Friday, October 30, 2020

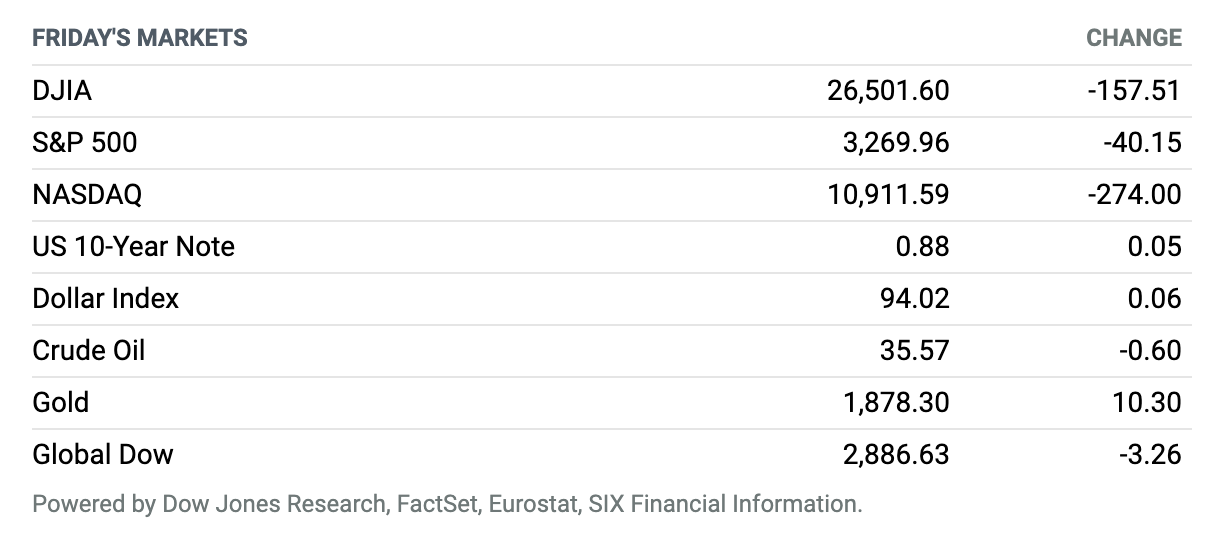

Down Week, Down Month. Stocks pared losses but still closed lower on Friday to end an ugly week on a down note, with the Dow Jones Industrial Average booking its biggest monthly drop since March as investors reacted to rising Covid-19 cases in the U.S. and Europe. Nervousness ahead of Tuesday’s presidential election—and the potential for an unclear or contested outcome—was also seen contributing to increased volatility, analysts said, with all three major indexes seeing their biggest weekly declines since the worst of the pandemic-inspired selloff in March. The Dow fell around 158 points, or 0.6%, to end near 26,502, while the S&P 500 lost around 40 points, or 1.2%, to finish near 3270, and the Nasdaq Composite gave up around 274 points, or 2.4%, to close near 10,912. The S&P 500 ended the week down 5.6% and fell 2.8% for the month, while the Dow booked a 6.5% weekly fall and a 4.6% monthly drop. Friday’s decline saw the Nasdaq turn negative for the month, falling 2.3%. The index was down 5.5% for the week.

The U.S. Economy Bounced Back in a Big Way, but It Still Has a Long Way to Go

The U.S. economy grew at a record 33.1% annualized pace during the third quarter, beating forecasts for 30.9%—but it still has a long way to go to return to pre-coronavirus levels.

The big jump in third-quarter GDP came after a 31.4% drop during the second quarter, and U.S. GDP remains 3.5% lower than it was at the end of last year. Consumption, which rose 40.7%, helped drive the recovery, and is only down 3.3% in 2020. “Overall, a solid read versus expectations,” writes BMO Capital Markets strategist Ian Lyngen.

Incomes Rebounded in September, and Consumers Spent More Freely

Americans’ pace of spending picked up in September amid a rebound in income as more businesses reopened and rehired workers, but a surge in coronavirus infections and lack of fiscal stimulus threaten to undermine the recovery.

Personal consumption expenditures increased 1.4% last month from August, the Commerce Department said Friday, better than the 1% increase expected by economists polled by the Wall Street Journal. The recent gains in spending have trailed well behind the snapback seen in May and June, when spending surged 8.7% and 6.5%, respectively, after lockdowns meant to slow the spread of the coronavirus were eased.

Jobless Claims Are at Lowest Level of Crisis

Roughly 751,000 Americans filed for unemployment for the first time in the week ended Oct. 24, data from the Labor Department showed Thursday. Economists had expected that 778,000 Americans sought initial claims in the latest week.

Thursday’s release marked an improvement from the prior week’s upwardly revised figure of 791,000 people newly seeking unemployment benefits. It also marked a new low in claims data since the economic shutdowns spurred by the coronavirus pandemic put millions of Americans out of work.

Alphabet Sales Growth Returns to Prepandemic Level

Alphabet gave investors reason to cheer late Thursday when it reported earnings, returning sales and profit growth to levels more consistent with pre-Covid-19 pandemic levels.

Google’s parent company handily beat Wall Street expectations amid what appears to be a broad rebound in online advertising spending. Alphabet reported third-quarter net income of $11.25 billion, which amounts to $16.40 a share, compared with a profit of $7.07 billion, or $10.12 a share, a year ago. Revenue rose 14% to $46.17 billion from $40.50 billion in the year-ago period.

Despite Drop in iPhone Sales, Apple Results Beat Estimates

Apple late Thursday posted slightly better-than-expected sales and profits for its fiscal fourth quarter ended Sept. 26. Revenue came in at $64.7 billion, up about 1% from a year ago and slightly ahead of the Wall Street consensus of $64.2 billion. Profits were 73 cents a share, two pennies ahead of consensus.

iPhone sales in the quarter were $26.4 billion, down 20.7% from the year-ago period, as demand slowed ahead of the iPhone 12 launch. But the company saw strength across its other segments. Mac sales were $9 billion, up 29%. iPad sales were $6.8 billion, up 46%. Wearables sales increased 20.8%, to $7.9 billion. Services revenue was $14.5 billion, up 16.3%.

Amazon Delivers Stellar Results

Amazon.com posted better-than-expected third-quarter results, as the company continued to benefit from the growth in e-commerce during the Covid-19 pandemic.

For the quarter, Amazon posted sales of $96.1 billion, up 37%, and well ahead of the company’s guidance range of $87 billion to $93 billion. Operating income was $6.2 billion, likewise ahead of its guidance range of $2 billion to $5 billion. Earnings were $12.37 a share, well ahead of the Wall Street analyst consensus at $8.87 a share.

AMD Agrees to Buy Xilinx for $35 Billion in Latest Effort to Take On Rival Intel

Advanced Micro Devices said early Tuesday that it had reached an agreement to acquire semiconductor maker Xilinx for $35 billion.

The acquisition could be transformative for AMD, giving it more resources and new business lines to better compete with its larger rival Intel, especially with chips designed for data centers and other cloud computing applications.

Boeing Cutting More Jobs in Response to Pandemic

Boeing said it will cut more jobs and review jetliner production rates in an effort to stop bleeding cash as the coronavirus pandemic roils global air travel.

Faced with a pileup of undelivered aircraft, the company said it would review its commercial aircraft production levels as airlines are either unable or unwilling to accept its newly produced jets amid a prolonged slump in passenger demand for flights.

China’s Ant Group to Raise $34 Billion in Record IPO

Ant Group’s long-awaited initial public offering could raise roughly $34.4 billion when the company goes public next week.

The IPO will take place on both the Hong Kong stock exchange and the Shanghai STAR Market. Ant is offering 1.67 billion shares in both Hong Kong and Shanghai, representing $17.2 billion in Hong Kong at 80 Hong Kong dollars a share and roughly the same amount in Shanghai at 68.8 yuan, according to regulatory filings.

Software Giant SAP Cuts Outlook Because of Covid-19

SAP cut its 2020 outlook and pushed out midterm goals by two years, owing to fallout from the Covid-19 pandemic. The news sparked the worst one-day decline in the company’s stock price in more than two decades.

“While SAP continues to see robust interest in its solutions to drive digital transformation as customers look to emerge from the crisis with more resilience and agility, lockdowns have been recently reintroduced in some regions and demand recovery has been more muted than expected,” the German business software company said in a statement.