Friday, May 14, 2021

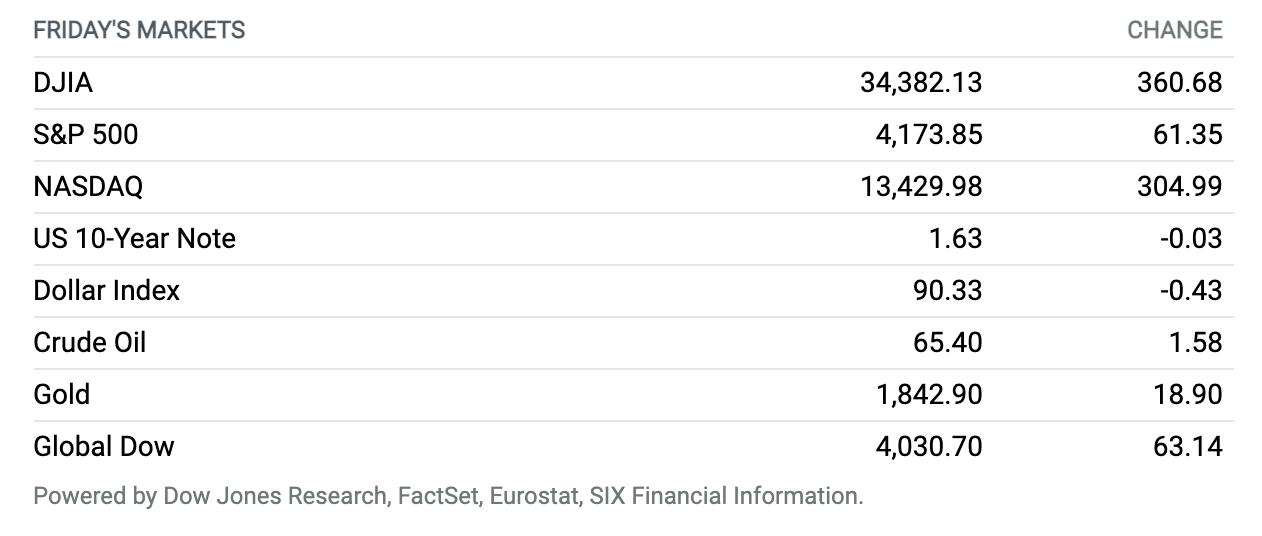

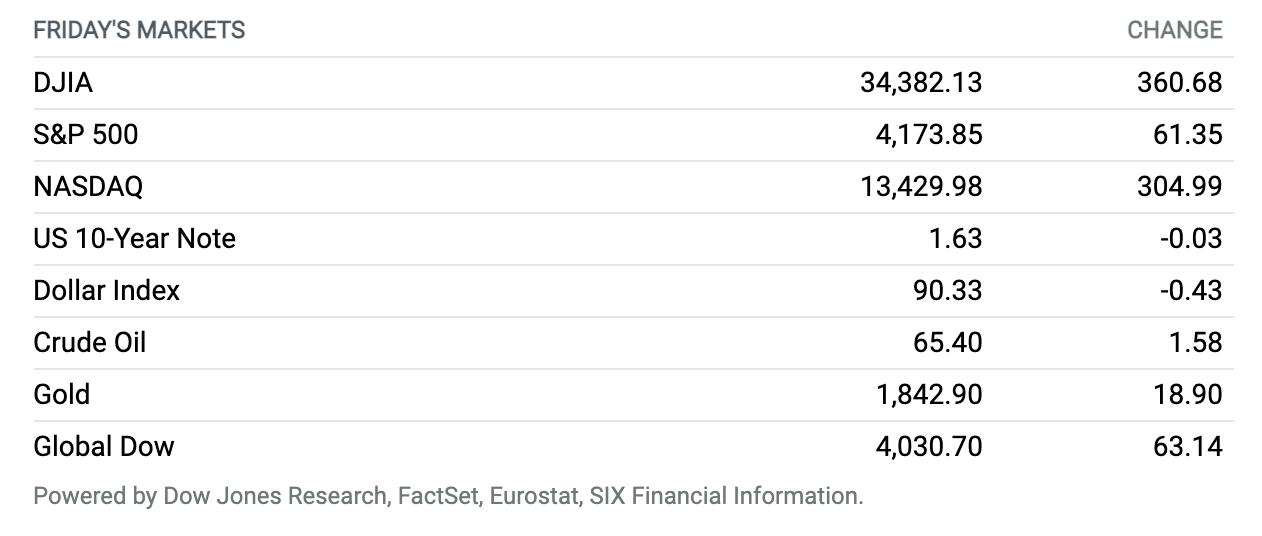

Dow Ends 360 Points Higher as Stocks Trim Weekly Decline. Stocks ended with strong gains Friday, building on the previous session’s bounce as major benchmarks trimmed weekly losses. The Dow Jones Industrial Average rose around 361 points to end near 34,382, according to preliminary figures. The S&P 500 finished around 61 points higher, near 4174, while the Nasdaq Composite rallied around 305 points to close near 13,430. Friday’s gains were broad based, with tech-related shares rising alongside stocks tied more closely to the economic reopening. Equities slumped earlier in the week and tumbled hard on Wednesday after data showed a hotter-than-expected rise in the April consumer price index. The bounce left the Dow with a weekly loss of 1.1%, while the S&P 500 stumbled 1.4%, and the Nasdaq declined 2.3%.

Fully Vaccinated People Don’t Need Face Masks Indoors, CDC Says

Fully vaccinated people don’t need to wear a mask or physically distance during outdoor or indoor activities, large or small, federal health officials said, the fullest easing of pandemic recommendations so far.

The fully vaccinated should continue to wear a mask while traveling by plane, bus or train, and the guidance doesn’t apply in certain places like hospitals, nursing homes and prisons, the U.S. Centers for Disease Control and Prevention said this week.

The agency said it was making the revisions based on the latest science indicating that being fully vaccinated cuts the risk of getting infected and spreading the virus to others, in addition to preventing severe disease and death.

Continue reading ›

U.S. Job Openings Soar to Record 8.1 Million, but Businesses Can’t Find Enough Workers

Businesses have a record 8.1 million jobs to fill. The problem, they say, is getting enough people to fill them.

Job openings in the U.S. topped 8 million in March for the first time ever, the Labor Department said this week. There were 7.5 million open jobs in February.

Continue reading ›

Retail Sales Were Flat in April. Economists Expected Growth.

Retail sales were roughly flat month over month in April, according to data from the Census Bureau, falling short of the nearly 1% growth economists predicted. March’s retail-sales growth was revised upward to 10.7% from 9.8%, a big jump that came in part because of the latest round of government stimulus checks.

Excluding gasoline and autos, retail sales dropped 0.8% last month. That said, on a year-over-year basis, things looked much brighter. Retail sales jumped 51.2% in April, not surprisingly given that the initial Covid-19 restrictions in the spring of 2020 closed stores and put many Americans out of work.

Continue reading ›

Facebook Faces Suspension of Data Transfers in Europe

Ireland’s High Court on Friday allowed the country’s Data Protection Commission to continue with a procedure that could lead to a ban of Facebook’s data transfers from the European Union to the U.S.

The DPC issued a provisional order last year saying that the mechanism Facebook uses for data transfers from Europe to its U.S. computer servers “cannot in practice be used.”

Continue reading ›

Tesla Will Stop Accepting Bitcoin for Environmental Reasons

Tesla won’t accept Bitcoin for vehicle purchases anymore because of environmental reasons, CEO Elon Musk tweeted late Wednesday, shaking up the world of cryptocurrencies for the second time in less than a week.

Musk told his more than 54 million followers that the electric vehicle pioneer is concerned coal being used to generate electricity for Bitcoin mining. Many cryptos are created—or mined in industry jargon—by computers that use electricity.

Continue reading ›

CDC Panel Recommends Pfizer’s Covid-19 Vaccine in Younger Teens. What Comes Next?

A key Centers for Disease Control and Prevention advisory committee has recommended that teenagers aged 12 to 15 receive Pfizer’s Covid-19 vaccine.

The guidance offers promising signs for the future of the Covid-19 vaccination campaign, and more indications that the messenger RNA-based vaccines will continue to play the leading role.

Continue reading ›

Mortgage Rates Fell Again This Week. Inflation Could Reverse the Trend.

The average mortgage rate was below 3% for the fourth consecutive week, according to Freddie Mac’s Primary Mortgage Market Survey released Thursday. Rising inflation could reverse the trend.

The average rate on a 30-year fixed-rate mortgage was 2.94% this week, according to Freddie Mac. That’s a decrease of two basis points from last week and 24 basis points lower than 2021’s high of 3.18% the first week of April. (One basis point equals one-hundredth of a percentage point.)

Continue reading ›

Surging Inflation Roils Markets

April’s inflation report is out, and it was a doozy. But there might have been less to it than meets the eye.

Yes, consumer-price inflation was strong, no matter how you looked at it. The consumer-price index rose 4.2% from a year ago and 0.8% from March. Removing food and energy prices doesn’t make the data look any weaker, with core CPI rising 0.9% in April from March and 3% year over year. Needless to say, those numbers, the strongest in decades, easily surpassed economists’ forecasts.

Continue reading ›

Marijuana Megamerger Would Create a U.S. Cannabis Giant

Trulieve Cannabis said it plans to acquire Harvest Health & Recreation in a $2.1 billion all-stock deal. The U.S. cannabis deal would give Florida’s dominant player a notable southwestern U.S. footprint.

Trulieve and Harvest Health combined would be one of the largest cannabis companies in the world, in terms of sales. Combining analyst estimates for both companies puts the estimated 2021 revenue at $1.24 billion, only slightly below consensus estimates for Curaleaf at $1.26 billion. Trulieve would also be the most profitable, notes CEO Kim Rivers, pointing to consensus estimates for combined 2021 adjusted earnings before interest, taxes, depreciation, and amortization, or Ebitda, of $461 million.

Continue reading ›

The Job Market Is Starting to Send Mixed Signals. Watch the Manufacturing Sector

Businesses and school districts say they want to hire. So why aren’t they? It’s an important puzzle, and anyone interested in the answer should focus on what’s happening in the manufacturing sector.

Consider the job numbers released last week, which weren’t just disappointing, but also confusing. Outside of leisure and hospitality and personal services, the private sector shed 157,000 payroll jobs in April. And while the weakness in sectors such as home building and motor-vehicle manufacturing can be attributed to shortages of specific inputs such as lumber and microprocessors, that doesn’t explain why hiring in the rest of the economy was so poor even as consumer spending is still at all-time highs.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.