Friday, February 18, 2022

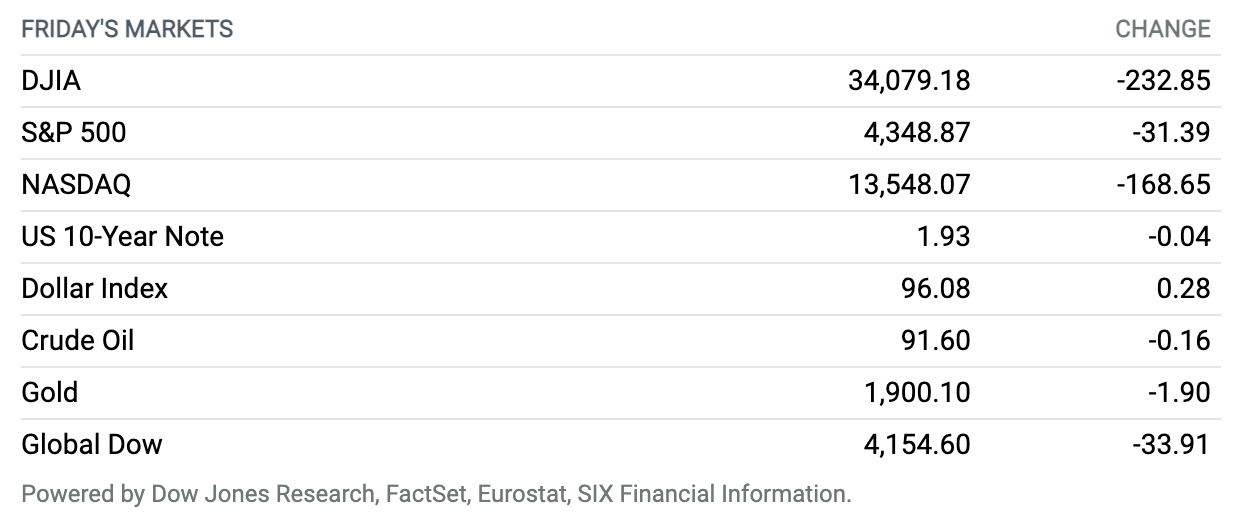

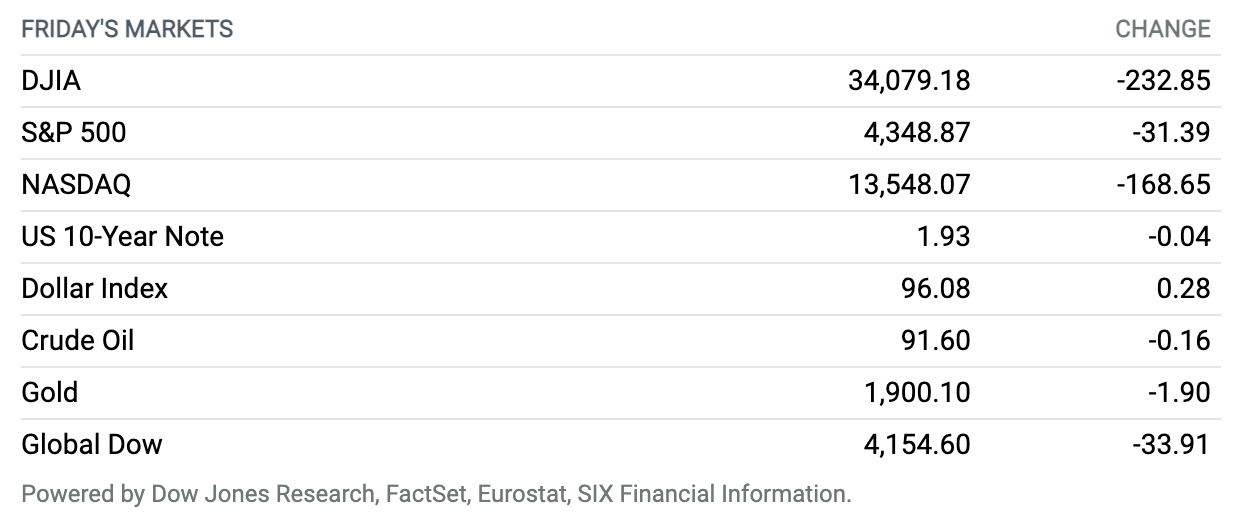

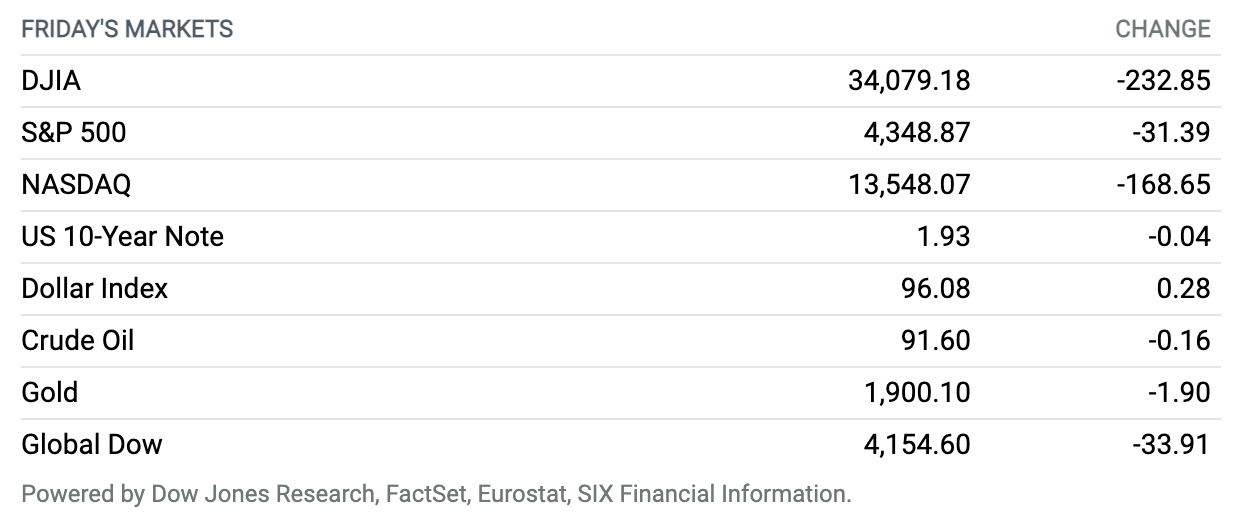

Stocks End Lower Friday on Russia-Ukraine Tensions. U.S. stock benchmarks were down Friday afternoon as investors monitored developments between Russia and Ukraine. The Dow Jones Industrial Average was down 233 points, or 0.7%, at around 34,079. The S&P 500 index fell 31 points, or 0.7%, to close around 4349, with information technology and energy the worst performers among the index’s 11 sectors. The Nasdaq Composite index declined 169 points, or 1.2%, to about 13,548. For the week, the Dow lost 1.9%, the S&P 500 was off 1.6%, and the Nasdaq logged a 1.8% decline.

Putin Says He Sees ‘Deterioration of Situation’ In East Ukraine

Russian President Vladimir Putin said Friday the situation in conflict-hit eastern Ukraine was worsening, as the West accuses him of planning an imminent attack on the country.

“Right now we are seeing a deterioration of the situation” in eastern Ukraine, Putin said at a press conference with his Belarus counterpart Alexander Lukashenko in Moscow.

Russia has held massive military drills near Ukraine’s borders in recent weeks, but Putin, who has demanded promises from the West that NATO won’t expand eastwards, said the drills—involving tens of thousands of soldiers—are not a threat.

Continue reading

Senate Passes Stopgap Government Funding. But It’s Only for 3 Weeks.

Fears over a government shutdown proved to be just that—fears—after the Senate passed a stopgap bill to extend funding until March 11.

The Senate passed the bill in a 65-to-27 vote late in the week, less than 48 hours before funding was set to expire. The House of Representatives approved the measure last week, meaning the bill now heads over to President Joe Biden’s desk.

Fed Signals Openness to Faster Interest-Rate Increases to Curb Inflation

Federal Reserve officials are open to the possibility of faster interest-rate increases later this year, as well as other policy-tightening measures, if inflation continues to run high, minutes from the central bank’s January meeting show.

The minutes, released this week, offer insight into the Jan. 25-26 meeting, following which Fed Chairman Jerome Powell reinforced expectations that the central bank would begin raising interest rates in March. They show that while central bank officials generally expect inflation to continue moderating throughout the year as monetary policy tightens, more aggressive action may be needed if that turns out not to be the case.

Continue reading

Bread, Pasta, and Packaged-Food Prices Are Rising. Here’s Why.

Tired of paying higher prices for groceries? Don’t expect your weekly bill to get any cheaper.

Prices for grains look set to climb even more if Russia invades Ukraine. If that were to occur, Sal Gilbertie, president and chief investment officer at Teucrium Trading, expects price increases for the big three grains: wheat, corn, and soybeans. The price of cooking oil would also be affected, he adds.

Continue reading

Existing-Home Prices Jumped 15.4%. The Housing Market Is Still Hot.

The price of an existing home jumped double digits from a year prior in January, according to National Association of Realtors data released Friday. It’s the latest sign that last year’s hot housing market has continued into the new year even as mortgage rates rise and the supply of homes for sale hits another low.

The median sale price of an existing home was $350,300 in January, an increase of 15.4% from last year and more than December’s 14.7% year-over-year increase.

Continue reading

Google Will Make It Harder to Track Consumers. It’s a Blow to Facebook.

Adding new pressure to Facebook parent Meta Platforms, Google this week unveiled new steps to make it harder for advertisers to track consumer behavior across apps on phones and other devices based on the Android operating system.

While Google will take two years to roll out the new approach, the move nonetheless provides the latest challenge to advertisers, online publishers, and ad networks who rely on signals of consumer behavior to target advertising.

Continue reading

Fed Approves Tighter Rules on Trading Activity for Senior Officials

The Federal Reserve banned senior officials from engaging in several forms of active trading, finalizing a sweeping series of changes to its ethics rules after several Fed officials became engulfed in controversy over their trading actions.

Since September, three top Fed officials, including former Vice Chairman Richard Clarida, have resigned since disclosing trading activity at the start of the pandemic. The disclosures led to a widespread backlash, and prompted Fed Chair Jerome Powell to order a review of the ethics rules for top officials.

Continue reading

Virgin Galactic Opens Reservations for Space. The Ticket Price Is Far Out.

Space-tourism pioneer Virgin Galactic is getting closer to commercial operations, announcing plans this week to open ticket sales for space flight to the general public.

For the astronauts, booking a passage to space is as simple as going to virgingalactic.com and starting the application process when the reservation window opens. They better be ready to put down some serious cash to book their spot, however.

Continue reading

ViacomCBS Is Changing Its Name. Subscribership Grew, but at a Cost.

ViacomCBS reported a very solid quarter of streaming-subscriber gains this week, but that growth didn’t come cheaply.

The company ramped up spending on content and marketing for its Paramount+ and other services, depressing profits in the fourth quarter. Legacy TV and advertising businesses plugged along, and won’t be raising any eyebrows, but there remains plenty for both optimists and pessimists to point to in the company’s results and trajectory.

Continue reading

Mastercard Is Hiring Young Professionals to Expand Crypto and ESG Consulting

Mastercard said it plans to hire more than 500 college graduates and young professionals this year in a bid to expand its consulting services to include insights on open banking, open data, cryptocurrencies, and ESG initiatives.

Mastercard offers payments-focused consulting services through its data and services segment, which employs more than 2,000 data scientists, engineers, and consultants. The new hires would join that team, the company said.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.