The “new federal housing rule” – real estate update

Special Edition Blog – We usually send blogs on Tuesdays, but realized that this is such a controversial topic and we wanted to help diffuse some of the confusion. We shared this with our staff and found it really helpful, and then sent it to all of our clients. We thought this simple explanation might provide some clarity to you as well.

This new rule is changing how upfront mortgage loan fees are calculated and it went into effect on May 1st, 2023.

According to Newsweek, “Starting in May, the current structure of the Loan-Level Price Adjustment (LLPA) matrix will be adjusted by the Federal Housing Finance Agency (FHFA) in the hope of addressing housing affordability challenges in the U.S.” This will be done by decreasing the initial closing fees for some loans (especially for first-time buyers), while increasing the fees for some other loans. (Note: interest rates are not affected by this.)

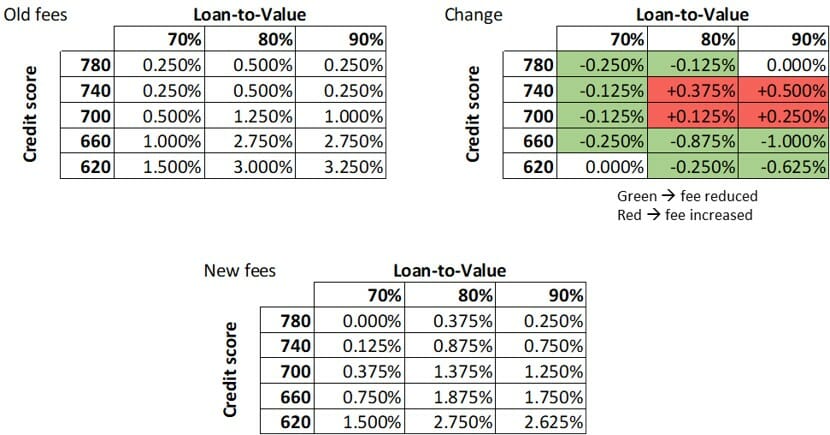

Here is a snapshot of the fee changes for a few cases, derived directly from the tables provided by FannieMae.

As can be seen from FannieMae’s tables, the fees are increasing for some lenders, but overall the fees will remain significantly lower for those with good credit – so it is important to keep your credit score as high as possible!