Friday, January 14, 2022

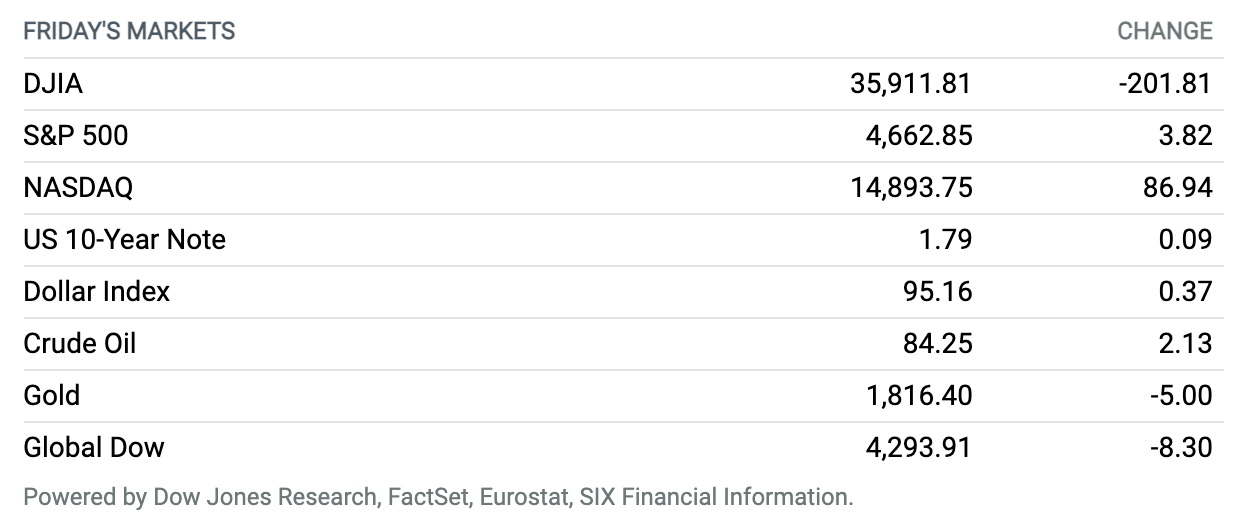

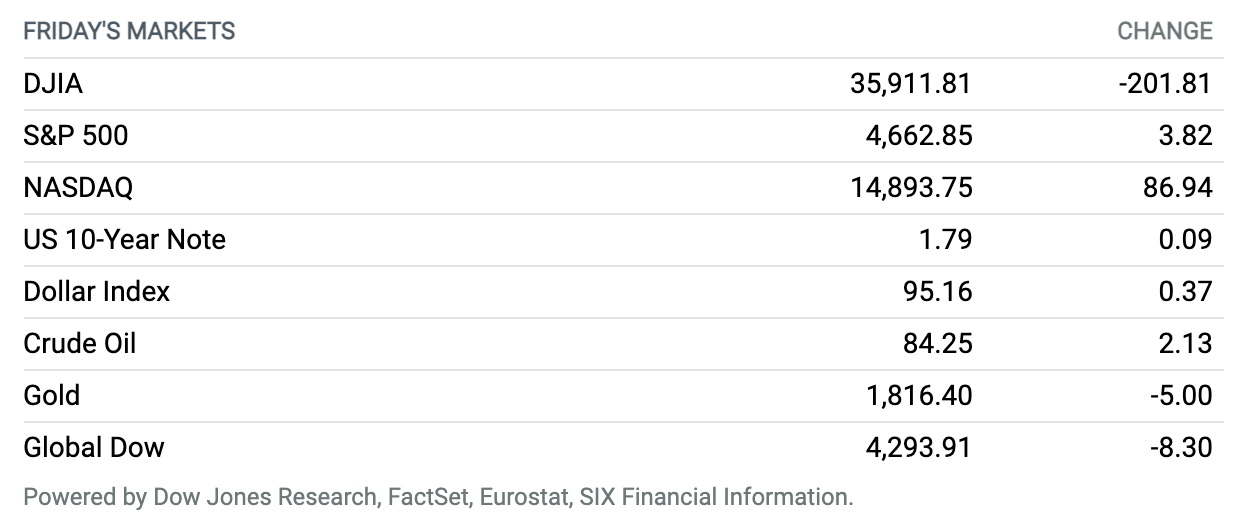

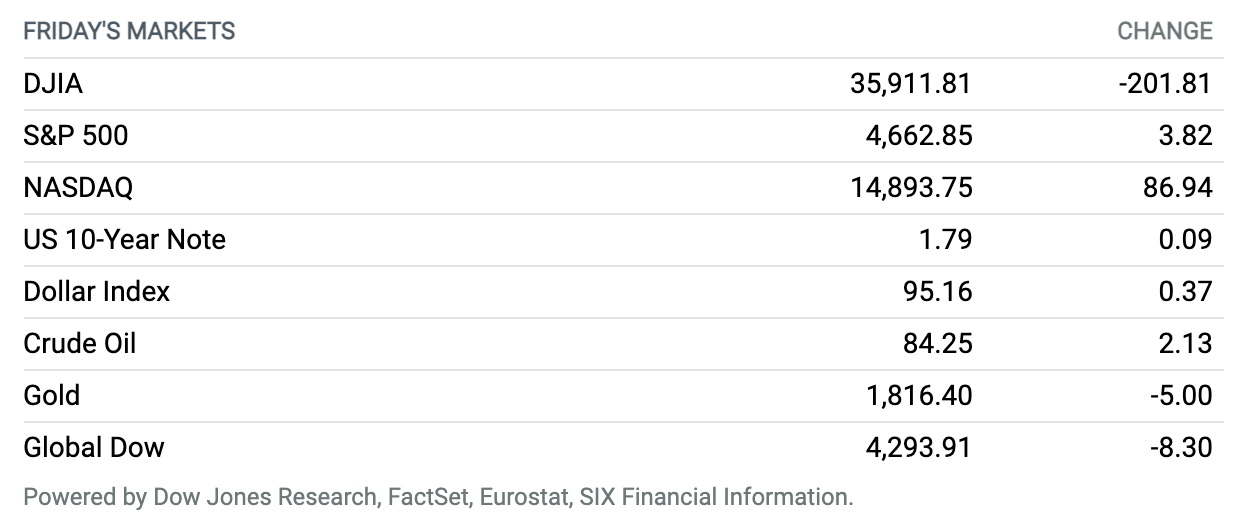

Stocks End Mixed After Weak Retail Sales, Bank Earnings. Stocks posted a mixed finish Friday after December retail sales showed an unexpected drop and as investors digested results from major banks as earnings season got under way. The Dow Jones Industrial Average fell 202 points, or 0.6%, to close near 35,912, while the S&P 500 rose 4 points, or 0.1%, to end near 4663. The Nasdaq Composite closed near 14,894, up 87 points, or 0.6%. All three major indexes lost ground for the week, with the Dow off 0.9% and the S&P and Nasdaq each down 0.3%.

Retail Sales Fell in December

U.S. retail sales fell 1.9% month over month in December, showing a slowdown in American spending during the holiday season as the Omicron variant spread and fast-rising prices shifted the way people are spending.

Economists forecast sales growth at 0.1%, according to FactSet. Retail sales, excluding autos and gas, rose 0.6% in November compared with a 1.5% increase in October, according to the Census Bureau. Retail sales rose 16.9% year over year in 2021.

Online sales declined sharply by 8.7%. Other categories that were down in December from the previous month include electronics stores, which declined by 2.9%, and auto dealers, which were down by 0.7%. Furniture and home stores had a decline of 5.5%, and restaurant and bar sales were down 0.8%.

Continue reading

Despite Supreme Court Ruling, Some Employers Will Still Require Vaccinations

The Biden administration’s nationwide Covid-19 vaccine-or-testing mandate for large private employers is dead, following the 6-3 Supreme Court opinion this week. But for many companies and their workers, a jab will still be a job requirement.

That’s because many local governments, including New York City’s, have vaccine requirements in place, which aren’t affected by the Supreme Court’s opinion. Neither is the U.S. government’s mandate that federal contractors’ employees be vaccinated. Still more U.S. employers large and small have their own requirements.

Many Hospitals Are Getting Overwhelmed. The Crisis Could Affect Healthcare for Years.

Each wave of Covid-19 has hit Washington state’s hospitals harder than the last. Now, two years into the pandemic, most of the nurses who worked at the emergency department at Harborview Medical Center in Seattle have left, and the department is having trouble finding enough nurses to treat its patients.

“We do not have the same nursing staff, essentially, that we had even last summer,” says Dr. Steve Mitchell, medical director of the department. “We’ve had to close certain beds in our emergency department because we don’t have the nurses to be able to help manage them.”

Continue reading

Mortgage Rates Surge. The Pandemic’s Ultralow Rates Are Over.

Mortgage rates climbed to their highest point since March 2020, according to data released this week. It’s the latest sign that the pandemic’s ultralow rates are a thing of the past.

The average rate of a 30-year fixed-rate mortgage was 3.45% this week, according to Freddie Mac’s Primary Mortgage Market Survey, the highest level since the week ending March 26, 2020. The increase of 23 basis points from last week’s rate of 3.22% was the sharpest gain since the week ending March 19, 2020.

Continue reading

Grocery Stores Are Struggling to Stock Shelves

Shoppers are facing an all-too-familiar picture in grocery stores recently. From meat to toilet paper, goods are in short supply and there aren’t enough workers to help get them back in stock.

The shortages are just some of the effects of the latest surge in Omicron variant. More workers are calling out sick, and delays due to winter storms are all part of systemic issues and congestion that have been present in the supply chain for years, Jessica Dankert, vice president of supply chain at the Retail Industry Leaders Association, told Barron’s.

Continue reading

Citigroup Says 99% of U.S. Staff Comply With Covid Vaccine Mandate

Citigroup said 99% of its U.S. workers complied with its Covid-19 vaccine mandate, and the bank said it would stick with its policy even as the Supreme Court blocked President Joe Biden’s vaccine mandate for large businesses.

Sara Wechter, Citigroup’s head of human resources, said in a LinkedIn post that most of the company’s 65,000 U.S. staff had now received a vaccine. Earlier this month, the bank said those workers who didn’t get vaccinated by Jan. 14 would lose their jobs by the end of the month.

Continue reading

Jobless Claims Higher Than Estimates but Still Point to Tight Jobs Market

The number of Americans filing for first-time unemployment benefits rose to 230,000 last week, surpassing economists’ expectations but continuing to point to a tight labor market.

Initial jobless claims for the week ended Jan. 8 rose 23,000 from the previous week’s unrevised level of 207,000, according to the Labor Department. Economists surveyed by FactSet were expecting claims to clock in at 205,000.

Continue reading

JPMorgan Earnings Beat Expectations

JPMorgan Chase‘s fourth-quarter earnings beat expectations as the biggest U.S. bank benefited from busy capital markets, though it faced higher expenses and slower trading activity.

The banking powerhouse posted profits of $10.4 billion in the final three months of 2021 on $30.3 billion in revenue. That took earnings per share to $3.33. Forecasters were expecting profits of $9.1 billion, or $3.01 a share, on revenue of $29.8 billion, based on analysts surveyed by FactSet.

Continue reading

Biden Buys 500 Million More Covid Tests, Sends Surge Teams to 6 States

President Joe Biden said the federal government would buy another 500 million rapid at-home Covid-19 tests, distribute free masks, and dispatch military medical teams to relieve overwhelmed hospitals in six states in his latest push to combat the fast-spreading virus.

The additional tests ordered Thursday will double the number of free tests the government plans to mail to Americans who request them.

Continue reading

Bausch + Lomb to Return to Public Markets

Bausch + Lomb, the eye health unit of Bausch Health, is going public again.

Bausch + Lomb is seeking to raise $100 million with its initial public offering, according to a prospectus issued this week. The company did not disclose how many shares it would sell or their price range. The $100 million is also a placeholder that will change as Bausch + Lomb provides more information.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.