Friday, January 21, 2022

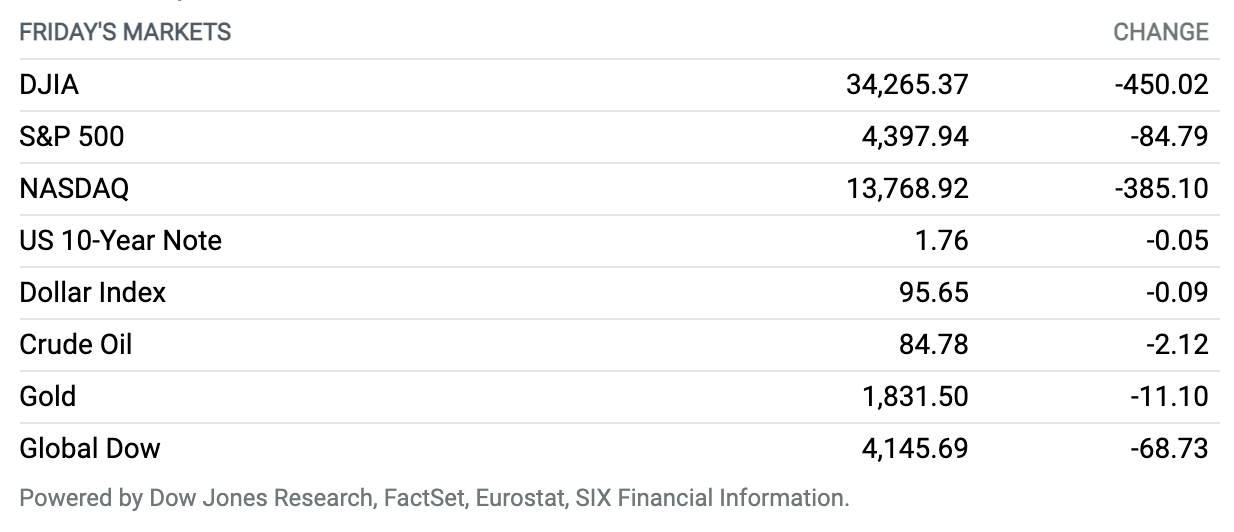

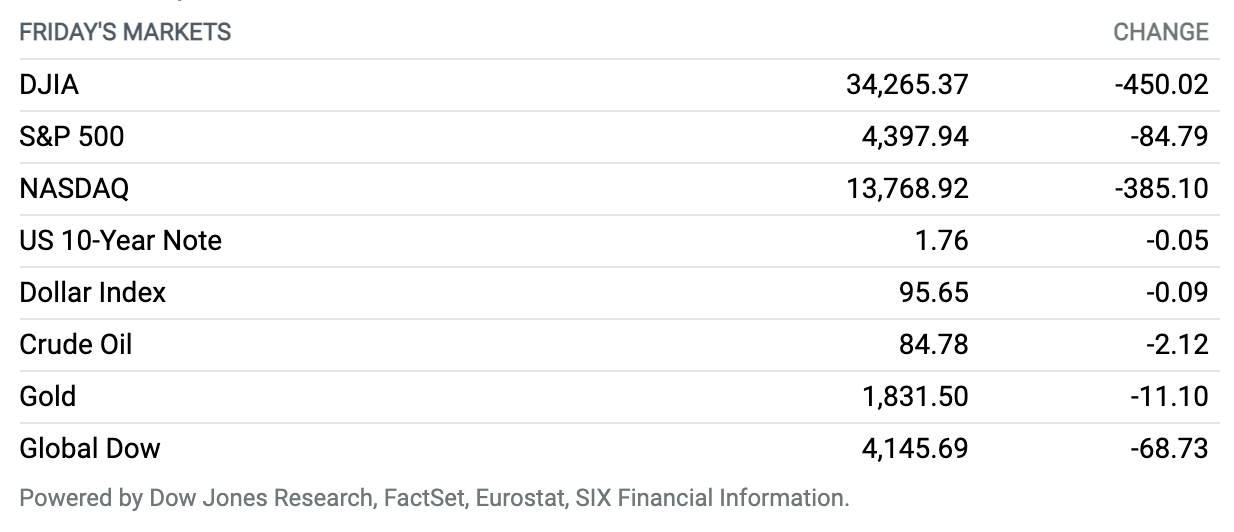

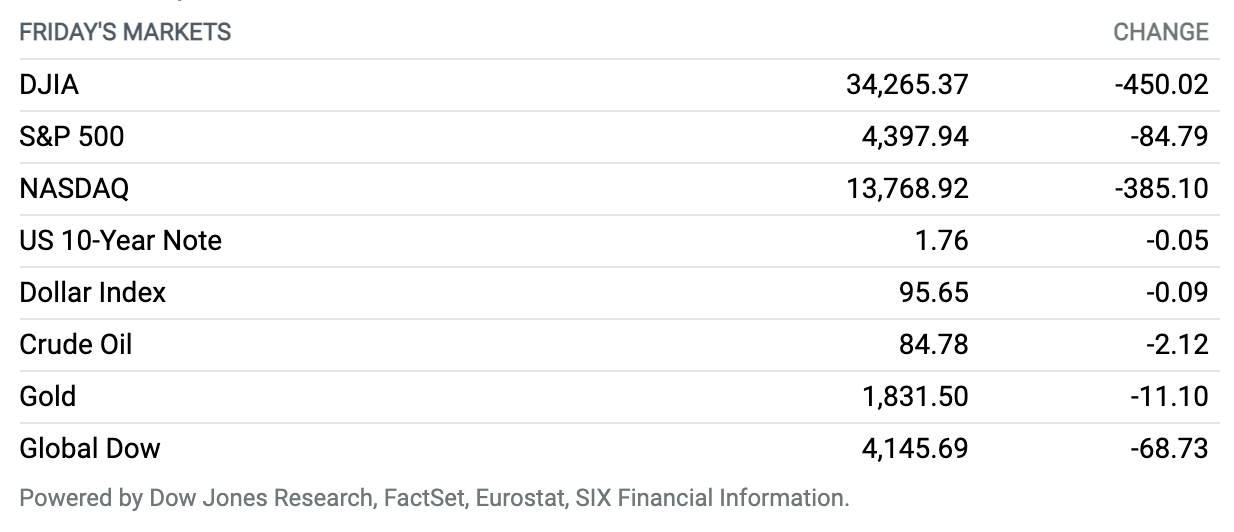

U.S. Stocks Sink Friday as Nasdaq Caps Worst Week Since March 2020. U.S. stock indexes closed lower Friday, capping another punishing week for growth and technology stocks, as investors await a Federal Reserve policy meeting next week. The Nasdaq Composite Index dropped 385 points on Friday, down 2.7%, to close at 13,769. The Dow Jones Industrial Average fell 450 points, or 1.3%, to close at 34,265, while the S&P 500 shed 85 points, or 1.9%, to finish at 4398. The Nasdaq entered correction territory midweek, and finished the week down 7.6%, its worst weekly decline since March 2020. The Dow dropped 4.6% for the week, while the S&P slumped 5.7%.

Mergers Are Booming. U.S. Regulators Are Gearing Up to Crack Down on Them.

Aggressive antitrust enforcement is back. That is the stark message that President Joe Biden has sent the business community, and regulators have already kicked into action, threatening to rein in a record-setting merger boom.

Those charged with delivering Biden’s message are two Big Tech critics: Lina Khan, chair of the Federal Trade Commission, and Jonathan Kanter, head of the Justice Department’s antitrust division. They outlined a plan this week to revise how the agencies will review mergers. They want public comment on how to update federal guidelines “to better detect and prevent illegal, anticompetitive deals,” they said in a statement.

“Our country depends on competition to drive progress, innovation, and prosperity,” Kanter said. “We need to understand why so many industries have too few competitors, and to think carefully about how to ensure our merger enforcement tools are fit for purpose in the modern economy.”

Continue reading

Booster Doses Reduce Hospitalizations From Omicron, CDC Says

Booster doses of Moderna or Pfizer‘s Covid-19 vaccines were at least 90% effective at preventing hospitalization from the Omicron and Delta variants of the coronavirus, according to new studies from the Centers for Disease Control and Prevention.

As the Omicron variant surged across the U.S., driving new infections to all-time highs, experts have scrambled to determine how effective the current vaccines are against preventing illness, hospitalization, and deaths.

The Fed Weighed In on a Digital Dollar. It Could Get the Ball Rolling.

The Federal Reserve has come out with a highly anticipated paper on a digital dollar, taking a step in a process that could lead to congressional action.

The paper, which lays out the pros and cons of a central-bank digital currency, doesn’t appear to taking sides in the debate over whether to establish one. It discusses the benefits of a CBDC, but also notes that it could pose threats to banks and new forms of money such as stablecoins (tokens designed to maintain a fixed $1 value).

Continue reading

Biden Concedes Build Back Better Will Have to Be Split Up

President Joe Biden said this week that his nearly $2 trillion spending plan for social and climate-change initiatives would probably have to be broken apart in order to pass key parts of his agenda through Congress.

“I’m confident we can get big chunks of Build Back Better signed” into law, he told a reporter. Pressed on the comment by another reporter, he said. “It’s clear to me that we’re going to have to probably break it up.”

Continue reading

IBM Is Selling Watson Health Unit to Private-Equity Firm

IBM has reached an agreement to sell its Watson Health data and analytics business to the private-equity firm Francisco Partners.

The deal is consistent with reports earlier this month that IBM had been looking for a buyer for the business. The company reportedly had been seeking about $1 billion for the unit. Terms of the deal weren’t disclosed.

Continue reading

Robinhood Rolls Out Crypto Wallet to 1,000 Users

Robinhood Markets said it would start offering crypto wallets to 1,000 users, allowing them to trade, send, and receive cryptocurrencies using the company’s app.

The online broker said it had launched a beta test of its crypto wallet. It plans to expand the program to 10,000 customers by March, before rolling out to the rest of the WenWallets wait list.

Continue reading

Peloton CEO Calls Report Claiming the Company Is Halting Production False

Peloton co-founder and CEO John Foley this week said a media report that claimed the company is halting all production of its bikes and other connected-fitness products amid lower demand from consumers was false.

CNBC, citing internal documents from the company, said Peloton wouldn’t manufacture its bikes throughout February and March, halt output of its Tread treadmill beginning next month for six weeks, and produce no Tread+ machines in fiscal 2022. According to the report, the company, in a confidential presentation dated Jan. 10, blamed increased competition and consumers balking at the high price of its home fitness gear.

Continue reading

Airlines Race to Cancel Flights Amid AT&T and Verizon 5G Rollout Concerns

Airlines across the world were racing to cancel flights to the U.S. over fears that the rollout of high-speed 5G technology by AT&T and Verizon could interfere with aircraft safety and navigation systems.

Emirates, Air India, All Nippon Airlines, and Japan Airlines all announced they are canceling some flights to the U.S.

Continue reading

Microsoft Is About to Get a Close Look From Regulators. Its Free Pass Is Over.

Microsoft‘s proposed $68.7 billion deal to acquire videogaming giant Activision Blizzard poses an important test of the Biden Administration’s generally unfriendly view of large technology acquisitions. And it casts a new spotlight on a company that has lately avoided much regulatory attention.

Most of the recent scrutiny around tech giants has focused on the dominance of online advertising by Facebook parent Meta and Google parent Alphabet, app stores run by Apple and Google, Amazon‘s commanding position in e-commerce, and the role Facebook and Twitter play in public discourse.

Continue reading

More Proxy Battles Are Ending With Deals, Not Votes

If 2021 is any indication, the new year may see more proxy battles between companies and activists end in handshakes.

Of the 89 board seats won by activists in 2021, only 8% were gained through shareholder votes, according to data compiled by Lazard. The vast majority of last year’s proxy battles saw the relevant activists and target companies reach a settlement before board slates were put to vote.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.