Friday, July 23, 2021

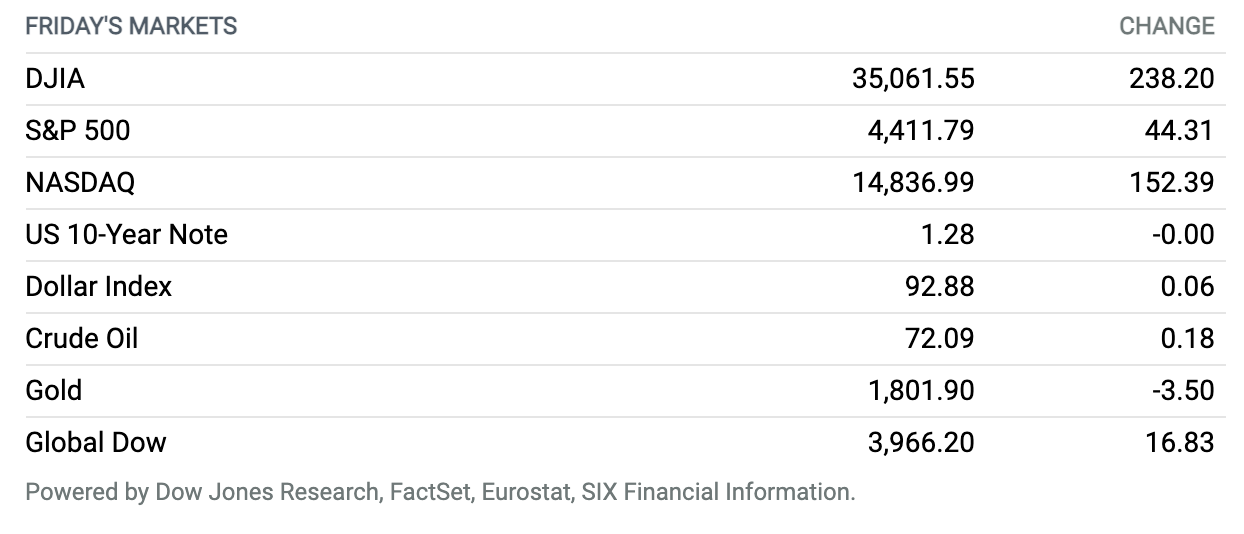

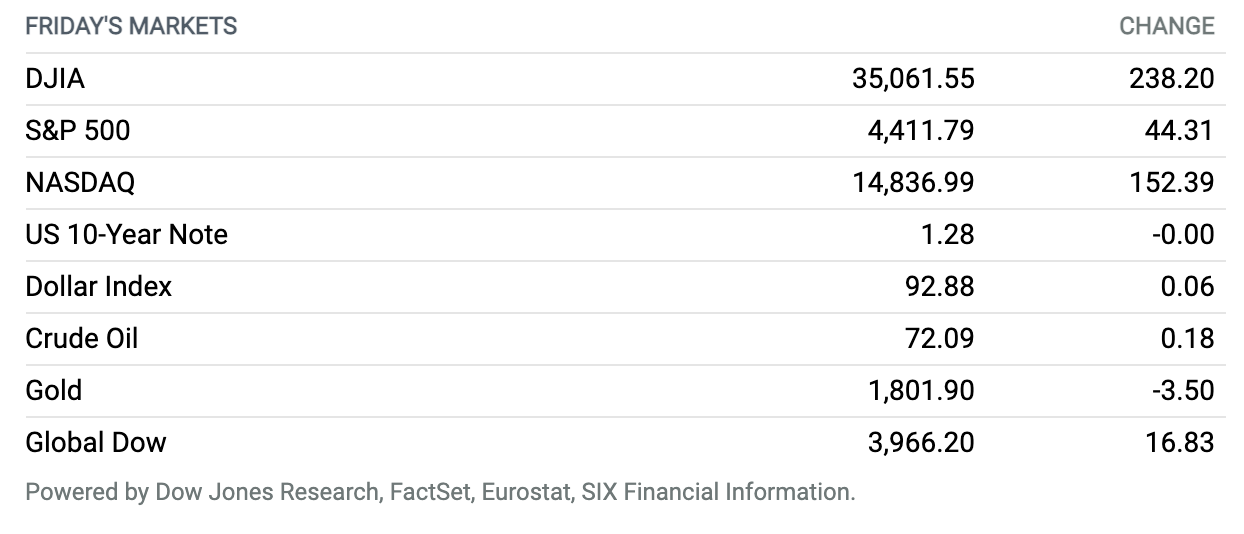

Dow Closes Above 35,000 as Stocks Extend Rally. Economic optimism helped U.S. stocks rise for a fourth straight session on Friday, with all three major indexes closing at record levels. The Dow Jones Industrial Average rose 239 points, or 0.7%, and closed above 35,000—a milestone it’s approached six times before. The S&P 500 and the Nasdaq Composite were both up 1%, new records as well. The 10-year Treasury yield, which usually rises and falls with expectations for economic demand and inflation, rose to 1.28% from 1.26%. One factor aiding the optimism: strong economic data overseas. The European Union Purchasing Managers Index was 60.06, better than the expected 60. Retail sales in the U.K. were up 0.5%, higher than the anticipated 0.4% increase. For the week, the Dow advanced 1.1%, the S&P 500 gained 2%, and the Nasdaq was up 2.8%.

Jobless Claims Jump Back Above 400,000, Because Blips Will Dot the Recovery

Initial claims for unemployment insurance unexpectedly jumped in the latest week, reinforcing the bumpy nature of the labor market’s recovery.

First-time claims for jobless benefits rose to 419,000 in the week ended July 17, up from an upwardly revised 368,000, the Labor Department said Thursday. The result was well above Wall Street’s expectations; economists surveyed by FactSet anticipated a decline to 350,000.

Despite the substantial surprise, many economists say observers shouldn’t worry. “Don’t panic,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics. “The claims numbers continue to suffer from seasonal adjustment difficulties caused by shifts in the timing and extent of the auto makers’ annual retooling shutdowns from year to year,” he says.

Continue reading ›

States Unveil $26 Billion Settlement Over Opioid Lawsuits

Seven states announced a $26 billion settlement with drug companies to resolve thousands of opioid-crisis lawsuits, paving the way for money to be funneled to communities to address the addiction epidemic.

The landmark settlement includes the attorneys general from Tennessee, North Carolina, Pennsylvania, New York, Louisiana, Delaware and Connecticut, The Wall Street Journal reported. Washington state is opting out and proceeding to trial, CNBC reported.

Continue reading ›

GM Recalls Chevy Bolt for Second Time Due to Fire Risk

General Motors is recalling its all-electric Chevrolet Bolt for a second time because of a potential battery defect that can cause a fire.

GM said Friday that its investigation into recent battery fires involving the cars found that manufacturing defects in a certain battery cell were the root cause. It is asking owners of 2017-2019 model year Bolts to keep their electric-vehicle charges at a certain level and to park the cars outside after charging them.

Continue reading ›

Kimberly-Clark Is Gloomier About the Outlook. Earnings Missed Forecasts.

Kimberly-Clark disclosed quarterly results marked by rising inflation and lower postpandemic demand.

Kimberly-Clark said it earned $404 million for the second quarter, or $1.19 a share, down from $1.99 in the year-earlier period. On an adjusted basis stripping out nonrecurring items, earnings per share were $1.47 a share. Sales edged up 2% year over year to $4.72 billion.

Continue reading ›

Intel CEO Says Global Chip Shortage Will Get Worse Before It Gets Better

The crippling chip shortage hampering the global economy is going to get worse before it gets better, Intel chief executive Pat Gelsinger said late Thursday on the company’s earnings call. The CEO maintained that the crunch could last until 2023.

“We remain in a highly-constrained environment where we are unable to fully support demand,” Gelsinger said. The Intel CEO joins other chip makers such as Taiwan Semiconductor Manufacturing who have said shortages will last well beyond this year.

Continue reading ›

ECB Hints at Looser Policy for Longer

The European Central Bank Thursday hinted that it would keep its monetary policy as loose as needed for as long as required to reach its newly formulated 2% inflation target, changing its guidance for markets to align its actual deeds with the “strategy review” it published two weeks ago.

Instead of aiming for inflation “below but close to 2%,” the ECB is now squarely targeting 2%, in a “symmetric” approach that will make it tolerate inflation to overshoot for a temporary period.

Continue reading ›

Bill Ackman’s SPAC Deal Is Off. What Comes Next.

Bill Ackman’s three-headed monster of a SPAC deal is off. Regulators at the Securities and Exchange Commission wouldn’t get on board with the largest-ever special-purpose acquisition company’s innovative but—in the end—overly complex proposed transaction.

Ackman’s SPAC, Pershing Square Tontine, announced a proposed deal just last month, but it wasn’t a traditional SPAC deal. In fact, it wasn’t even a merger, and would have created three public vehicles, with two hoping for more deals in the future.

Continue reading ›

J&J Earnings Beat Expectations as Study Raises Doubts Over Vaccine’s Efficacy

Johnson & Johnson said it expects $2.5 billion in sales of its Covid-19 vaccine this year, as a new study by researchers at New York University raised questions about the vaccine’s efficacy against the Delta variant.

The Big Pharma giant reported stronger financial results than expected for the second quarter of its fiscal year. Management pushed back against the findings of the study.

Continue reading ›

Robinhood Is Going Public Next Week. It Is Seeking a $35 Billion Valuation.

Robinhood Markets, the zero-commission investment app, will list its shares next week.

Robinhood said on Monday that it would offer 55 million shares at $38 to $42 each. It will trade under the ticker HOOD on the Nasdaq market. At $42 a share, Robinhood could be valued at $35 billion.

Continue reading ›

Blue Origin Becomes the First Company to Take a Paying Passenger to Space

Jeff Bezos rocketed into history on Tuesday when his company successfully carried the first paying customer to space and back. The 10-minute flight from a tiny town in Texas to the edge of space is the second successful launch in a matter of weeks for the fledgling commercial space tourism industry.

The Blue Origin spacecraft, called New Shepard, launched at around 9:13 a.m. ET this morning from the company’s Launch Site One facility in Van Horn, Texas. The spacecraft accelerated to speeds of 2,700 miles per hour minutes after taking off. After separating from its rocket, the capsule continued on to an apogee of 65.8 miles above the surface of the Earth before returning for a landing back at Blue Origin’s facility. The ship pierced the Karman line, an arbitrary border set 100 kilometers above sea level, the highest a commercial space flight has flown.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.