Planning for Medicare before retirement is essential to ensure seamless healthcare coverage as you transition into your post-working years. This guide provides a step-by-step approach to navigating Medicare before retirement, including when to take specific actions, how to sign up, and valuable tips for maximizing your benefits. By understanding the Medicare enrollment process and planning ahead, you can make informed decisions in alignment with your retirement goals and financial well-being.

This guide is not meant to be an exhaustive explanation of Medicare. It is important to find a reputable and knowledgeable partner who can help you navigate Medicare for your specific situation. Healthcare options can be complicated, and we do not want you to make a mistake that can cost you or create more stress.

Step 1: Understand Your Medicare Eligibility

- You can determine your eligibility for Medicare based on your age (65 or older) or specific qualifying conditions, such as disability.

- Assess your current healthcare coverage to understand how Medicare will complement or replace your insurance.

- Check out this helpful Medicare fact sheet.

Step 2: Learn About Medicare Coverage Options

Familiarize yourself with Medicare’s different parts:

- Part A (hospital insurance)

- Part B (medical insurance)

- Part C (Medicare Advantage)

- Part D (prescription drug coverage)

- Medigap supplemental plans

Let’s break down the four parts of Medicare:

Part A (Hospital Insurance):

- Part A helps cover inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Think of Part A as the coverage you’d need if you have to stay overnight in a hospital or a skilled nursing facility for a short-term stay or receive hospice care.

Part B (Medical Insurance):

- Part B helps cover medically necessary services like doctor’s visits, outpatient care, preventive services, and some home health care.

- Think of Part B as the coverage you’d need for things like doctor’s appointments, lab tests, medical equipment, and outpatient surgeries.

Part C (Medicare Advantage):

- Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and Part B) offered by private insurance companies approved by Medicare.

- Medicare Advantage plans must cover all the services that Original Medicare covers, and many also include prescription drug coverage (Part D) as well as extra benefits like vision, dental, and fitness programs.

- These plans often have networks of doctors and hospitals you must use, and they may require referrals to see specialists.

Part D (Prescription Drug Coverage):

- Part D helps cover the cost of prescription drugs.

- Think of Part D as the coverage you’d need for medications prescribed by your doctor, whether you pick them up at a pharmacy or have them delivered to your home.

- Part D plans are offered by private insurance companies approved by Medicare.

Next, you will want to understand each part’s coverage benefits, costs, and potential out-of-pocket expenses.

Let’s break down the costs associated with each type of Medicare:

We recommend you refer directly to the official Medicare website or contact Medicare directly for the most up-to-date information on premiums, deductibles, and coinsurance. These numbers may vary from year to year due to changes in healthcare policies, inflation, and other factors.

Part A (Hospital Insurance):

- Premium: For most people, Part A is $0 (premium-free) if you or your spouse paid Medicare taxes while working – generally at least ten years. If you don’t qualify for premium-free Part A, you may have to pay a monthly premium. You won’t pay a Part A premium if you get Medicare earlier than age 65. This is sometimes called “premium-free Part A.”

Do I qualify for premium-free Part A?

- If you don’t qualify for premium-free Part A, You might be able to buy it. As of 2024, you’ll pay either $278 or $505 each month for

- Part A, depending on how long you or your spouse worked and paid Medicare taxes.

Remember:

- You also have to sign up for Part B to buy Part A. Learn more about how Medicare works.

- You might pay a penalty if you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65). Find out more about how to avoid the Part A penalty.

- Deductible: There is a deductible for each benefit period, which is the amount you must pay before Medicare starts to pay its share. As of 2024, the Part A deductible is $1632 for each inpatient hospital benefit period before Original Medicare starts to pay. There’s no limit to the number of benefit periods you can have in a year. This means you may pay the deductible more than once in a year.

How do benefit periods work?

- Coinsurance: After you’ve met the deductible, you typically pay a coinsurance amount for covered services during the benefit period.

Part B (Medical Insurance): - Premium: Most people pay a standard monthly premium for Part B coverage, determined by income. In 2024, the minimum premium is $174.70 monthly (or higher, depending on your income). The amount can change each year. You’ll pay the monthly premium even if you don’t get any Part B-covered services.

Who pays a higher Part B premium because of income?

- You might pay a monthly penalty if you don’t sign up for Part B when you’re first eligible for Medicare (usually when you turn 65). You’ll pay the penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. Find out how the Part B penalty works and how to avoid it.

- Deductible: There is an annual deductible for Part B, which is the amount you must pay out of pocket before Medicare starts to pay its share. For 2024, the deductible is $240 before Original Medicare starts to pay. You pay this deductible once each year.

- Coinsurance: After you’ve met the deductible, you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment.

Part C (Medicare Advantage):

- Premium: Medicare Advantage plans may have a monthly premium in addition to the Part B premium. The cost varies depending on the plan and insurance company.

- Deductibles and Copayments: Medicare Advantage plans often have deductibles, copayments, and coinsurance for covered services. These costs can vary widely depending on the plan and your services.

- Out-of-Pocket Maximum: Most Medicare Advantage plans have an out-of-pocket maximum, which limits the amount you have to pay for covered services in a calendar year.

Compare costs for specific health care plans.

Part D (Prescription Drug Coverage):

- Premium: Part D premiums vary by insurance and your income. Here is a link to show if you must pay more based on your income.

- Deductibles, Copays, and Coinsurance: Varies by your insurance plan and pharmacy.

- It’s important to note that costs for Medicare Advantage and Part D plans can vary widely depending on factors such as the plan’s coverage, network of providers, and location. When choosing a plan, be sure to consider not only the premiums but also the deductibles, copayments, coinsurance, and coverage for your specific healthcare needs.

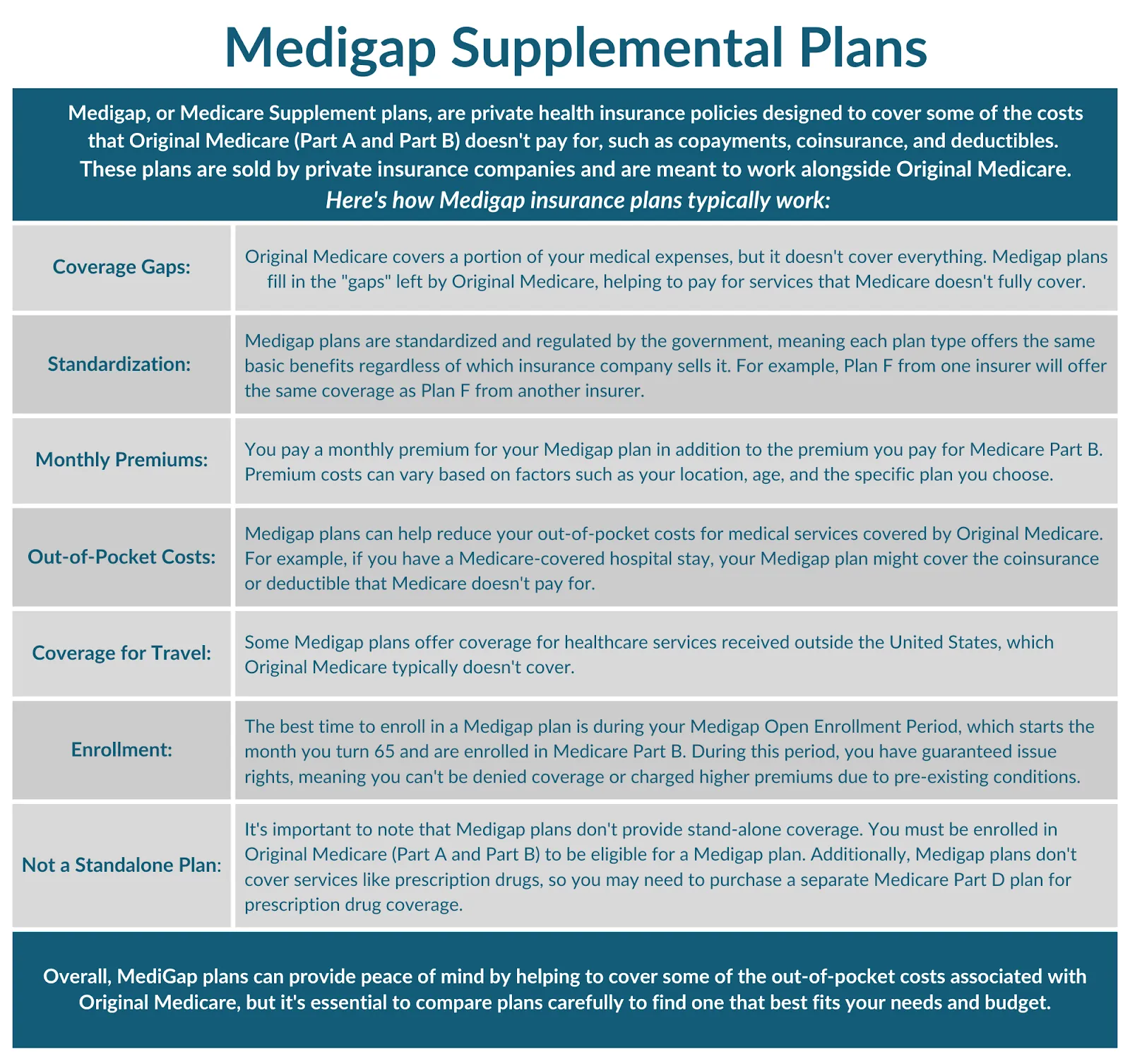

Medigap

- Premium: Varies based on which Medigap policy you buy, where you live, and other factors. The amount can change each year.

- Medigap usually helps pay your portion of the costs (like deductibles and coinsurance)

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

There are many ways to create a plan that works best for you and your needs. For example, a neighbor mentioned that he has Medicare Parts A & B, an AARP supplemental coverage plan, and an AARP prescription plan from a private company (in his case, United Healthcare / UHC).

How to choose the best options? It depends on your healthcare needs and preferences:

- Original Medicare (Part A and Part B) provides coverage for hospital and medical services, but it doesn’t include prescription drug coverage (Part D) or many other benefits like dental, vision, and hearing.

- If you want coverage for prescription drugs, you’ll need to enroll in a Part D plan.

- Medicare Advantage (Part C) combines hospital, medical, and often prescription drug coverage into one plan, and some plans offer additional benefits not covered by Original Medicare.

Choosing which part is best for each individual depends on factors such as health status, medication needs, budget, and preferred doctor and hospital networks. It’s essential to compare the costs, coverage benefits, and provider networks of different Medicare options to find the best fit for your needs. Consulting with a Medicare advisor or healthcare professional can also provide personalized guidance in selecting the most suitable Medicare coverage.

Step 3: Know When to Enroll in Medicare

- Initial Enrollment Period (IEP): This is the seven-month period surrounding your 65th birthday (three months before, the month of, and three months after). It’s crucial to enroll during this period to avoid late enrollment penalties. If you are approaching 65, you might want to consider marking your calendar with a reminder three months before your 65th Birthday to give you ample time to enroll.

- Special Enrollment Periods (SEPs): If you have qualifying circumstances, such as losing employer coverage, you may be eligible for a particular enrollment period outside your IEP.

Step 4: Once you’ve decided on your plan, the final step is to sign Up for Medicare during your seven-month window.

Enroll through the Social Security Administration (SSA) website, by phone, or in person at your local SSA office.

Frequently Asked Questions about Medicare:

Q: What if I’m still working at age 65?

A: If you’re still working and have employer-sponsored health coverage, you may delay enrolling in Medicare without penalty until you retire and lose that coverage. You will NOT pay a penalty for delaying Medicare as long as you enroll within eight months of losing your coverage or stopping work (whichever happens first). Check out this link from Medicare.gov if you are still planning to work past 65.

Q: Will Medicare cover all my healthcare expenses?

A: While Medicare provides comprehensive coverage, it doesn’t cover everything. You may still have out-of-pocket costs such as deductibles, copayments, and coinsurance.

Q: How do I choose between Original Medicare and Medicare Advantage?

A: Consider factors such as cost, coverage benefits, provider networks, and prescription drug coverage when comparing Original Medicare and Medicare Advantage plans.

What Not to Miss or Do:

- Don’t miss your Initial Enrollment Period (IEP) for Medicare to avoid late enrollment penalties.

- Don’t assume that Medicare will cover all your healthcare needs; consider supplemental coverage options such as Medicare Advantage or Medigap plans.

Helpful Tips for Navigating Medicare:

- Research and compare Medicare plans before enrolling to find the best coverage for your needs.

- Utilize online resources such as the Medicare website and plan comparison tools to make informed decisions.

- Consult with a Medicare advisor or financial planner specializing in retirement planning for personalized guidance.

Get free personalized health insurance counseling

Conclusion:

Navigating Medicare before retirement is a crucial aspect of comprehensive retirement planning. By understanding your eligibility, coverage options, enrollment periods, and potential pitfalls, you can take proactive steps to ensure seamless healthcare coverage as you transition into retirement. Remember to plan ahead, enroll on time, and explore supplemental coverage options to maximize your Medicare benefits and financial security in retirement.