Justin Pitcock, CFP® professional, shares the market update and trade rationale.

Nov 5, 2024

The Markets

Are we witnessing an historic event?

For an airplane or a spacecraft, a soft landing occurs when the vehicle “touches the ground in a controlled and gradual way that does not damage it,” according to The Britannica Dictionary.

For the American economy, a soft landing happens when the Federal Reserve raises interest rates to cool the economy and push inflation lower—and achieves its goal without causing a recession and significantly higher unemployment. It’s not an easy task.

“Historically, soft landings have been tough to pull off…Keeping unemployment and inflation low while at the same time having robust growth is difficult. Threading that needle has proven to be quite elusive,” reported a source cited by Aly J. Yale of The Wall Street Journal.

Solid economic growth, low unemployment, rising wages, and falling inflation have one Federal Reserve official and several economists declaring that the American economy has achieved this rare event—a soft-landing, reported Bryan Mena of CNN.

So, exactly how well is the U.S. doing?

“The extent to which America has outperformed other countries since the start of the COVID-19 pandemic is breathtaking. Its real GDP has expanded by more than 10 [percent], nearly three times as much as the euro area. Among the G20 group, which includes both rich countries and emerging markets, America is the only one where output is above pre-pandemic expectations, according to the International Monetary Fund,” reported Simon Rabinovitch of The Economist.

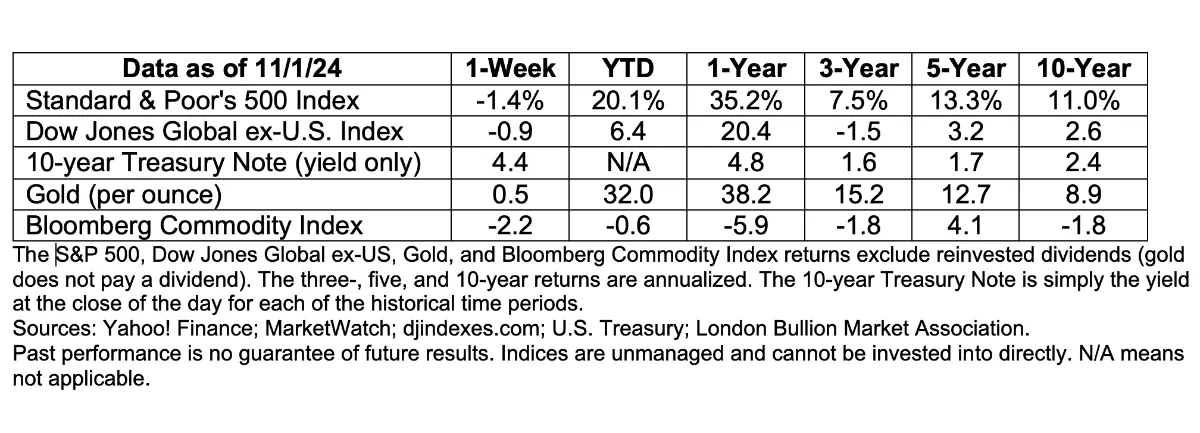

Last week, “with an election and Federal Reserve meeting still to come, stocks faltered under the weight of the uncertainty,” reported Teresa Rivas of Barron’s. Major U.S. stock indices finished the week lower. Uncertainty about the direction of future government spending and its possible effect on Federal Reserve policy caused some turmoil in bond markets, too, reported Paul R. LaMonica of Barron’s. Yields on longer maturities of U.S. Treasuries moved higher over the week, while yields on shorter maturities moved lower.

PERCEPTION VS. REALITY.

The human brain is complex and powerful. It runs on about 20 watts of power and brains need to be recharged, just like your cell phone does, according to Northwestern Medicine.

It’s interesting to note that brains are not objective. They catalogue our experiences, beliefs, and emotions and then interpret what’s happening around us. As a result, our reality on any given day is affected by “our personal physical abilities, energy levels, feelings, social identities, and more,” reported Jill Suttie in Greater Good Magazine.

For example, studies have found that hills look steeper when people are:

- Tired.

- Wearing backpacks.

- Thinking of people they dislike.

In contrast, hills look less steep when people feel energetic or think of a supportive friend.

An August survey from the National Federation of Independent Business, a small-business advocacy group, reinforced the idea that there is a gap between economic perception and economic reality. The survey found that small business owners were quite optimistic about the financial state of their businesses, reasonably optimistic about the state of their local economies, and pessimistic about the state of the U.S. economy.

| Excellent/ Good | Okay | Poor | |

| The current financial state of my business is: | 70 percent | 25 percent | 5 percent |

| The current state of my local economy is: | 36 percent | 44 percent | 20 percent |

| The current state of the U.S. economy is: | 10 percent | 32 percent | 58 percent |

When survey participants were asked when the United States might experience another recession, 52 percent said the U.S. economy was in a recession right now. A recession is a downturn in economic activity that lasts for a significant period. Economic data show the U.S. economy, as measured by gross domestic product (the value of all goods and services produced in the U.S.), has been growing since late 2020.

The answers were interesting because most businesses—small and large—experience declines in sales and profitability when the national economy is doing poorly or in a recession. The gap in perception and reality may reflect the fact that “people are upbeat about what they see directly but pessimistic about what they glean indirectly through media (and social media),” opined Rabinovitch of The Economist.

Weekly Focus – Think About It

“A politician needs the ability to foretell what is going to happen tomorrow, next week, next month, and next year. And to have the ability afterwards to explain why it didn’t happen.”

— Winston Churchill, former British Prime Minister