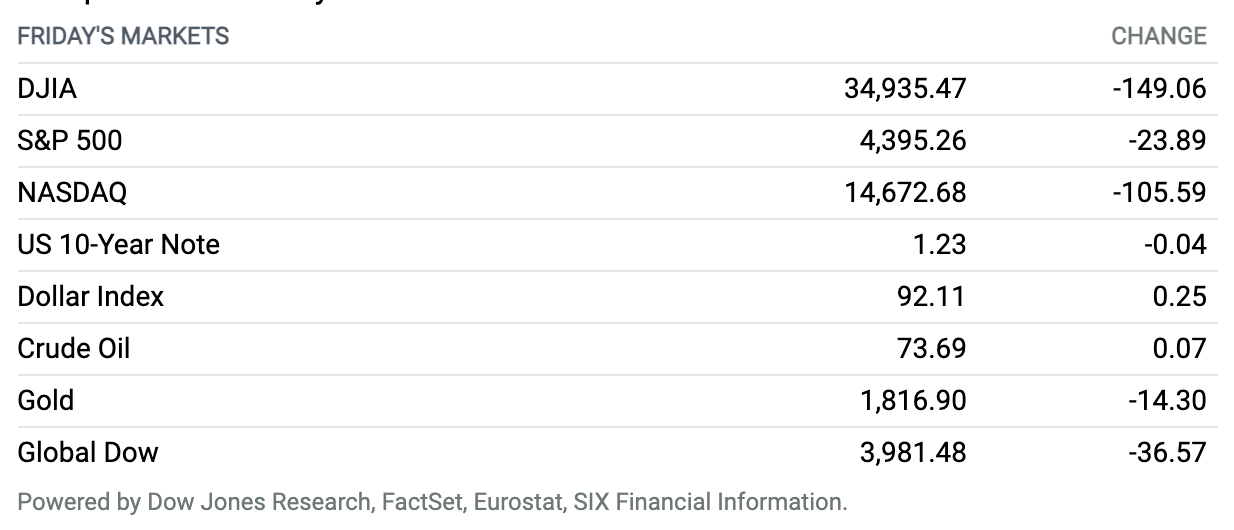

Stocks Drop in Wake of Amazon Earnings. Stocks fell Friday, leaving major averages negative for the week but still holding monthly gains as July trading came to a close. Equities were pressured after e-commerce giant Amazon.com late Thursday delivered disappointing quarterly results. The S&P 500 fell 24 points, or 0.5%, to close at 4395, while the Nasdaq Composite fell 106 points, or 0.7%, to finish near 14,673. The Dow Jones Industrial Average fell 149 points, or 0.4%, ending at 34,935. That left the S&P 500 with a 0.4% weekly loss, but the index rose 2.3% for July, marking its sixth consecutive monthly advance. The Nasdaq fell 1.1% for the week holding on to a 1.2% monthly gain, while the Dow saw a 0.4% weekly drop and a 1.3% July advance. Amazon shares fell 7.6%.

Second-Quarter GDP Was Strong but Disappointing

The U.S. economy grew at a seasonally adjusted annual rate of 6.5% in the second quarter, far short of Wall Street’s expectations and up just a touch from the first quarter.

The preliminary reading on gross domestic product places economic output above its prepandemic level for the first time. But the much cooler-than-expected rate of expansion underpins concerns that growth from the depths of the short but deep pandemic-induced recession has peaked.

What’s more, the peak rate appears lower than anticipated. Economists polled by FactSet expected an 8.5% rise in second-quarter GDP, up from a downwardly revised 6.3% rate in the first quarter.

Continue reading ›

Amazon Earnings Show a Sharp Slowdown in E-Commerce

Amazon late Thursday reported mixed results for the June quarter, with better-than-expected profits but sales that fell shy of Wall Street estimates.

The miss reflects a shortfall in Amazon’s e-commerce business, which suffered a sharp deceleration from recent growth trends. The e-commerce slowdown was partially offset by better-than-expected results in the company’s cloud computing, advertising, and third-party seller segments.

Continue reading ›

Robinhood Suffers Dismal First Day as Publicly Traded Stock

Robinhood Markets, the trading website that transformed the brokerage industry, ended Thursday—its first day of trading—with a $29 billion market valuation, well below the $35 billion valuation it was seeking with its IPO.

Shares of Robinhood opened at their IPO price of $38 and dropped more than 12% before rebounding. They closed Thursday at $34.82, down more than 8% from their offer price, making Robinhood a broken deal.

Continue reading ›

Nikola’s Founder Is Charged With Misleading Investors

Nikola founder and former CEO Trevor Milton was charged Thursday by federal prosecutors with making misleading and false statements to the company’s investors.

Milton resigned from the electric-truck company on Sept. 20, 2020, and Nikola is trying to distance itself from the charges. “Today’s government actions are against Mr. Milton individually, and not against the company,” reads a company statement sent to Barron’s.

Continue reading ›

Fed Says Economic Progress Has Been Made, but It’s Too Soon to ‘Taper’

The Federal Reserve on Wednesday said the economy has made progress toward the standards it set for starting to slow down its bond-buying program, but said not enough progress has been made to start tapering yet.

“Last December, the Committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings,” the Fed’s policy statement said.

Continue reading ›

SEC to Require More Disclosure From Chinese Companies Before IPOs

Chinese companies will need to disclose more information to the Securities and Exchange Commission before they’re allowed to sell shares and raise money from American investors.

The new disclosure requirements will focus mostly on the so-called Variable Interest Entities, a form of shell company commonly used to get around Chinese government’s restrictions on foreign ownership and overseas listings, SEC Chairman Gary Gensler said on the agency’s website.

Continue reading ›

Didi Might Not Go Private, but the Risks Are Real for Chinese Stocks

Didi Global on Thursday denied a Wall Street Journal report that it is considering going private. No matter Didi’s actual intention, Chinese companies listed in the U.S. face could decide to call it a day and go private as pressures from Beijing—and from U.S. regulators, who are considering delisting some of them—continue to grow.

The Wall Street Journal reported on Thursday, citing people familiar with the matter, that Didi Global is mulling going private as a way to appease Beijing and compensate investors after the company’s shares slid as much as 43% following its $4.4 billion initial public offering. Reuters, however, reported that the company denied such plans.

Continue reading ›

Facebook Blows Past Estimates, but Warns Growth Will ‘Decelerate’

Facebook is the latest tech giant to cash in on a surge in digital advertising, but it also offered downbeat guidance for the second half of the year.

The social-media giant, which relies almost exclusively on advertising, said it earned $10.39 billion, or $3.61 a share, topping forecasts of $3.04 a share, according to analysts polled by FactSet. Facebook’s sales catapulted 56% to $29.08 billion, eclipsing estimates of $27.85 billion.

Continue reading ›

Apple Sees Profit Nearly Double as iPhone Sales Boom

Apple posted its strongest June quarter ever, with a near doubling of profits and a huge revenue beat for its iPhone business.

The company posted fiscal third-quarter net income of $21.74 billion, or $1.30 a share, up from $11.25 billion, or 65 cents a share, a year earlier. Analysts tracked by FactSet were expecting earnings per share of $1.01.

Continue reading ›

Why ‘Black Widow’ Star Scarlett Johansson Sued Disney

Scarlett Johansson, the star of Marvel’s Black Widow, sued Disney for breach of contract over the release of the film on the media giant’s streaming service at the same time as its debut in theaters earlier this month.

The lawsuit, filed in Los Angeles Superior Court on Thursday, says Johansson’s agreement with Disney‘s Marvel Entertainment guaranteed an exclusive release in theaters, with a salary tied to the box-office performance. The Wall Street Journal reported that the lawsuit accused Disney of “intentionally” inducing the breach “without justification, in order to prevent Ms. Johansson from realizing the full benefit of her bargain with Marvel.” Disney couldn’t be reached for comment, the Journal added.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.