Friday, May 6, 2022

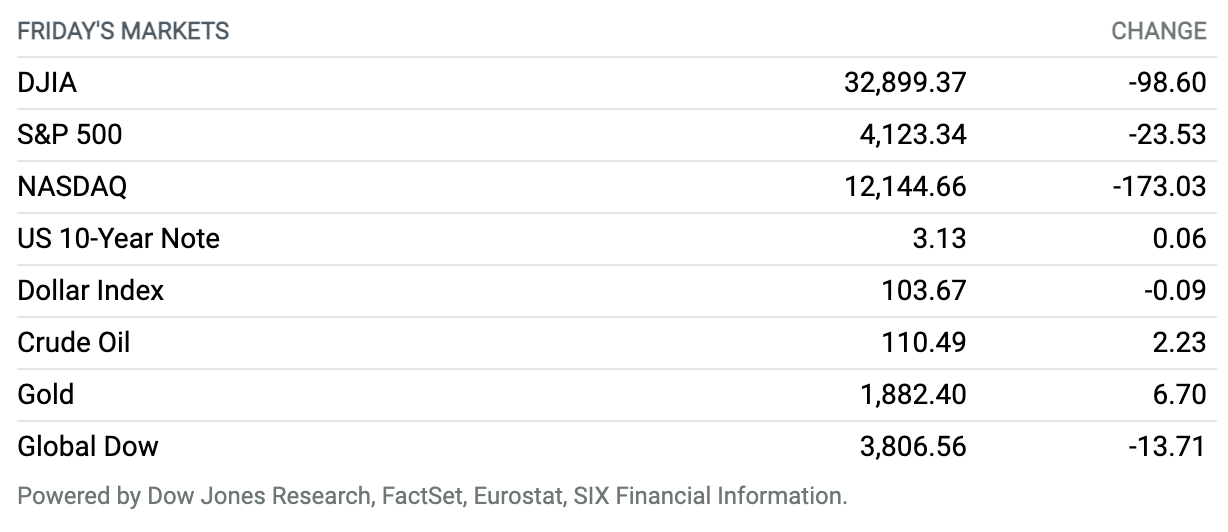

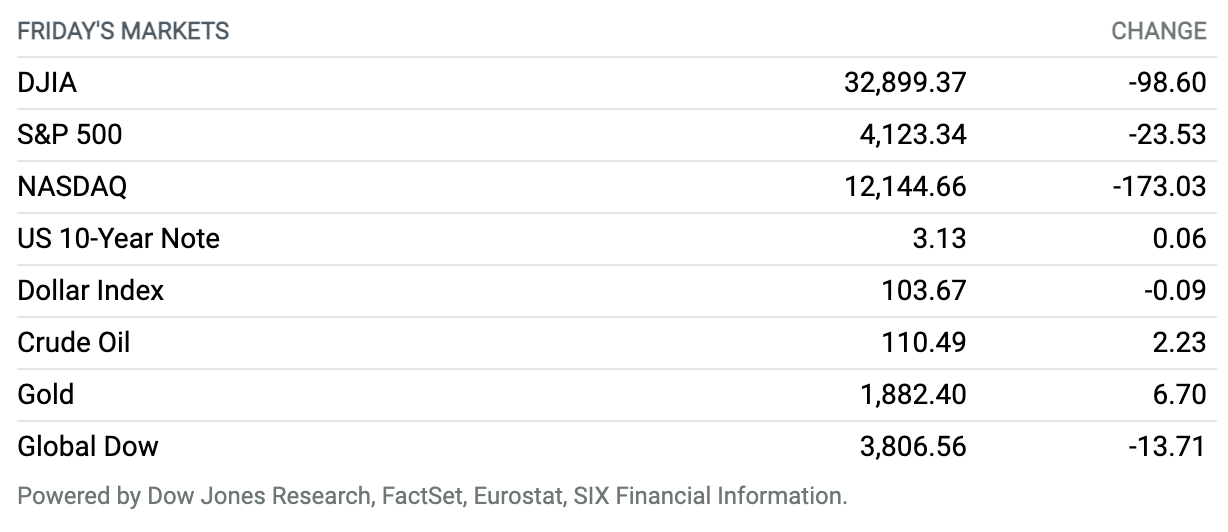

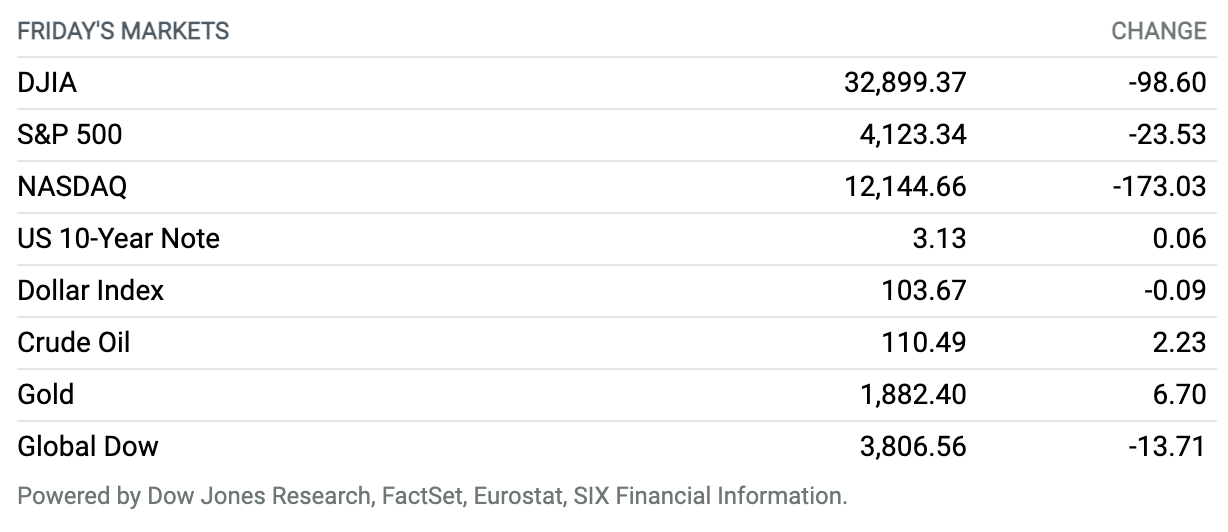

Stocks End Lower Friday, Finish a Volatile Week Down on Wall Street. U.S. stock indexes finished lower on Friday, capping a turbulent week on Wall Street with modest losses after the Federal Reserve moved its policy rate up by a half-percentage point and signaled similar increases were likely at the central bank’s next two policy meetings. The Dow Jones Industrial Average shed about 99 points, or 0.3%, ending Friday at 32,899, while recording a 0.2% weekly loss. It marked the Dow’s sixth-straight weekly loss. The S&P 500 index finished the session down nearly 24 points, or 0.6%, to close at 4123. The Nasdaq Composite index dropped 173 points, or 1.4%, to finish at 12,145. For the week, the S&P was down 0.2%, while the Nasdaq shed 1.5%.

April’s Solid Jobs Report Won’t Change Fed’s Aggressive Stance

U.S. employers hired at a solid pace in April and the unemployment rate stayed steady as fewer people entered the workforce, the latest signs of a tight labor market that will likely keep the Federal Reserve in line to aggressively tighten monetary policy.

The number of jobs rose by 428,000 last month, in line with March’s downwardly revised figure, the Labor Department reported Friday. Economists had expected a 400,000 increase and the unemployment rate, taken from a separate survey of households, to fall to 3.5%. Unemployment, however, remained steady at 3.6%, a hair above where it stood in February 2020 before the onset of the pandemic.

Against this backdrop, average hourly earnings rose by 10 cents, or 0.3%, to $31.85 in April from March. Over the past 12 months, average hourly earnings rose 5.5%. While the monthly figure was a shade below the 0.4% increase economists expected, the annual reading was in line with expectations thanks to a revision to March’s reading. Those wage gains came as the labor-force participation rate edged lower to 62.2% from 62.4%; it remains 1.2 percentage points below its prepandemic level.

Continue reading

Powell, Vowing Aggressive Inflation Fight, Believes Fed Can Hit Soft Landing

The Federal Reserve launched an aggressive push this week to rein in inflation and cool the U.S. economy, with Chairman Jerome Powell signaling a series of steep interest-rate increases this year and vowing to bring prices down to help the American people.

Following the Fed’s two-day meeting, during which the central bank’s policy-making arm raised rates by a half percentage point and unveiled plans to start shrinking its balance sheet next month, Powell sought to project optimism that the U.S. economy is strong enough to handle what he suggested would be a series of sizable interest rate hikes and other policy-tightening measures this year.

Leaked Draft of Supreme Court Opinion Indicates Roe v. Wade May Be Overturned

A leaked Supreme Court draft opinion written by Justice Samuel Alito and published late this week by Politico indicated the court may be preparing to overturn Roe v. Wade, the 1973 precedent that established a constitutional right to an abortion.

The 67-page opinion, marked as a first draft, declared that Roe was “egregiously wrong and deeply damaging,” and that Planned Parenthood v. Casey, a 1992 decision that limited but didn’t eliminate abortion rights, prolonged the court’s error.

Continue reading

Wholesale Clubs Are Selling Gas So Cheap, They’re Losing Money in Some States

With gasoline prices near record highs, wholesale clubs are luring customers by offering extra discounts at the pump—cuts so steep that the chains are effectively losing money for each gallon of gas sold in some states, new numbers show.

Walmart announced last week that members of its Walmart+ subscription, launched just 18 months ago, will save up to 10 cents per gallon at more than 14,000 gas stations across the country. That’s twice the discount the retail giant previously offered, with the number of eligible gas stations expanding sixfold through a partnership with Exxon Mobil.

Continue reading

Elon Musk Gets $7 Billion in Financing for Twitter Buyout

The pieces for Tesla CEO Elon Musk’s purchase of Twitter continue to fall into place.

Musk this week disclosed a new bit of financing for his buyout. He has cobbled together almost 20 co-investors who will put up $7.1 billion in equity financing for the takeover of Twitter.

Continue reading

Global Water Crisis Puts Billions at Risk

Climate change gets all the headlines, but risks related to water are grave and mounting, groups tracking the issue warn.

According to a new analysis, the water crisis is draining billions of dollars from financial institutions. And the group of banks, investors, and insurers putting money toward companies that are most exposed to water is increasingly concentrated, says a report from the nonprofits CDP and Planet Tracker.

Continue reading

Toyota Is Trying to Catch Up in the Crowded EV Race. It May Be Too Late.

Toyota Motor became the world’s most successful car company through the spirit of kaizen, or continuous improvement. Now, with electric vehicles on the rise, kaizen might prove to be its undoing.

Kaizen is all about evolution and refinement. It helped Toyota break into the U.S. market with the Toyopet Crown sedan in the late 1950s, take 5% of market share by the 1980s with its fuel-efficient Corollas, and finally become the top-selling auto maker in North America. Along the way, it became the car manufacturer to emulate, particularly for Ford Motor and General Motors.

Continue reading

Boeing Plans to Move Its Headquarters. It’s Not Near Seattle.

Boeing is expected to move its corporate headquarters from Chicago to the Washington, D.C., area. That is farther away from Seattle, where the company makes many of its commercial planes.

The move will put Boeing executives in closer proximity to key D.C. decision makers, according to a report from The Wall Street Journal, which cited unidentified people who are familiar with the matter. An announcement of the move is expected as soon as next week, the Journal reported.

Continue reading

Shanghai Eases Restrictions as Covid-19 Cases Decline

Shanghai continues to allow more businesses to resume operations, as the number of new Covid-19 cases falls and the city gradually loosens a draconian lockdown that is well into its second month.

Nearly 2,000 companies in China’s financial capital have been given the green light to restart work—albeit under restrictive conditions, such as requiring workers to live at factories and undergo weekly if not daily nucleic-acid testing.

Continue reading

Nvidia to Pay $5.5M to Settle SEC Charges It Failed to Disclose Crypto Mining Impact

Nvidia will pay a $5.5 million fine to the Securities and Exchange Commission to settle charges that allege the company failed to disclose the impact of cryptocurrency mining on its gaming business.

According to the SEC, Nvidia failed to disclose that cryptomining was a significant element of its revenue growth from the sale of its gaming graphics processing units during consecutive quarters in 2018.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.