Gold

Here are some reasons our team of advisors does not recommend gold as an investment. Our retirement advisors are generally OK if you want to keep a reasonable amount, meaning 1-3% of your investable assets in cash, precious metals, or other commodities in a safe you keep at home if this provides you peace of mind. More than 1-3% is not recommended.

Why don’t we recommend gold as an investment?

Lack of Income Generation:

Gold does not generate income like dividends from stocks or interest from bonds. Investors rely on capital appreciation, hoping that the price of gold will increase over time.

Volatility:

Gold prices can be highly volatile in the near term. While it is often considered a safe-haven asset, it does not guarantee stable returns. Price fluctuations can be influenced by factors such as economic conditions, geopolitical events, and changes in interest rates.

No Inherent Value or Cash Flow:

Unlike stocks, which represent ownership in a company with the potential for earnings and dividends, gold does not have inherent value or cash flow. Supply and demand dynamics and investor sentiment primarily determine its value.

Storage Costs:

Physical gold, such as bullion or coins, requires secure storage. Storing gold in a safe place can incur additional costs, and holding gold in a depository may involve fees.

Opportunity Cost:

Investing in gold means allocating capital away from other potential investments that may generate income or offer higher returns. The opportunity cost of holding gold is the lost potential returns from other assets.

Inflation Hedge vs. Deflation Risk:

While gold is often considered an inflation hedge, its performance may vary in different economic scenarios. In periods of deflation or economic stability, gold may not provide the same level of protection.

Market Sentiment:

The value of gold can be influenced by market sentiment, speculation, and macroeconomic factors. It may sometimes move in line with underlying economic fundamentals and perform quite good, but not always.

https://www.longtermtrends.net/stocks-vs-gold-comparison/

Long-term performance comparison

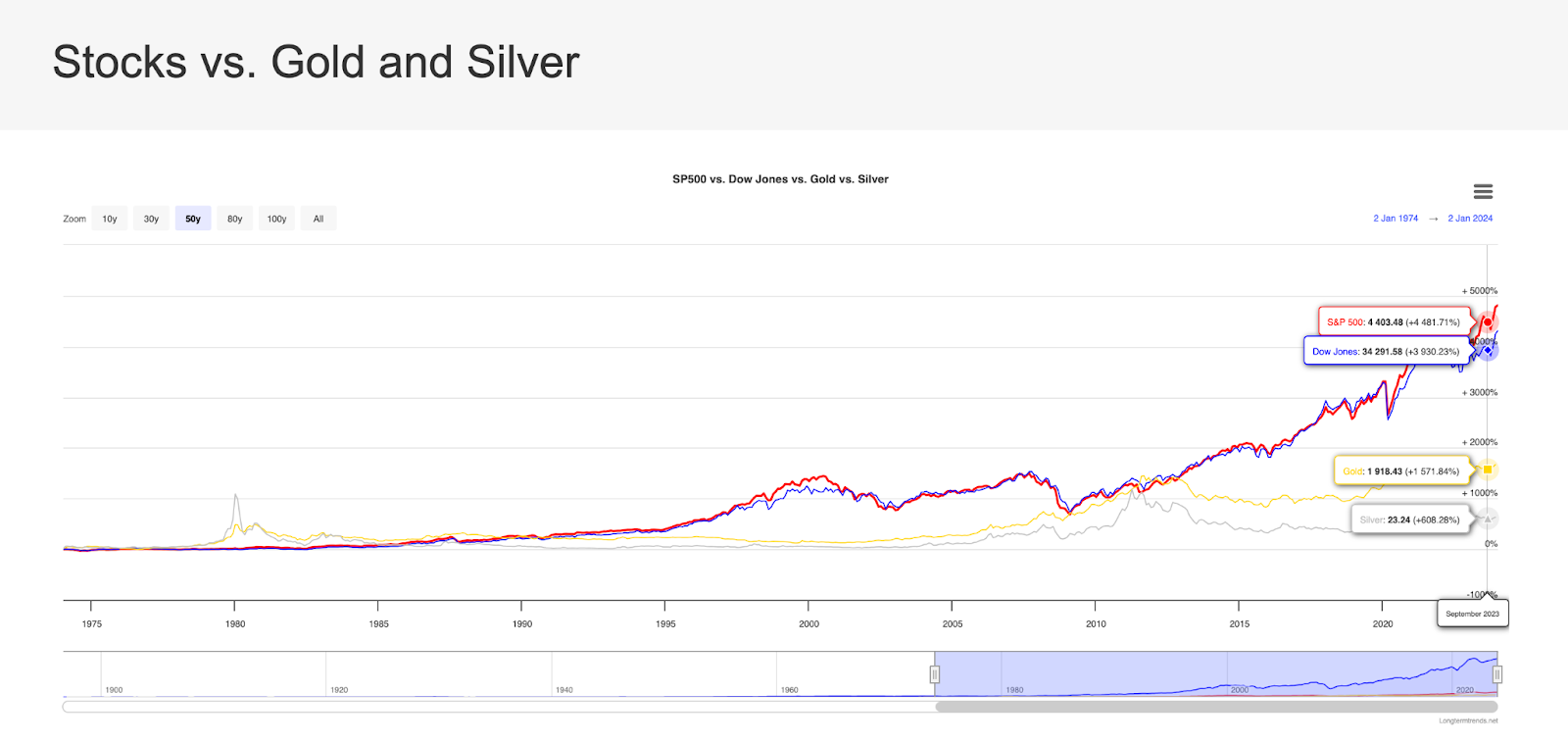

Which was the best investment in the past 30, 50, 80, or 100 years? This chart compares the performance of the S&P 500, the Dow Jones, Gold, and Silver.

The Dow Jones is a stock index that includes 30 large publicly traded companies based in the United States. It is one of the oldest and most-watched indices in the world. The S&P 500 consists of 500 large US companies, it is capitalization-weighted, and it captures approximately 80% of available market capitalization. For these reasons, it is more representative of the US stock market than the Dow Jones. Both versions of these indices are price return indices in contrast to total return indices.

If you would like to meet with one of our advisors to discuss your retirement plan and how we can help you make wise investment decisions per your specific goals and risk tolerance, please schedule a call.