The Santa Clause rally

Too many folks are only informed by the news they watch and listen to, and thus seem to be prone to emotional and fear-based decision making. At GIA, we do not encourage this behavior when it comes to investing. We follow historical trends and are a data driven company that supports investing based on your long-term goals. This also means we discourage you from watching the news and letting fear drive your investment decisions, or any decisions for that matter, because this can lead to knee jerk reactions that might not be helpful to you in the long run.

Spoiler alert – It is true that the economy and stock market and most publicly traded companies are actually doing really well right now!

Historically, there is a trend called the Santa Claus rally. According to Investopedia.com, “The Santa Claus rally refers to the tendency for the stock market to rally over the last weeks of December into the new year. Theories for its existence include increased holiday shopping, optimism fueled by the holiday spirit, and institutional investors settling their books before going on vacation.” Tim Goodwin, founder and President of Goodwin Investment Advisory confers that the overall upbeat feelings and focus on family is certainly a strong reason for why the market does so well during the holiday season. Another reason is that large companies are funding profit sharing retirement plans with the profits that they made throughout the year. This increases the demand for stocks and often drives the prices up.

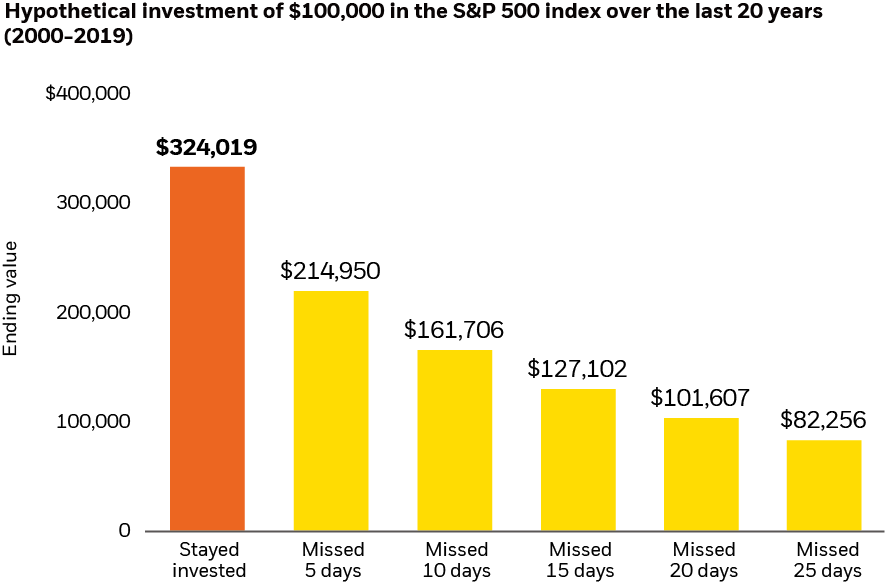

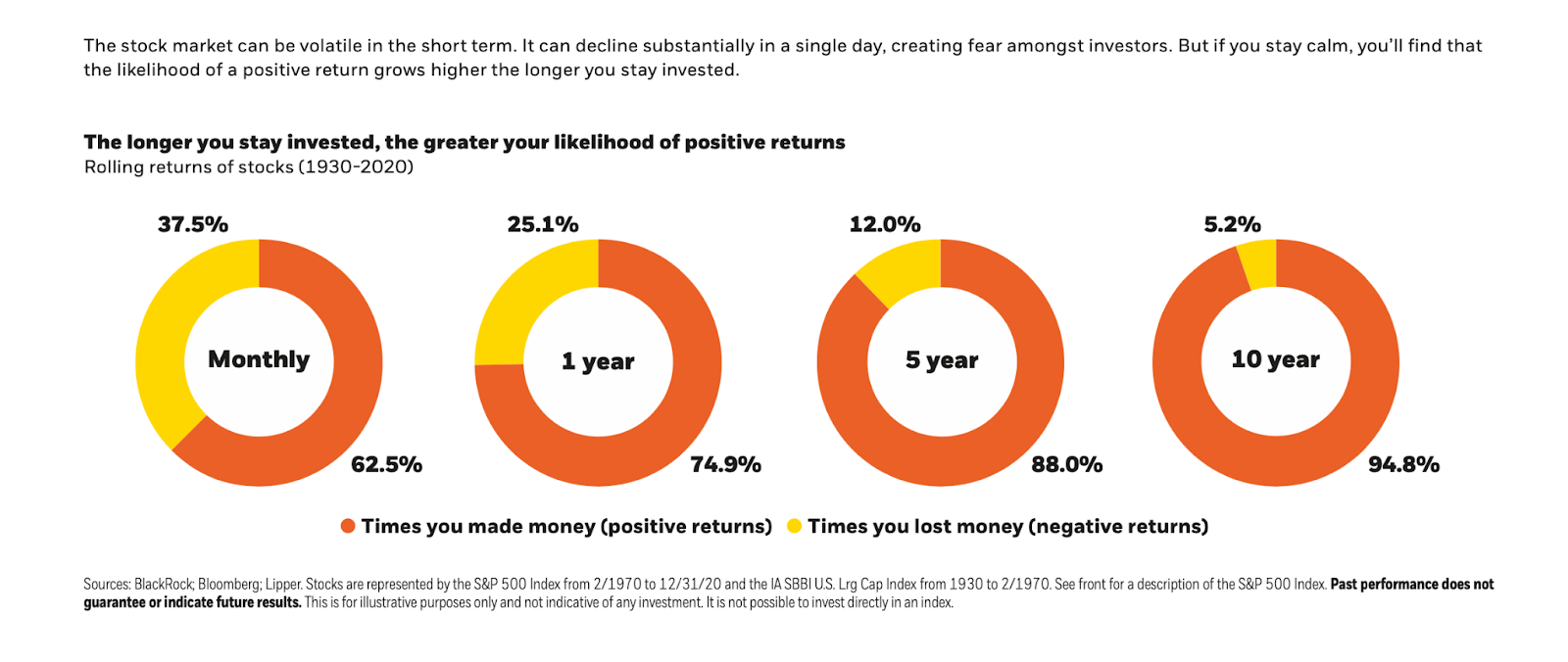

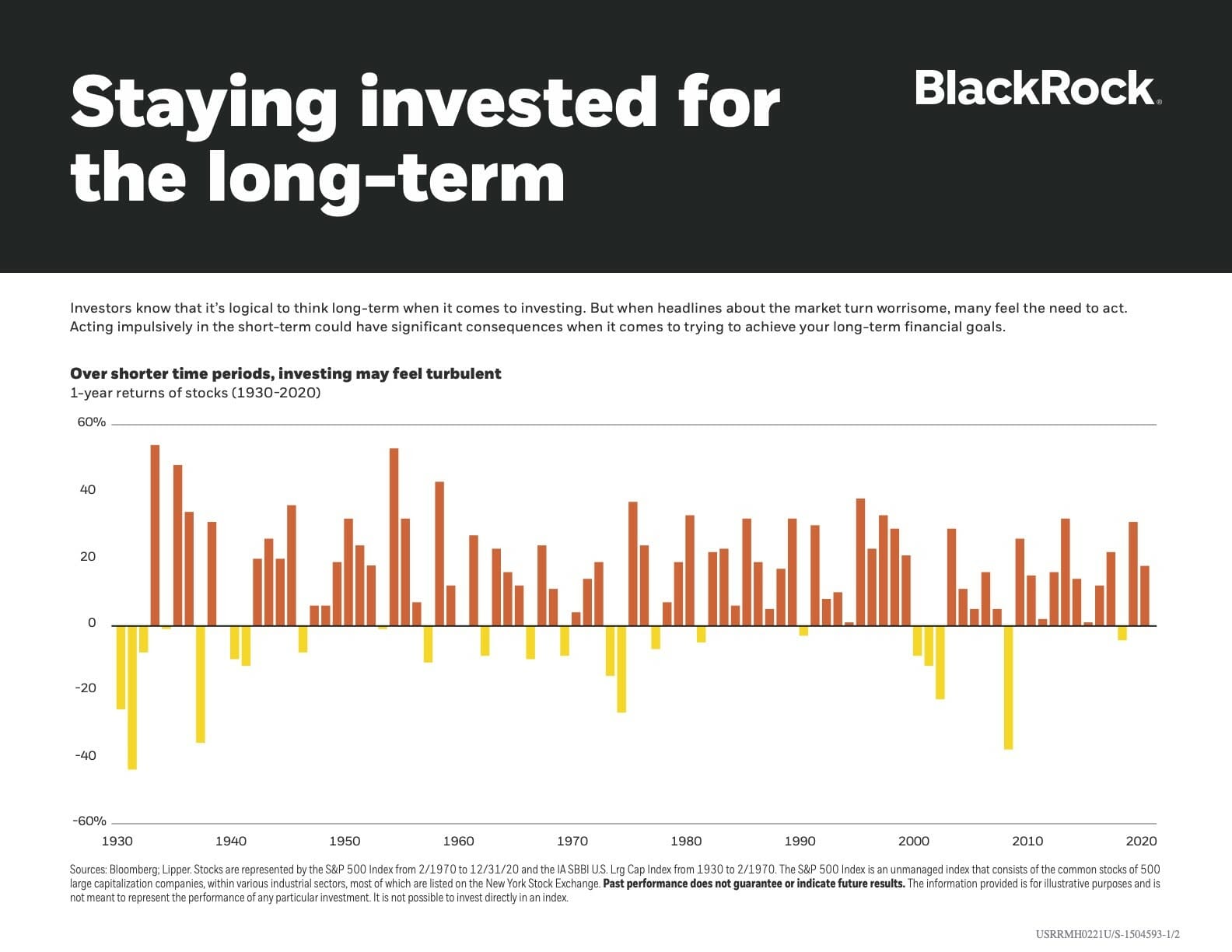

Not that we recommend following the technical trends, but it seems every year, once the fall and winter holidays are near, the market does very well. Does this mean you should take your gains and cash in and get out of the market? No, not really, because there never is a good time to just get out of the market. Historically speaking, November-May is a really bad time to be in cash. Below are some charts that show the difference between long-term investing and timing the market. As you can see, the S&P 500 Index using a time-in-the-market model by staying invested for all the ups and downs is the best option in the long-term.

The long-term average of the stock market is why you want to stay in the market. Even when it tanks, it comes back, and lately it comes back pretty quickly.

Time-in the market

At Goodwin Investment Advisory, we believe in time-in, not timing. We do not go to cash. The reason we support the time-in-the market model is because keeping your investments in the market long-term–even through all the ups and downs–allows you to see the most reward. Despite the dips in the market, trends show that staying in for the long haul and not timing the market is typically the wisest choice.

See our core guiding portfolio managing principles below:

1. Use a systematic approach – Never time the market and go to cash

2. Never liquidate the portfolio and go to cash

3. Always diversify using funds, not individual stocks or bonds

4. We design and manage portfolios based on the process below:

1. Start with the goal in mind and build a time-tested assets allocation using asset classes with historically persistent sources of return

2. Adapt to changing market conditions by making calibrated adjustments to risk exposures, and opportunities as the investment landscape changes

3. Select appropriate investment vehicles to gain exposure to desired asset classes

4. Use technology to understand and manage investment risk within the portfolio

The bottom line is just enjoy the ride, keep your emotions in check, diversify and manage risk based on your investment time horizon. When the market is good or bad, stay in the market for the long haul–you will be glad you did!