Friday, December 11, 2020

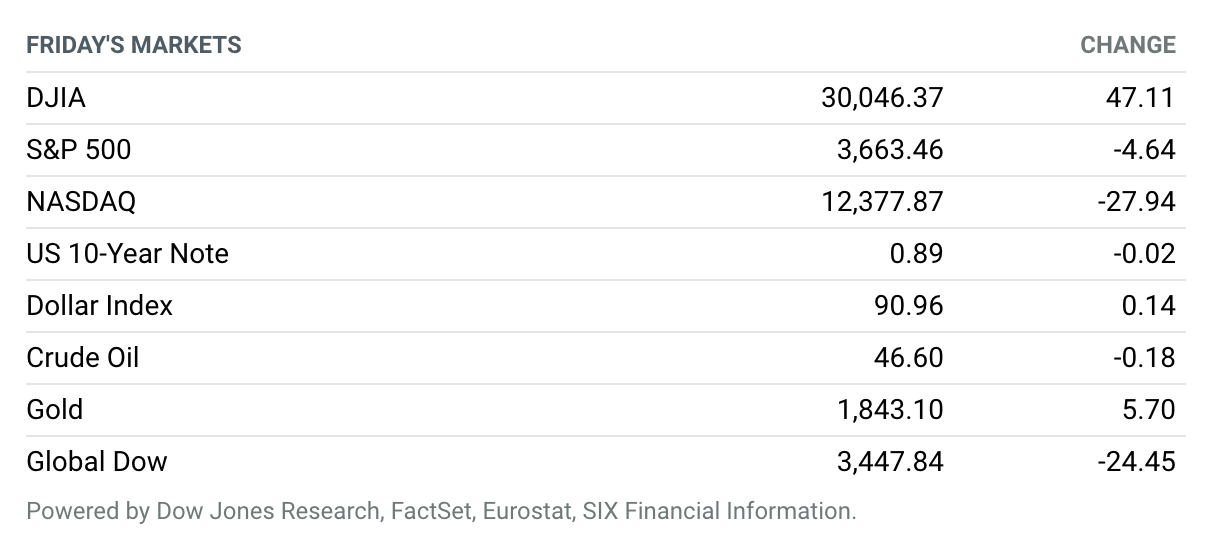

Investors Still Waiting on Stimulus Package. U.S. stock indexes finished mixed Friday, capping a week marked by unsteady progress toward another coronavirus relief package by Congress and thus-far unsuccessful negotiations on Britain’s trade relationship with the European Union. Hand-wringing about overly bullish sentiment and lofty valuations, despite progress on a coronavirus vaccine rollout, has also unsettled investors after stock indexes hit new highs earlier in the week. The Dow Jones Industrial Average gained 47 points, or 0.2%, to close at 30,046. The S&P 500 index retreated about 5 points to reach 3663, a decline of 0.1%, and the Nasdaq Composite Index lost 28 points, or 0.2%, to close near 12,378. For the week, the Dow slipped 0.6%, the S&P 500 index shed 1%, and the Nasdaq Composite lost 0.7%.

FDA Advisory Committee Recommends Authorization of Pfizer’s Covid Vaccine

In Thursday’s daylong review of the Covid-19 vaccine developed by Pfizer and BioNTech, there seemed little doubt that the shots work. A panel of outside advisors to the U.S. Food and Drug Administration discussed the 95% efficacy demonstrated in the vaccine’s clinical trial, but spent most of the day asking scientists from Pfizer and the FDA about the safety evidence from the vaccine’s accelerated clinical trial.

At the end of the day, the advisors voted 17 to 4 to recommend authorizing the Pfizer/BioNTech shots as America’s first vaccine against Covid, with one abstention. The FDA’s reviewers have already said they’re convinced of the vaccine’s safety and efficacy, so an emergency use authorization will quickly ensue. Pfizer and the federal government’s Operation Warp Speed have already distributed doses, so vaccination can begin shortly after FDA authorization.

Next week, the FDA’s advisors will discuss the vaccine from Moderna, whose clinical trial provided similarly good results.

Facebook Is Hit With Lawsuits by 48 States, Federal Trade Commission

The U.S. Federal Trade Commission and 48 state attorneys general filed two separate lawsuits, accusing Facebook of maintaining an alleged monopoly, eliminating perceived threats through acquisitions, and hurting third-party developers who use the social-networking company’s platform.

The lawsuits accuse Facebook of seeking to limit competition to protect an alleged monopoly, both through the acquisitions of Instagram and WhatsApp for $1 billion and $19 billion, respectively, and via the terms it imposes on developers of software that accesses its platform.

U.K. and EU Leaders Prepare the Public for a Hard Brexit

U.K. Prime Minister Boris Johnson and Ursula von der Leyen, the president of the European Commission, said on Friday that the U.K. is likely to crash out of the European market at the end of the year without a trade treaty on the U.K. and European Union’s future relationship, two days after a dinner in Brussels that failed to bridge what both sides have called “wide differences” on substantive matters.

That is, at least, something both leaders agreed on, after 10 months of tense negotiations that failed to produce any results in the harsh light of the country’s intense political debate on the real meaning of Brexit.

Disney Lays Out Its Streaming Future

Walt Disney executives laid out the next chapter in the company’s direct-to-consumer streaming-focused evolution at an investor day on Thursday afternoon, and set ambitious targets for the company’s future subscriber and content investment goals. It’s also raising the cost of Disney+, the breakout streaming service of the past year.

Disney management now expects Disney+, Hulu, and ESPN+ combined to have up to 350 million subscribers in four years, when the company could be spending $16 billion a year just on content for its streaming services.

Airbnb Stock Soars in Its Market Debut

Shares of Airbnb soared nearly 143% in its first day as a public company.

The stock opened at $146 and hit a high on Thursday of $165. At $165, Airbnb has a market capitalization of $114.8 billion. Shares traded lower on Friday and closed around $141.

The home sharing network raised $3.5 billion late Wednesday, selling 51,551,723 Class A shares at $68 each. The $68 price was above the $56 to $60 price range the company set earlier this week, and higher than previous expectations of $44 to $50.

DoorDash Stock Opens 80% Higher Than IPO Price

DoorDash priced its initial public offering at $102 a share on Tuesday night, above an already increased price range of $90 to $95 a share. The IPO’s bankers still weren’t aggressive enough: DoorDash opened for trading early Wednesday afternoon at $182 a share, 78% above the IPO price. At $182, DoorDash has a market value of about $69 billion.

DoorDash has thrived during the Covid-19 pandemic, as consumers and restaurants alike turned to food delivery. DoorDash had 2019 revenue of $885 million, up 204% from the prior year. For the nine months through Sept. 30, revenue was $1.9 billion, up 226%, with the pandemic adding fuel to the company’s growth.

Jobless Claims Soar as Covid Resurgence Hits Economy

The number of people filing initial unemployment claims surged last week as rising coronavirus cases caused a new wave of restrictions on business activity.

Some 853,000 people filed new claims for the week ended Dec. 5, marking an increase of 137,000 from the prior week’s upwardly revised level of 716,000, according to data released by the Labor Department Thursday. The jump in initial claims pushed the four-week moving average up by 35,500 to 776,000. It was the highest claims number in three months.

Apple Plans Next Series of Mac Chips

Apple has taken a further step into the chip-making business it began with iPhone processors. Bloomberg News reported Monday that the company has elected to develop and offer more advanced versions of the PC chips it announced earlier this year.

The news service reported that Apple was making new chips that are supposed to be better than those produced by Intel, the main provider of semiconductors for Apple products. The Bloomberg article said Apple will may sell the new chips next year, and may include them in several Mac products, but didn’t offer much detail beyond that.

Universal Music Buys Bob Dylan’s Entire Catalog

Universal Music has bought the entire back catalog of Bob Dylan’s songs, the company announced Monday, describing the deal as “one of the most important” music publishing agreements of all time.

The deal covers more than 600 song copyrights spanning 60 years including “Blowin’ In The Wind,” “The Times They Are a-Changin’,” “Like A Rolling Stone,” “Lay Lady Lay,” (and) “Forever Young,” Universal Music said in a statement.

CEOs of Big Companies Pledge $100 Million for Initiative to Hire 1 Million Black Workers

Chief executives from 37 of the biggest U.S. companies including Merck, Nike, and Walmart have banded together to ensure more Black Americans get a better shot at success in the business world.

The group will spend $100 million next year to launch a talent recruitment startup called OneTen with a mission to help companies hire 1 million Black workers over the next decade.