Friday, April 22, 2022

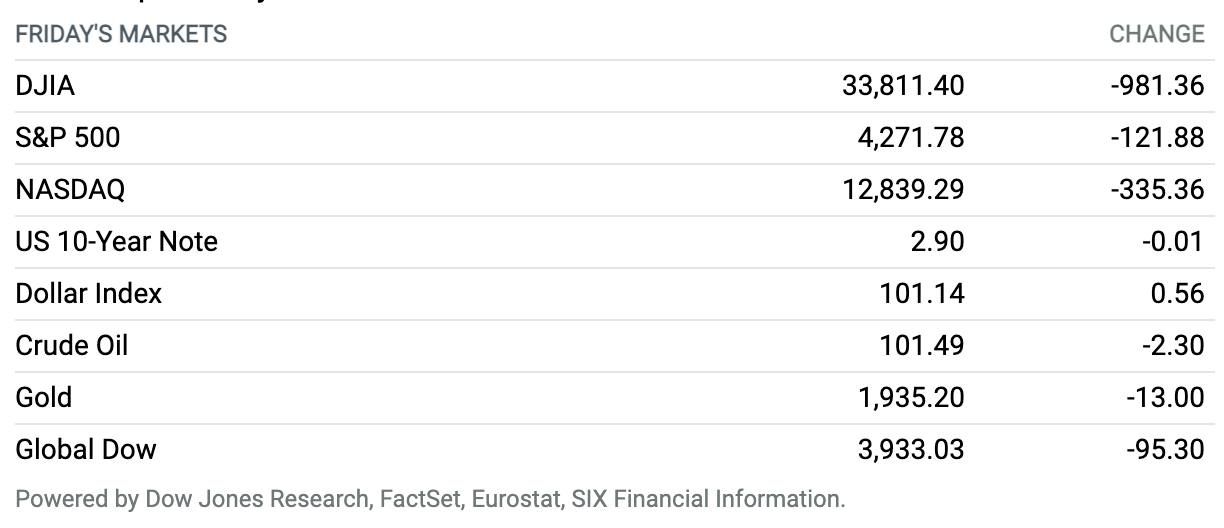

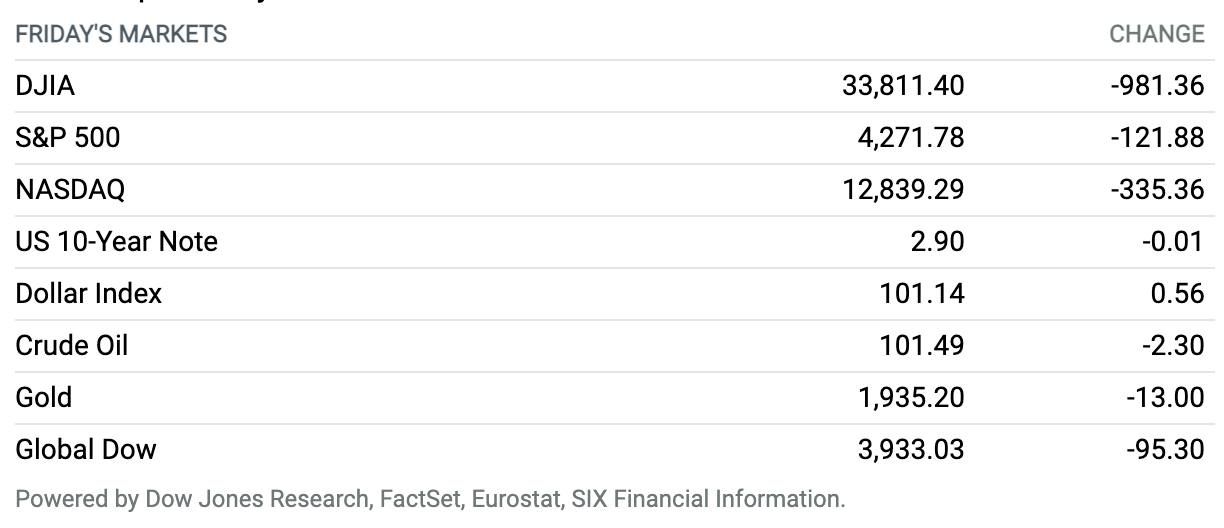

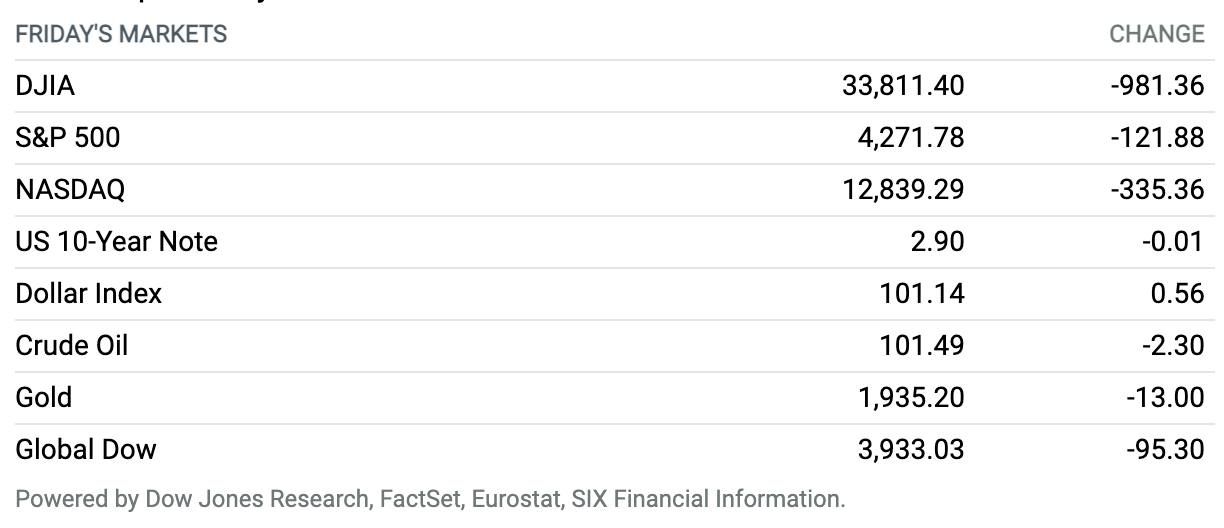

Dow Closes Down 981 Points Friday, Books Worst Day Since October 2020. Stocks finish sharply lower Friday to book weekly losses, as Wall Street focused on a potentially compressed timeline for the Federal Reserve to swiftly raise interest rates in a bid to curtail inflation. The Dow Jones Industrial Average shed about 981 points, or 2.8%, ending near 33,811. It marked the worst daily percentage drop for the index since Oct. 28, 2020. The S&P 500 index fell 122 points, or 2.8%, to close at 4272, and the Nasdaq Composite index dropped 335 points, or 2.6%, to finish at 12,839. For the week, the Dow was down 1.9%, the S&P 500 off 2.8%, and the Nasdaq lower by 3.8%.

Fed’s Powell Puts Half-Point Rate Hike on the Table for May

Federal Reserve Chairman Jerome Powell confirmed this week that the U.S. central bank will be considering a more aggressive path of monetary policy tightening when officials meet for their next policy meeting in less than two weeks.

Speaking as part of a panel of top economic policy officials for a debate on the global economy, Powell said a half-point interest-rate increase “will be on the table” during the May policy meeting and noted that many central bank officials had already felt such a move was appropriate during the March meeting.

Compared with the central bank’s 2004-06 tightening cycle, inflation now is higher and yet monetary policy remains more accommodative, Powell said.

Continue reading

Elon Musk Puts the Pressure on Twitter. All Eyes Are on the Board.

Elon Musk said in a filing with the Securities and Exchange Commission that he has the funding to take Twitter private and is exploring whether to make a tender offer for all shares outstanding. The move appears aimed at pressuring the company’s board, legal experts say.

In an amended 13D filing, Musk said he’s exploring taking his $43 billion offer to buy Twitter directly to shareholders via a tender offer since the social media company’s board hasn’t responded to his proposal. Musk said in the filing that he hasn’t determined whether or not he would do so yet, but has hinted at a tender offer in posts on Twitter. He also provided commitment letters outlining how he’d finance the deal through debt and equity.

The IMF Is Calling the Sheriff for a Crypto ‘DeFi’ Crackdown

The International Monetary Fund has a message for governments: Find ways of regulating DeFi platforms for trading and lending cryptocurrencies before the risk to the global financial system spirals out of control.

The IMF made that call in its latest Global Financial Stability Report, published this week. The document outlines a litany of risks to the global financial system, including “shockwaves from the war in the Ukraine” and a dangerous mix of inflation, debt, and monetary policies.

Continue reading

New Omicron Subvariants Muddy the Pandemic Picture

The pandemic picture in the U.S. has grown messier in the past week, as a new subvariant has begun to vie with BA.2 for dominance, making the future of the current wave even harder to predict.

Just weeks ago, the state of the pandemic seemed somewhat clear. Cases were rising in parts of the U.S., driven largely by an Omicron subvariant known as BA.2, which had arrived in the northeastern U.S. after driving a steep rise in cases in parts of Europe.

Continue reading

GM, Honda Are Joining the Race for the Next Big Thing in EV Power

General Motors and Honda Motor are deepening their electric-vehicle partnership.

The pair are going to develop solid-state batteries for their electric vehicles, Honda said earlier this month. Solid state, in this instance, refers to a battery without a liquid facilitating the electrical charge. Removing the liquid, along with other advancements, can result in cheaper, more powerful batteries that charge faster and are safer than today’s generation of lithium-ion batteries.

Continue reading

Apple Store Workers in Atlanta File for Union Vote

Apple store workers in a mall near Atlanta have filed for a union election with the National Labor Relations Board. If the vote passes, they would become the first group of Apple workers to unionize.

The Communications Workers of America represents the group, which includes sales staff, technicians, creative workers, and operations personnel who work at an Apple store located in the Cumberland Mall. About 70% of the more than 100 store employees signed union authorization cards, the CWA said on Wednesday.

Continue reading

France Goes to the Polls. The Result Could Upset the World Order.

While it is increasingly likely that Emmanuel Macron will be re-elected as France’s president this Sunday, a victory by Marine Le Pen should not be discounted completely, even though she lags by 10 points in the polls.

Propelling Le Pen, the nationalist who has been at pains to soften her image in this repeat of 2017’s contest, into office could mean market moves in commodities, equities, and oil. It could also weaken the euro, and has the potential to change the course of world events.

Continue reading

Florida Governor to Sign Bill Removing Disney’s Special Tax Status

Florida Governor Ron DeSantis is expected to sign a bill revoking a 1967 law allowing Walt Disney to self-govern its 25,000-acre Orlando theme parks.

The Florida House of Representatives on Thursday voted 70-38 to end Disney’s special tax status, after the Senate backed the measure by a 23-16 vote this week. The bill will now be put before DeSantis, who has made clear he will sign it into law, which would take effect June 1, 2023.

Continue reading

AB InBev Warns of $1 Billion Hit From Russian Venture Exit

Anheuser-Busch InBev said on Friday that it will sell its stake in its Russian joint venture in a deal that could result in a $1.1 billion hit for the world’s largest brewer.

The maker of Budweiser, Stella, and Corona said it is in talks to sell its noncontrolling interest in joint venture AB InBev Efes to Turkish partner Anadolu Efes.

Continue reading

Home Prices Surged to a Record as Sales Fell. What’s Cooling the Hot Housing Market.

Existing-home sales fell in March as home prices climbed to their highest level ever, according to industry data.

Sales of existing homes dipped nationally by 2.7% from the month prior to a seasonally adjusted annual rate of 5.77 million, the National Association of Realtors said, reporting a figure in line with what the FactSet consensus expected.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.