Listen to the podcast here: https://moneypig.buzzsprout.com/2136084/14121881-end-of-year-tax-savings

Reid Trego welcomes the audience to the Money Pig podcast, joined by Tim Goodwin, for a discussion on end-of-year planning.

To subscribe to the valuable content put out monthly by Goodwin Investment Advisory, text the word “BLOG” to 66866, and you will automatically receive our content and our guides on various life transitions and retirement planning.

Tax Tips:

- No Wash Sale with Cryptocurrency

If you have a crypto account and unrealized losses… you could save on taxes this year.

There’s an extra benefit that cryptocurrency has over stocks and other conventional assets when selling at a loss. The IRS states that for tax purposes, virtual currency should be treated as property rather than as a capital asset, like a stock.

This is important because capital assets are subject to wash sale rules while property is not. (This is true as of Dec. 2023, but might be changing in the future)

Wash sale rules bar investors from artificially harvesting tax benefits by selling capital assets for a loss and then immediately repurchasing the same or a broadly similar asset within thirty days of the sale. Since crypto isn’t considered a capital asset, it’s not subject to the rule.

So, if you’ve got unrealized losses but want to hold your crypto long-term, you could sell your crypto positions, immediately repurchase them, and still be allowed to realize the loss on your taxes.

Remember, capital losses can offset capital gains and up to $3,000 of your income.

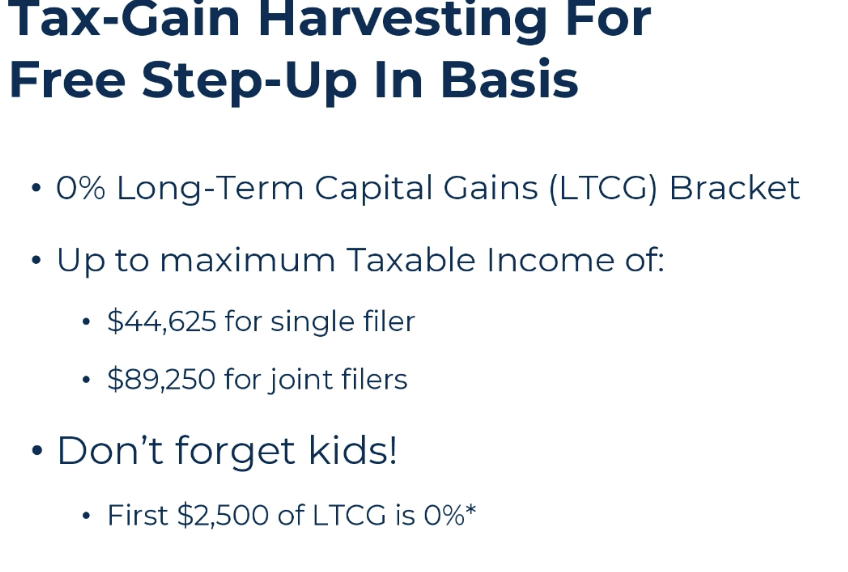

- Tax gain harvesting for free

For 2023, individuals with taxable income below $44,625 ($89,250 for married couples) pay 0% tax for long-term capital gains (LTCG). In years when you’re under the threshold—say, if you’re in between jobs or receive a smaller bonus—you could effectively lock in tax-free long-term gains. If you have a UTMA or UGMA (brokerage accounts for kids), the first $2500 of long-term capital gains is taxed for free. To learn more, check out this article titled “How to leverage 0% capital gains with this lesser-known tax strategy.”

- Failure to pay your estimated income tax comes with an 8% penalty this year

Failing to keep up with tax payments now could lead to an expensive surprise next spring. As of Oct. 1, the Internal Revenue Service charges 8% interest on estimated tax underpayments, up from 3% two years ago. The increase is one of the many effects of rising interest rates. To learn more, read the article titled “The Surprise Bill Coming to Those Who Do Underpay Their Taxes.” If you live in Georgia, the State’s estimated underpayment penalty is 5% for 2023.

- You can now take up to $1000 in an emergency withdrawal from your IRA

A provision in the Secure 2.0 Act allows special emergency distributions of up to $1,000 per year beginning in 2024. You can withdraw the money penalty-free and repay it over three years. Within those three years, no other emergency distributions can be taken out of the account unless the amount has been repaid. The new rule would waive the 10% early-withdrawal tax penalty for savers who pull up to $1,000 from a 401(k) or individual retirement account for a financial hardship. This rule also lets savers self-certify that they need the funds.

Estate planning tips:

- Don’t forget to designate beneficiaries on your IRAs and consider options such as per stirpes designation.

- Update property titles and have a will, power of attorney, and healthcare directive in place with the help of an estate attorney. Online services may not be reliable or complete for these purposes.

If you want help managing and investing your money, or just a second opinion on your retirement plan, one of our CFP® professional wealth advisors would love to discuss your individual goals and options with you. Please reach out by scheduling a free 20 minute intro call with our Goodwin Investment Advisory consultant here.