Friday, July 24, 2020

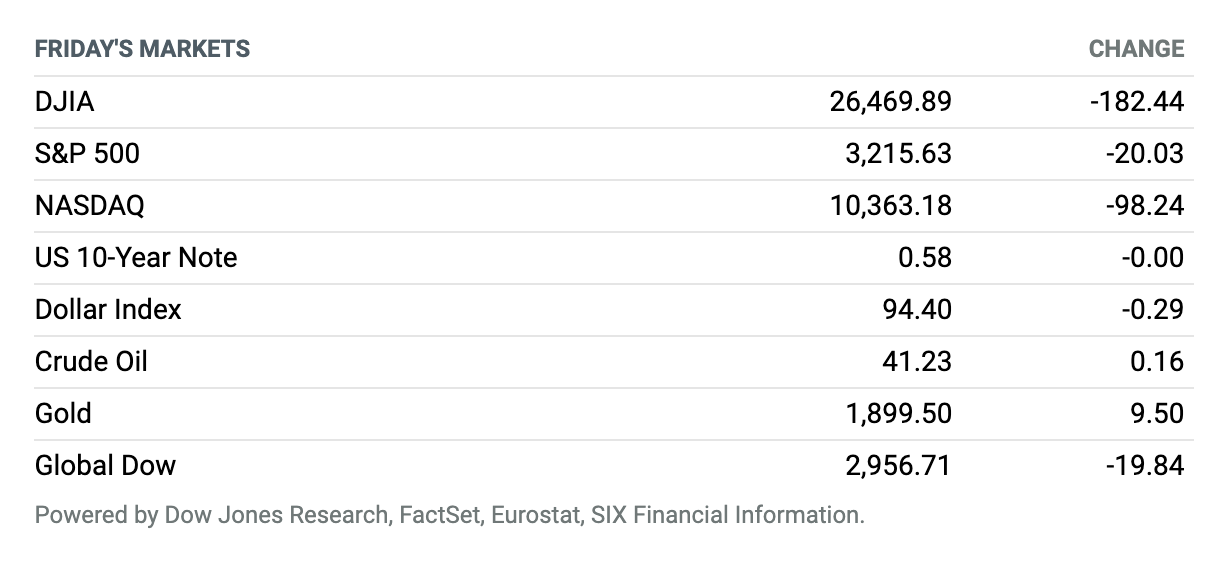

Political Worries Hurt Stocks. Stocks tumbled on Friday, with tech stocks posting their first two days of consecutive declines in two months, as political developments swept a wave of negativity across markets. The Dow Jones Industrial Average fell 182.44 points, or 0.7%, to 26,469.89. The S&P 500 declined 20.03 points, or 0.6%, to 3215.63. The tech-heavy Nasdaq Composite was down 98.24 points, or 0.9%, to 10,363.18. For the week, the S&P 500 was down 0.3%, the Dow fell 0.8%, and the Nasdaq slipped 1.3%. Tech stocks posted the steepest declines in the S&P 500 index around midday Friday, declining 1.2%. The health-care sector declined 1.1% as U.S. President Donald Trump unveiled executive orders aimed at reducing drug prices. He was scheduled to sign the orders after delivering remarks on Friday. Beijing made good on its threat to retaliate against the U.S. after the Trump administration ordered the closure of the Chinese consulate in Houston. China ordered the U.S. to close its own consulate in Chengdu, as the spat between the world’s two largest economies intensified on Friday.

EU Nations Agree to $2.1 Trillion Budget and Coronavirus Relief Plan

Weary but relieved, European Union leaders finally clinched a deal on an unprecedented 1.8 trillion-euro ($2.1 trillion) budget and coronavirus recovery fund early Tuesday, somehow finding unity after four days and nights of fighting and wrangling over money and power in one of their longest summits ever.

To confront the biggest recession in its history, the EU will establish a 750 billion-euro coronavirus fund, partly based on common borrowing, to be sent as loans and grants to the hardest-hit countries. That comes on top of the seven-year, 1 trillion-euro EU budget that leaders had been haggling over for months even before the pandemic.

Jobless Claims Turn Up for First Time Since March as Reopenings Get Rolled Back

Claims for unemployment insurance rose for the first time since late March, signaling the recovery so far in the U.S. labor market and beyond is sputtering as some states and companies roll back reopenings amid rising Covid-19 infections.

The Labor Department said Thursday that 1.42 million Americans filed for first-time jobless benefits in the week ending July 18 on a seasonally adjusted basis. That’s up from a revised 1.31 million in the prior week, and it’s higher than the 1.3 million economists polled by FactSet had predicted. In recent weeks, what had been a steady decline in claims from a March peak started to stall.

Ann Taylor and Lane Bryant Owner Joins Growing List of Retailers Filing for Bankruptcy

The parent company of Ann Taylor and Lane Bryant, Ascena Retail Group, joined a growing list of retailers filing for bankruptcy after suffering declining sales from the coronavirus shutdowns.

Ascena owns about 2,800 stores of the two brands and others like Loft, Lou & Grey, Catherines, and Justice, at malls in North America. As the operation has been “severely disrupted” by the pandemic, “we took a strategic step forward today to protect the future of the business for all of our stakeholders,” Carrie Teffner, Ascena’s interim executive chair said in a Thursday statement.

As Revenue Tumbles, Schlumberger to Cut 21,000 Jobs

Schlumberger said Friday it had a net loss of $3.434 billion, or $2.47 a share, in the second quarter, after income of $492 million, or 35 cents a share, in the same period a year ago.

Excluding charges and credits, the oil company had adjusted per-share earnings of 5 cents, ahead of the FactSet consensus for a loss of 1 cent. Revenue tumbled 35% to $5.356 billion from $8.269 billion, below the $5.373 billion FactSet consensus.

The company is reorganizing and combining its 17 product lines into four divisions, restructuring geographically around five key basins of activity and streamlining management, CEO Olivier Le Peuch said. It is cutting 21,000 jobs as part of the restructuring.

Ant Could Be the Biggest IPO Ever, but It Will Bypass the U.S.

The U.S. stock exchanges won’t get to brag about what could be the largest initial public offering in history.

Chinese fintech giant Ant Group Co., which owns mobile payment network Alipay, plans a dual listing in Hong Kong and on Shanghai’s version of the Nasdaq for its much-anticipated initial public offering. The IPO of the company, an affiliate of e-commerce giant Alibaba, could also be a harbinger for other big Chinese debuts.

Chevron Makes First Big Energy Deal of the Pandemic Era

Chevron on Monday announced an all-stock deal to buy Noble Energy, an oil and gas producer with large positions in U.S. shale and a major gas field off the coast of Israel. The $13 billion deal—about $5 billion in stock and roughly $8 billion in debt—values Noble at $10.38 a share, a 7.5% premium to its closing price on Friday.

The deal would expand Chevron’s oil and gas reserves by 18% at an average price of less than $5 a barrel of oil reserves, and the companies say they can cut $300 million in annual expenses. Chevron would add to its acreage in Colorado’s DJ Basin, and boost its position in the Permian Basin. Noble’s Israeli gas project—the largest discovery the company has made—is another key asset.

Goldman Reaches Settlement With Malaysia Over 1MDB

Goldman Sachs Group’s agreement with the government of Malaysia over the 1MDB scandal should come as a relief to Wall Street.

Goldman announced on Friday that it would pay Malaysia $2.5 billion in cash and guarantee a further $1.4 billion to cover any shortfall in the sale of seized assets from the sovereign-wealth fund, 1 Malaysia Development Berhad, or 1MDB. Malaysia will drop the criminal charges against subsidiaries of Goldman.

Tesla’s Earnings Smash Forecasts Again

Elon Musk has done it again, beating Wall Street’s expectations for Tesla’s earnings significantly for the fourth quarter in a row.

The electric vehicle company on Wednesday reported adjusted earnings per share of $2.18, and a profit under generally accepted accounting principles, or GAAP, of 50 cents a share. Analysts were looking for results near the break-even line. It’s hard to be more precise because earnings estimates on Tesla have been all over the place for the pandemic-affected second quarter.

Microsoft Earnings Beat Estimates, Thanks to the ‘At-Home’ Trend

Microsoft posted better-than-expected financial results for its fiscal fourth quarter, as demand for its cloud-based software surged amid the pandemic-induced shift to working and learning from home.

For the quarter ended June 30, Microsoft posted revenue of $38 billion, up 13% from a year ago, and well ahead of the Wall Street analyst consensus at $36.4 billion. Earnings were $1.46 a share, ahead of the Street consensus at $1.38.

Existing-Home Sales Leapt 21% in June. Expect More Gains.

The housing market is on fire, even as the broader U.S. economic recovery wobbles. Investors should expect further gains.

Sales of previously owned homes surged 21% in June from a month earlier, to a seasonally adjusted annual rate of 4.72 million, the National Association of Realtors said Wednesday. That’s a record pace as sales snapped a three-month stretch of declines as mortgage rates tumble.