Market Volatility: Should I get out of the market before it’s too late?

Volatile markets can cause anxiety

In these challenging times, it is sometimes hard to deal with the ups and downs of the market. Current volatility caused by the economic responses to the Russian invasion of Ukraine can cause stress and fear. At Goodwin Investment Advisory, we understand your frustration and anxiety as our personal money is invested in the same things as our clients – we feel your pain, but we also trust history and the market to correct itself over time. It can be hard to trust, but if you stick to the basic principles of investing such as buy and hold and time-in the market, typically the market trends back upwards in time.

In Wes Moss’s podcast titled, “Perfection vs. Participation: The Quest for Timing Investments in the Stock Market,” he posed the question, “Is there an ideal moment to invest in the market?” His response was simple, “participation is pivotal, and it is always better to participate than perfectly time the market.” Timing investments is a market strategy based on trying to predict future market prices. This simply means to sell or switch funds between asset classes – selling when the market is high and getting back in the market at a better, lower price in the future is ideal. But, who can predict the future or time it perfectly? So, the answer to the question about a perfect time to invest is always to invest and this answer stays the same regardless of the current market conditions.

Long-term vision

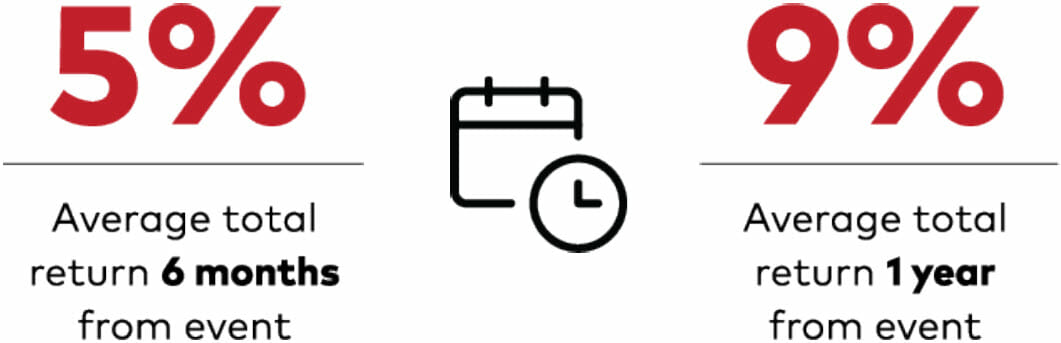

A long-term mindset with a disciplined approach to investing is the key to keeping a sound mind throughout the turmoil and influx. Focusing on the long-term is pivotal to staying the course and reminding yourself of the times in history this has happened before. We believe that if you can maintain perspective throughout the volatility and stay in the market you will come out closer to your goals. Ask yourself if your goals have changed? If they are the same then your approach should not change either. In an article titled, “How to Withstand Challenging Markets – Again” Greg Davis, Vanguard Chief Investment Officer, shared that Vanguard has studied more than two dozen geopolitical events, some of which upended the markets. In almost all instances Greg Davis stated that it didn’t take long for equity markets to recover from initial sell-offs in response to these events.

Find wisdom in the uncertainty

It is always best to stay diversified and invested and participating in the market is more important than having perfect timing when it comes to trying to time the market. Time-in-the-market not timing the market is key. We advise you to continue to invest and stay in the market even when it seems scary to do so. The markets have always had their ups and downs, and we have seen this through the recent pandemic. This time is no different. We trust it will recover as history typically repeats itself. So stay the course and wait it out – try not to check your accounts everyday and trust the process.

Here is a reminder of GIA’s 4 pillars investment strategy.

Funds only

Diversify

Low cost

*Disclosure – This information is shared based on our personal and professional experience, but we cannot guarantee market behavior or investment returns. Investing always involves risk, and past performance is not a guarantee of future results. Each individual’s situation and investment portfolio is unique, and therefore your personal results may vary. Please consult with our team if you have questions about your personal investment portfolio.