Friday, August 13, 2021

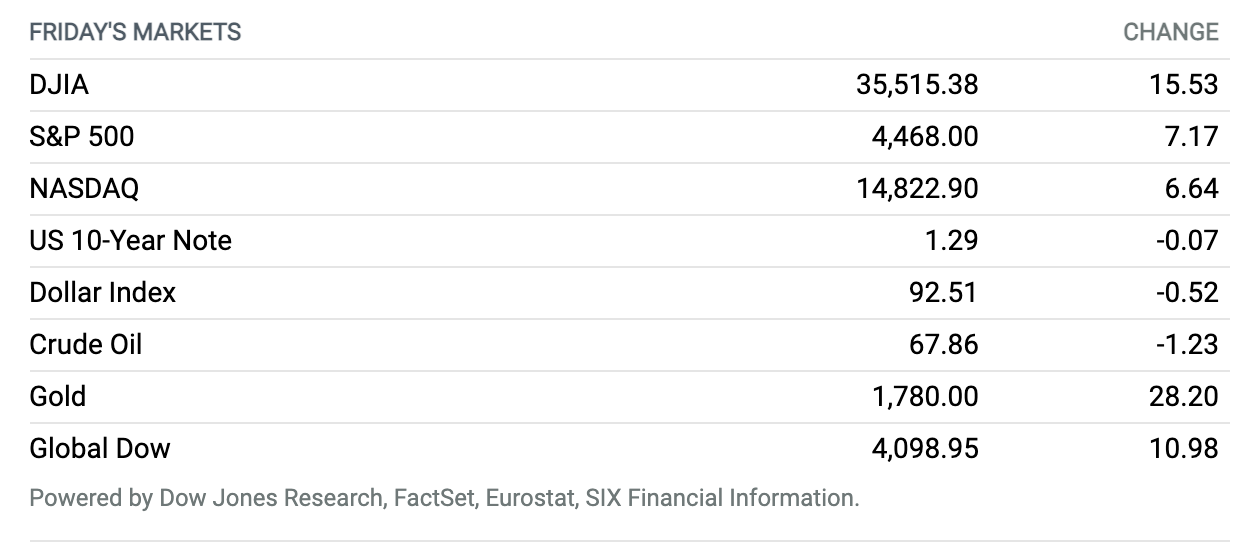

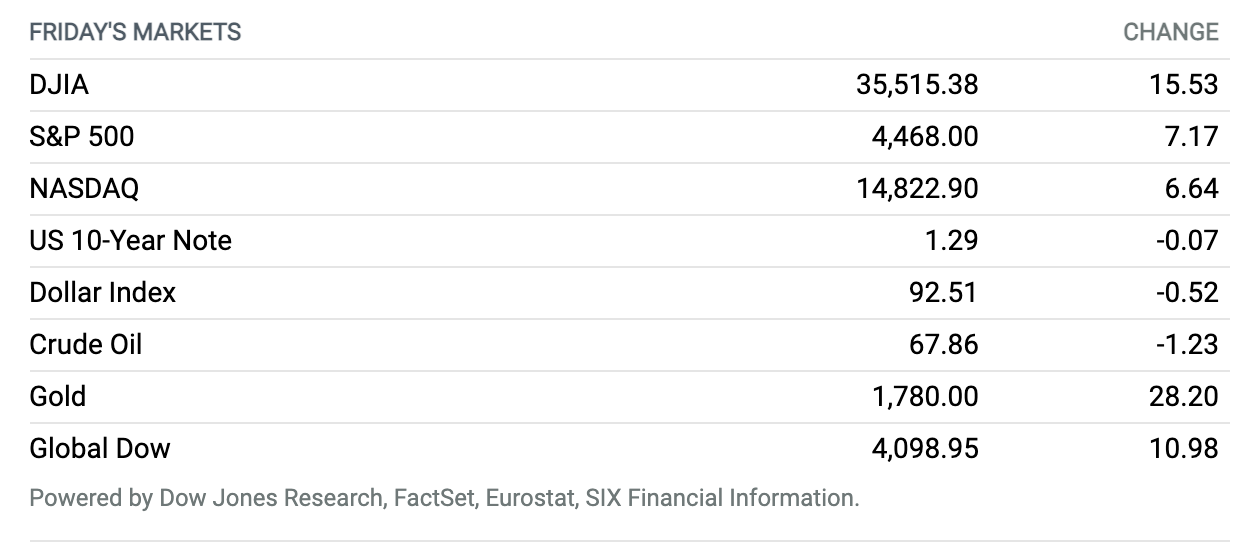

Dow, S&P 500 End Week With Fourth Straight Record Close. Stocks ended mostly higher Friday, with the Dow Jones Industrial Average and the S&P 500 each logging a fourth straight record close as investors cheered a strong earnings season. The Dow eked out a gain of around 16 points, or less than 0.1%, to finish at 35,515, giving it a weekly gain of 0.9%. The S&P 500 rose 7 points, or 0.2%, to end at 4468, for a 0.7% weekly advance. The Nasdaq Composite managed a gain of nearly 7 points, or less than 0.1%, to finish near 14,823, leaving it down 0.1% for the week. The simultaneous streak of record finishes for the Dow and S&P 500 is the longest since the pair posted a five-day run that ended on Oct. 20, 2017, according to Dow Jones Market Data.

U.S. Authorizes Third Dose of Covid Vaccines. Don’t Call Them Booster Shots.

Federal health authorities in the U.S. authorized an additional dose of Pfizer or Moderna’s Covid-19 vaccines for certain people with compromised immune systems on Thursday and Friday, in what could be a first step toward an eventual broader rollout of booster doses.

Health officials were careful not to refer to the additional doses for the immunocompromised as booster shots, but rather as a third dose of the primary series meant to increase the immune response in people whose immune systems can’t defend against Covid-19 after just two doses.

In a statement issued just before midnight on Thursday, the U.S. Food and Drug Administration said it had updated its emergency-use authorization for both Pfizer and Moderna’s Covid-19 vaccines to include a third dose for recipients of solid organ transplants, and to people with other conditions that “are considered to have an equivalent level of immunocompromise.”

Continue reading ›

Inflation Isn’t Going Away Just Yet, Producer-Price Index Shows

Wednesday’s consumer-price index provided evidence that inflation may be transitory. Thursday’s producer-price index showed that it may be sticky after all.

Producer prices rose 7.8% in July year over year, above the consensus forecasts for 7.3%, while increasing 1% month over month, above expectations for 0.6%. Instead of colling off, inflation for producers remains hot, hot, hot.

Continue reading ›

Consumer-Price Inflation Cooled, a Little, in July. It’s Still a Problem.

Consumer prices rose at a slower pace in July after June’s torrid rise, a relief for investors and policy makers alike. It is too soon, however, to call the inflation debate settled.

The Labor Department said Wednesday that the overall consumer-price index, which includes everything from food and shelter to haircuts, rose 0.5% in July from a month earlier. In June, total CPI surged 0.9% month over month.

Continue reading ›

Disney Earnings Were a Win-Win. Theme Parks Are Recovering as Streaming Grows.

Walt Disney’s latest quarterly results checked the major boxes observers had been hoping for: A postpandemic rebound is under way at several legacy media and entertainment businesses while streaming continues to grow despite the competition from a reopening economy.

Disney+ added plenty of subscribers, while theme parks revenue rose more than threefold.

Continue reading ›

Senate Passes $1 Trillion Infrastructure Plan. What’s Inside.

The Senate passed a nearly $1 trillion infrastructure bill Tuesday in a bipartisan 69-30 vote after days of struggling to reach an agreement over numerous amendments to the plan. The legislation, formally called the Infrastructure Investment and Jobs Act, next heads to the House of Representatives, where it will be vigorously debated.

A key part of President Joe Biden’s economic agenda, the agreement calls for $550 billion in new federal spending on top of about $450 billion in previously approved funds. The bill is an ambitious plan to upgrade and modernize the nation’s roads, bridges, water systems, broadband access, and electric grid, starting in 2022.

Continue reading ›

How Will the U.S. Pay for the $3.5 Trillion Resolution? Taxes, Mostly.

The day after voting to approve the $1 trillion infrastructure bill, the Senate early Wednesday passed the broad outline for the second half of President Joe Biden’s economic agenda: a sweeping 10-year, $3.5 trillion budget resolution to invest in what the president calls “human infrastructure.” The Senate passed the budget blueprint in a 50-49 party line vote, just before 4 a.m. Wednesday. How to pay for all this new spending will be the focus of debate in the coming months.

The budget resolution aims to fight poverty and inequity, invest in programs for children and seniors, and fight climate change—paid for by the largest corporations, the wealthiest Americans, and other revenue sources.

Continue reading ›

Adidas to Sell Reebok to U.S. Firm Authentic Brands Group

German sportswear giant Adidas said Thursday it has agreed to sell its ailing Reebok unit to the U.S. company Authentic Brands Group in a deal worth 2.1 billion euros ($2.5 billion).

Adidas bought Reebok in 2006 but announced that it would offload the brand in February this year after struggling to lift its fortunes.

Continue reading ›

Southwest Airlines Cancellations Rise With the Delta Variant

Southwest Airlines has a Delta problem—and it’s not about carrier rivalry.

In a filing with the Securities and Exchange Commission, Southwest warned on Wednesday that it’s seeing an increased number of cancellations this month, as well as slowing bookings, which the airline blamed on consumer concerns about the highly contagious Delta variant of Covid-19.

Continue reading ›

Apple Sees Profit Nearly Double as iPhone Sales Boom

Apple posted its strongest June quarter ever, with a near doubling of profits and a huge revenue beat for its iPhone business.

The company posted fiscal third-quarter net income of $21.74 billion, or $1.30 a share, up from $11.25 billion, or 65 cents a share, a year earlier. Analysts tracked by FactSet were expecting earnings per share of $1.01.

Continue reading ›

New York Governor Andrew Cuomo Resigns After Harassment Claims

New York Governor Andrew Cuomo, facing possible impeachment over sexual harassment claims from 11 women and mounting pressure to quit from fellow Democrats, announced his resignation on Tuesday.

It was a stunning reversal of fortune for the 63-year-old Cuomo, who just a year ago earned praise for his handling of the Covid-19 pandemic before being engulfed in the harassment allegations and claims that he covered up the scale of deaths in nursing homes.

Continue reading ›

Earnings Slump at Softbank, but It Shrugs Off the Chinese Crackdown–for Now

Earnings have slumped at Softbank Group, the Didi Global and Alibaba investor, which posted a first-quarter update Tuesday. But the tumble had little to do with its exposure to Chinese groups listed on world markets—for now.

Net profit fell 39% in the quarter ended in June, but the Japanese conglomerate’s two Vision Funds posted a handsome $2.1 billion profit in the same period. While the earnings haircut is far from the stellar, record-beating performance of the previous quarter, much of that had been due to impressive paper gains from its portfolio of listed assets, boosted by still exuberant markets.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.