Thursday, December 31, 2020

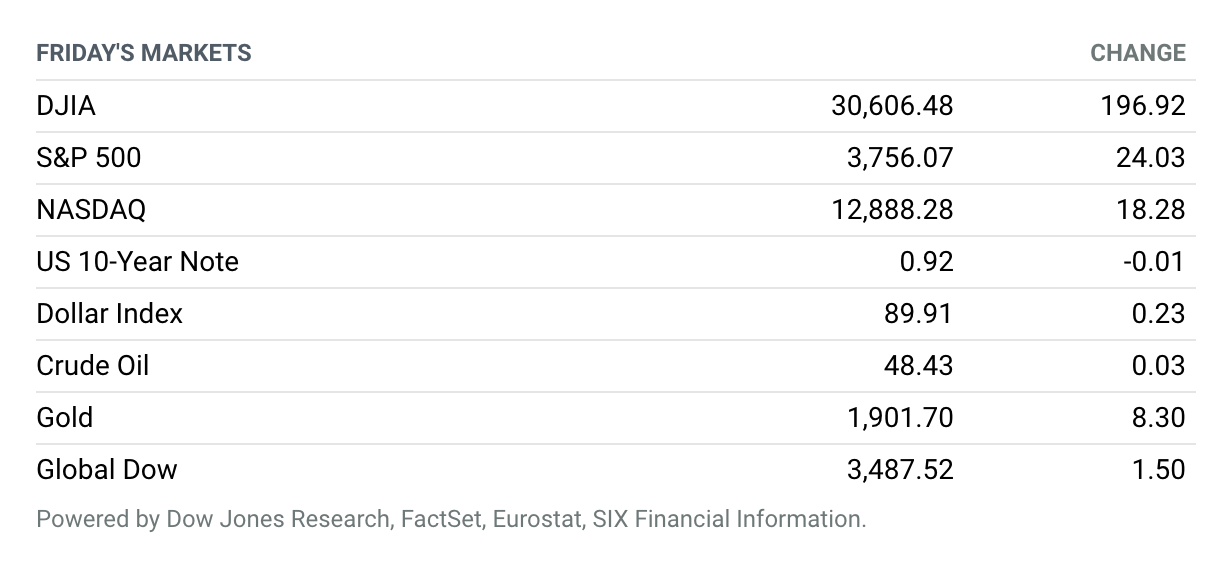

Ringing Out 2020 With Records. Equity benchmarks finished higher Thursday, the last trading session in 2020, to end the year on a strong note after plunging into a bear market in February and March as the Covid-19 pandemic threw the global economy into a deep recession. The promise of vaccines and outsize fiscal and monetary-policy aid helped to foster buying that pulled stocks up and away from their March lows. On Thursday, U.S. data showed that first-time jobless benefit claims unexpectedly declined by 19,000 to 787,000 last week. The Dow Jones Industrial Average rose about 197 points, or 0.7%, to end at around 30,606, marking a record close for the blue-chip index. The S&P 500 index notched its own record close, finishing the session up 0.6% at 3756. The Nasdaq Composite Index closed just shy of a record, up 0.1% at 12,888. However, the Nasdaq Composite registered its best annual gain since 2009, up 43.6%, FactSet data show.

(Editor’s note: We are publishing this weekly Market Brief on Thursday because the stock market will be closed Friday for New Year’s Day.)

Trump Signs Relief Package

Sunday night, President Donald Trump signed a relief package that he previously objected to that includes $900 billion in pandemic relief and $1.4 trillion to fund the government through September.

The legislation passed in Congress last week with bipartisan support. Trump initially rejected the package, saying the proposed $600 direct payments to Americans should be increased to $2,000 per person.

Because Trump did not sign the legislation until Sunday, pandemic-related unemployment benefits ended on Saturday, affecting an estimated 14 million people.

AstraZeneca and Oxford University’s Covid-19 Vaccine Is Approved in the U.K.

The Covid-19 vaccine developed by AstraZeneca and the University of Oxford has been approved in the U.K., paving the way for widespread vaccinations with a homegrown shot that is cheaper and easier to transport and store than other vaccines.

The U.K. government’s department of health and social care said in a statement on Wednesday that “the Government has today accepted the recommendation from the Medicines and Healthcare products Regulatory Agency (MHRA) to authorize Oxford University/AstraZeneca’s COVID-19 vaccine for use.”

Jobless Claims Fall, Surprising Economists

The end of 2020 brought some positive news on the employment front.

Initial claims for unemployment benefits fell to 787,000 for the week ended Dec. 26, down from an upwardly revised figure of 806,000 from the prior week, Labor Department data showed. Economists expected that the number of people filing for unemployment benefits for the first time would total 828,000.

Thursday’s data marked the first time in four weeks that the initial-claims total fell below 800,000. The four-week moving average for initial claims, which smooths out the weekly data, increased by 17,750 to 836,750.

Regeneron’s Antibodies Appear to Help Hospitalized Patients

As everyone waits for Covid-19 vaccine shots, cases have surged and a new variant of the coronavirus that’s more infectious has been discovered. That’s why it was encouraging when Regeneron Pharmaceuticals said late Tuesday that its REGN-COV2 cocktail of antibodies against the virus seems to be helping hospitalized patients in a large clinical trial. If the final readout is good, the treatment could help manage the Covid upsurge and bring Regeneron a 2021 revenue boost.

Infusions of synthetic antibodies from Regeneron and Eli Lilly each got emergency authorizations from U.S. regulators for use in keeping infected patients out of the hospital. But those treatments haven’t yet proven their benefit in sicker patients already hospitalized. In October, Lilly stopped recruitment for a trial of its single antibody bamlanivimab in hospitalized Covid patients after a monitoring committee concluded the treatment wasn’t working. Regeneron’s Tuesday announcement that its data monitors decided to continue its own trial is positive news.

This Was the Busiest Year for IPOs Since the Dot-Com Bubble

In 2020, a soaring IPO market not only rebounded from the Covid-19 pandemic that nearly killed it, but also posted its busiest year since 1999. Initial public offerings aren’t taking much of a holiday breather, with some deals expected to launch the week of Jan. 4

More than twice as many companies went public this year as did in 2019, while valuations jumped 168%. According to Dealogic, 456 U.S. IPOs raised $167.4 billion as of Dec. 24, compared with $62.5 billion collected by 211 companies for the same period in 2019.

Boeing ‘s 737 MAX Jet Returns to U.S. Service

Boeing’s 737 MAX jet carried commercial U.S. passengers on Tuesday for the first time since the aircraft was grounded for safety concerns in March 2019. That removes a worry that has dogged the aerospace giant for nearly two years.

American Airlines operated the first commercial U.S. flight using the Boeing plane since regulators allowed it to return to service. The flight left Miami on Tuesday morning and landed at New York’s LaGuardia Airport in the afternoon. United Airlines has said it would begin using its 737 MAX fleet next month. Southwest Airlines will bring their planes back in the second quarter.

Activist Investor Daniel Loeb Pushes Intel to Explore Deals

Activist investor Daniel Loeb of Third Point reportedly has acquired a significant stake in chip maker Intel and is pushing it to explore strategic alternatives.

Loeb’s hedge fund has a nearly $1 billion stake in the $200 billion company, Reuters reported Tuesday. Loeb, who recently pushed for Walt Disney to focus more on its streaming platform and permanently suspend its dividend, is urging Intel to hire an investment adviser to help it determine whether it should remain an integrated device manufacturer and whether it should divest some of its recent acquisitions.

Alibaba Affiliate Ant Group May Have to Become More Like a Bank

Ant Group, the Jack Ma-backed fintech that was forced to scuttle its initial public offering last month, has to return to its payments roots, Chinese regulators say.

The People’s Bank of China said Tuesday that the Alibaba affiliate was working on a plan to set up a financial holding firm, according to a Reuters report citing a statement by the central bank.

Home Prices Look Set to Keep Rising in 2021

The latest release of the Case-Shiller home-price index confirmed what other recent data and anecdotes have suggested: Home prices, undeterred by the pandemic and recession, have risen to new highs remarkably quickly.

Home-price appreciation is ordinarily considered a positive, boosting household wealth and contributing to the greater economy, but today it comes as the Covid-19 pandemic has put millions out of work. While home sales in recent months have soared above last year’s levels, housing market economists have been sounding the alarm about the potential impact of rising prices and a historically tight inventory of homes for sale.