Friday, April 23, 2021

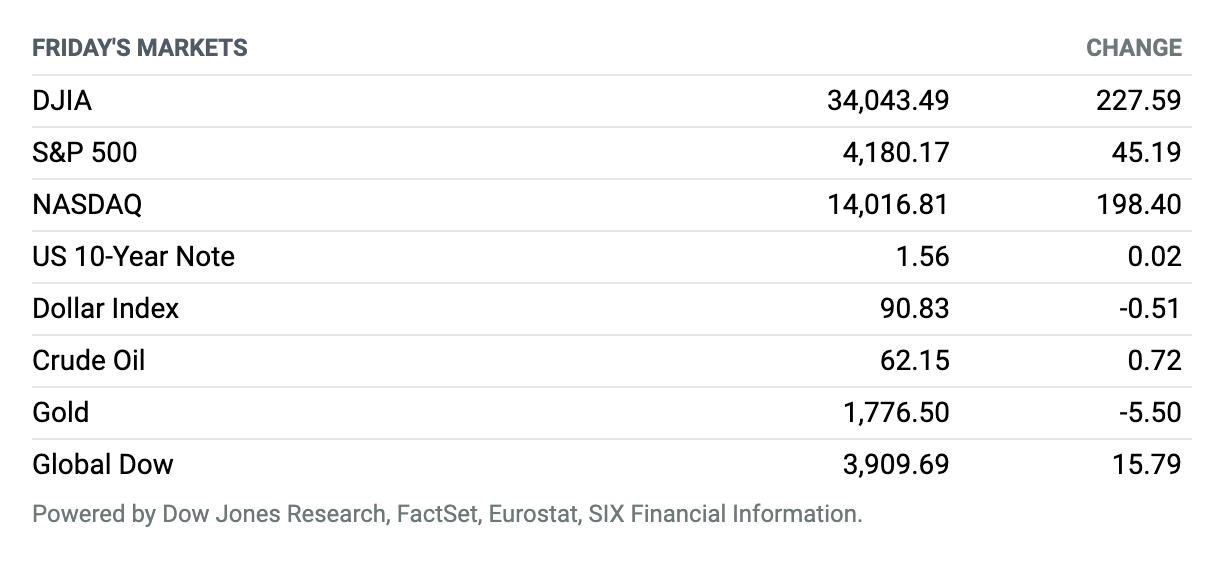

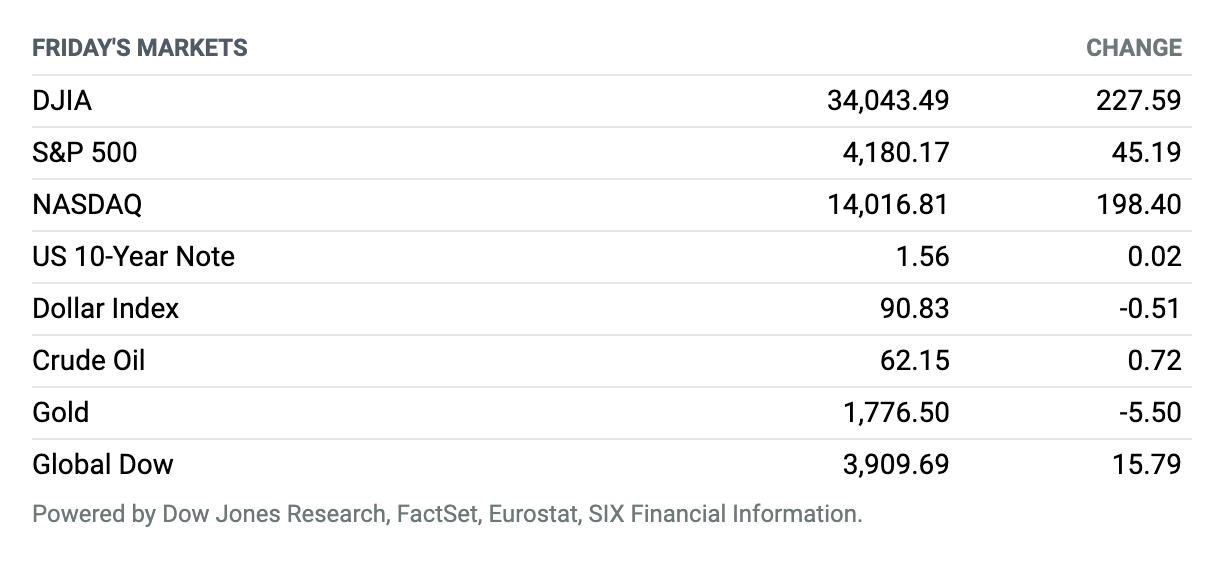

Markets Bounce Back. Stocks finished with gains, but off session highs and with weekly losses for major benchmarks, bouncing a day after reports that President Joe Biden plans to nearly double the capital-gains tax rate for Americans earning more than $1 million a year. The Dow Jones Industrial Average finished around 228 points higher, up 0.7%, at 34,043.49, after rising more than 300 points at its session high. The S&P 500 closed 1.1% higher near 4180, after trading above its April 16 closing high at 4185.47 during the session. The Nasdaq Composite advanced around 198 points, or 1.4%, to close near 14,017. Stocks were lifted after IHS Markit purchasing managers index readings for the manufacturing and services sectors hit records and data showed home sales continued at a rapid pace. Investors also played down worries over a rise in the capital-gains tax rate, noting that past rises have been shown to have little correlation with equity returns. The benchmarks lost ground for the week, however, with the S&P 500 off 0.1%, the Dow down 0.5% and the Nasdaq off 0.3%.

What to Know About Biden’s Potential Capital-Gains Tax Hike

Reports that federal tax rates could rise to as much as 43.4% on investment gains for Americans earning $1 million or more caused all three major U.S. stock indexes to slump on Thursday, although they bounced back on Friday.

As first reported in the New York Times, the tax increase would help fund President Joe Biden’s American Families Plan, aimed at helping Americans improve their job skills and enhance childcare options. Biden is expected to unveil the details before his first address to a joint session of Congress on Wednesday.

For wealthy Americans, capital-gains taxes would effectively double, from the current 20% to 39.6%. An additional Obama-era tax of 3.8% on capital-gains taxes for high earners would push total investment taxes to as high as 43.4%.

Continue reading ›

Johnson & Johnson’s Covid Vaccine Faces a Make-or-Break Vote Friday

A key Centers for Disease Control and Prevention advisory committee was meeting Friday to continue its discussion of the rare blood clots seen in a small number of patients who have received Johnson & Johnson’s Covid-19 vaccine.

The committee, called the Advisory Committee on Immunization Practices, failed to come to a decision when it met last week about whether to recommend changes for use of the Johnson & Johnson vaccine. On April 13, the CDC and the U.S. Food and Drug Administration had jointly announced a recommended pause in administration of the vaccine, after reports that six people had developed rare blood clots and low levels of blood platelets after receiving it.

Continue reading ›

Biden Pledges to Cut U.S. Greenhouse Gases 50% by 2030

President Biden has pledged to cut U.S. greenhouse gas emissions at least in half by the end of the decade, the White House said Thursday, an ambitious goal that climate analysts say can be met only by sharply cutting back oil, gas, and coal use.

The 50%-52% reduction would nearly double the nation’s previous commitment. It also makes it more likely the U.S. can meet its mission of net zero emissions by 2050, a common refrain from a Biden administration that has made combating climate change a fixture of the first 100 days in office.

Continue reading ›

Netflix Predicts Worst Quarter for Streaming Growth in Its History

Netflix has come back down to earth after massive gains during the opening months of the Covid-19 pandemic.

The streaming giant on Tuesday reported 3.98 million net new paid subscribers in the first quarter, down from 8.5 million reported in the previous quarter and well below the 6 million the company predicted three months ago.

Continue reading ›

AT&T Reports Strong Mobile and Streaming Subscriber Growth

AT&T reported a blowout quarter of mobile and streaming subscriber growth, and added better-than-expected earnings and revenue to boot.

Critics will point out, however, that the rapid customer growth came at the expense of AT&T’s profit margins in the quarter. HBO Max subscribers aren’t profitable yet, and the company was aggressive with its wireless discounts and promotions in the first quarter.

However, Dr. June Raine, chief executive of the MHRA, said that for young people it was more “finely balanced.” As a result, the U.K. government’s Joint Committee on Vaccination and Immunisation said people under age 30 would be offered an alternative vaccine, such as the one made by German biotech BioNTech with U.S. drug company Pfizer or the shot from U.S. biotech Moderna.

Continue reading ›

Credit Suisse Taps Investors for Cash After Archegos and Greensill Debacles

Swiss bank Credit Suisse said on Thursday it would sell convertible notes to its current shareholders in a bid to raise nearly $2 billion of fresh capital, to repair its balance sheet after losses triggered by the meltdowns of U.S. hedge fund Archegos Capital Management and British supply-chain finance group Greensill.

Swiss financial regulator Finma also said on Thursday that it had “opened enforcement proceedings” against the bank and will notably investigate “possible shortcomings in risk management” in the two financial scandals.

Continue reading ›

Messaging App Discord Calls Off Talks With Microsoft, Others

Communications platform Discord is no longer in talks to sell itself to Microsoft. Instead, the start-up may be eyeing an initial public offering.

Discord recently halted conversations with suitors, which included Microsoft, The Wall Street Journal reported, citing people familiar with the matter. It previously reported that Microsoft and Discord were engaged in advanced talks to buy the platform for $10 billion.

Continue reading ›

P&G Flags Price Increases as Earnings Beat Forecasts

Procter & Gamble disclosed better-than-expected financial results but said it planned to raise prices for some products, making it clear that it too is being hit by rising costs.

The consumer-products company said Tuesday morning it earned $3.27 billion, or $1.26 a share, up from $1.12 a share in the year-earlier period. Revenue climbed 5% to $18.11 billion. Analysts were looking for EPS of $1.19 on revenue of $17.97 billion.

Continue reading ›

Boeing Says CFO Greg Smith Will Retire

Boeing made a couple of big management announcements Tuesday: CEO Dave Calhoun can stay until he’s 70, five years longer than Boeing’s mandatory retirement age, and CFO Greg Smith is retiring at 54.

The news seemed to unnerve investors, who don’t like to be caught off guard. Calhoun staying might not be a big surprise, but Smith leaving is.

Continue reading ›

Nvidia’s $40 Billion Takeover of Arm Faces U.K. National Security Probe

The U.K. has opened a formal investigation into Nvidia’s $40 billion takeover of chip designer Arm, after the government said the deal could have national security implications.

Digital secretary Oliver Dowden on Monday issued a public interest intervention notice relating to the proposed deal and requested that the U.K.’s Competition and Markets Authority prepare a report on the implications of the deal.

Continue reading ›

Apple Announces a New iPad, iMac, and AppleTV

Apple announced its much-anticipated iPad Pro on Tuesday, but the company also snuck in a bit of a surprise when it debuted a new line of iMacs built around its much-touted M1 chips. The announcements came during the company’s “Spring Loaded” event.

The new tablet includes the company’s M1 chip, as well as a 5G cellular connection. Apple said the graphics on the new iPad Pro are 1,500 times faster than the original iPad. The devices support the latest PlayStation and Xbox controllers for gaming, too.

Continue reading ›