Friday, March 11, 2022

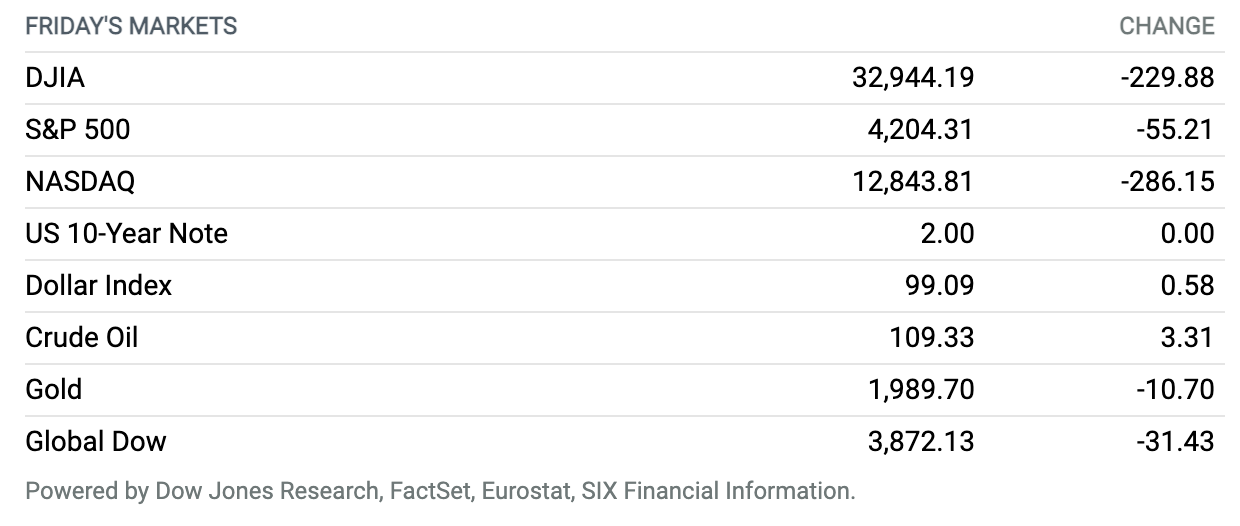

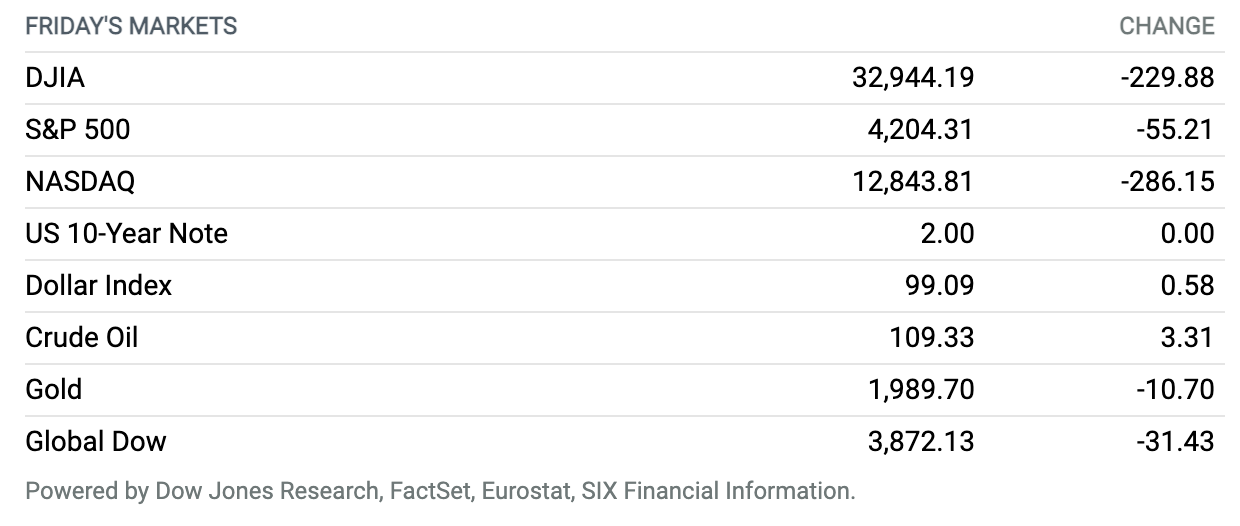

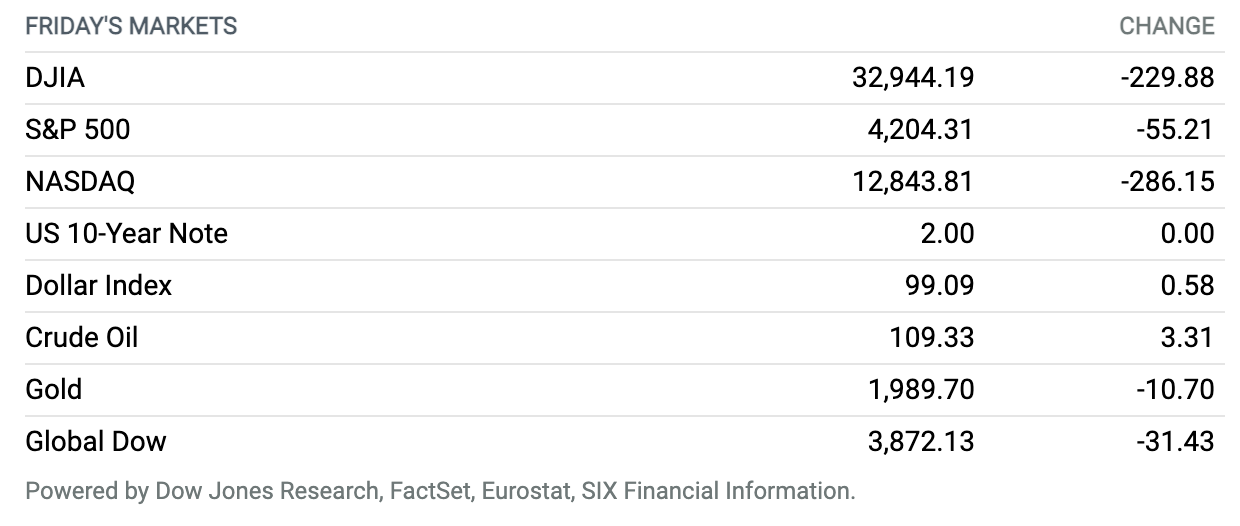

Stocks Stumble Late Friday as Dow Books 5th Straight Weekly Skid. U.S. stocks slid into the closing bell on Friday, giving up earlier gains and leaving the Dow down for five straight weeks as America and its allies looked to ratchet up economic pressure against Moscow amid the worsening conflict in Ukraine. The Dow Jones Industrial Average fell 230 points, or 0.7%, on Friday to end at 32,944. The S&P 500 index dropped 55 points, or 1.3%, on Friday to close at 4204. The Nasdaq Composite index gave up 286 points, or 2.2%, to finish at 12,844. For the week, the Dow lost 2%, the S&P 500 dropped 2.9%, and the Nasdaq shed 3.5%.

U.S. to Revoke Russia’s ‘Most Favored Nation’ Status, Ban Russian Vodka and Seafood

President Joe Biden called on Congress to revoke Russia’s “most favored nation” status on Friday, a move that would effectively end normal trade relations with the country after its invasion of Ukraine.

The European Union and the Group of Seven countries also will remove Russia’s status as “most favored nation.”

The designation is a baseline for global trade that ensures countries within the World Trade Organization are given the same terms of trade—low tariffs, few barriers to trade, and the highest possible imports allowed into the U.S. In the U.S., the term is known as permanent normal trade relations, or PNTR. Removing the status would allow the U.S. and its partners to impose higher tariffs on some Russian imports.

Continue reading

Inflation Worsened Last Month, Hitting Another 40-Year High

Consumer prices surged at a 7.9% annual pace in February as gasoline, shelter, and food costs soared, extending a four-decade high for inflation and intensifying pressure on the Federal Reserve to tighten policy.

The consumer price index rose 0.8% in February from a month earlier, the Labor Department said this week, marking an uptick from January’s 0.6% pace. Economists had expected prices to rise 0.7% in February over the month and 7.8% over the year.

Jobless Claims Rise to Just Shy of 230,000, Higher Than Estimates

Initial weekly jobless claims rose to nearly 230,000 during the first week of March, above economists’ expectations.

The number of first-time unemployment claims increased by 11,000 to 227,000 during the week ended March 5, according to new data released by the Labor Department this week.

Continue reading

Suffocated by Sanctions, Russia Squeezes Foreign Firms Leaving

Russia is piling huge pressure on foreign companies fleeing the country following Moscow’s decision to send troops to Ukraine even as some tycoons warn that the seizure of assets would take the country “back to 1917.”

Late in the week, Russian President Vladimir Putin approved a plan to nationalize foreign-owned companies, and on Friday parliament’s lower house was set to discuss the initiative.

Continue reading

Iran Talks Setback Could Keep Oil Prices Higher for Longer

U.S. negotiators are pulling every lever to try to bring oil prices down, but they are not getting very far. The latest setback means that high prices are likely to stick around longer.

Europe and the United States have paused talks on a deal with Iran that would ease oil sanctions there in return for a commitment not to move forward on nuclear arms. Russia had thrown the deal into disarray a few days ago when negotiators demanded protections from sanctions be included in the language.

Continue reading

Russia Moves to Ban Instagram After Meta Makes Ukraine-Friendly Policy Shift

The social-media platform Instagram faces a ban in Russia after Moscow called for an end to its parent company’s new policies linked to the country’s invasion of Ukraine.

The office of Russia’s prosecutor-general has requested that the country’s communications regulator restrict access to Instagram and designate Meta Platforms an extremist organization, the state-owned news agency RIA Novosti reported on Friday.

Continue reading

ECB Plans to Phase Out Stimulus Sooner Than Expected

The European Central Bank said it would aim to phase out its large bond-buying program by September, sooner than expected, taking a key step toward raising interest rates to contain surging inflation despite the shock of war in Ukraine.

The ECB said in a statement that it would keep its key interest rates on hold but paved the way for increases before the end of the year. Any rate rises will take place “some time” after the end of the bank’s bond-buying program and will be gradual, the ECB said.

Continue reading

Peloton’s New CEO Has a Plan to Fix the Company

New Peloton Interactive CEO Barry McCarthy is testing subscription options in his efforts to turn around the fitness firm.

The company this week unveiled One Peloton Club, a limited offering that promises its flagship bike as a subscription option, rather than an upfront purchase. The company said the offering will be available at physical locations in Texas, Florida, Minnesota, and Colorado. If a customer wants to cancel, Peloton takes back the bike, and the delivery fee is nonrefundable. A One Peloton Club member can later decide to buy the bike outright.

Continue reading

China Promises More Stimulus to Reverse Economic Slowdown

As its weeklong legislative gathering concluded, China set a challenging GDP growth target and presented a range of policies—including a tax cut package—to boost its sagging economy.

Two highlights of the annual event—which brings together thousands of legislators from across the country—centered around Premier Li Keqiang, who kicked off the gathering by summarizing what China has in store for its economy and society for the year. This year’s GDP growth target will be “around 5.5%,” he said, which most observers called ambitious, despite the fact that it would be the weakest expansion for China in more than 30 years.

Continue reading

Apple Announces a New Mac and a Cheaper iPhone

At its “Peak Performance” virtual event this week, Apple announced the latest version of its lower cost iPhone SE, starting at $429.

The phone, as expected, adds 5G wireless capability and uses the same A15 Bionic chip used in the company’s flagship iPhone 13. The new phone starts at $429, with preorders starting Friday, and shipments starting on March 18.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.