Friday, October 23, 2020

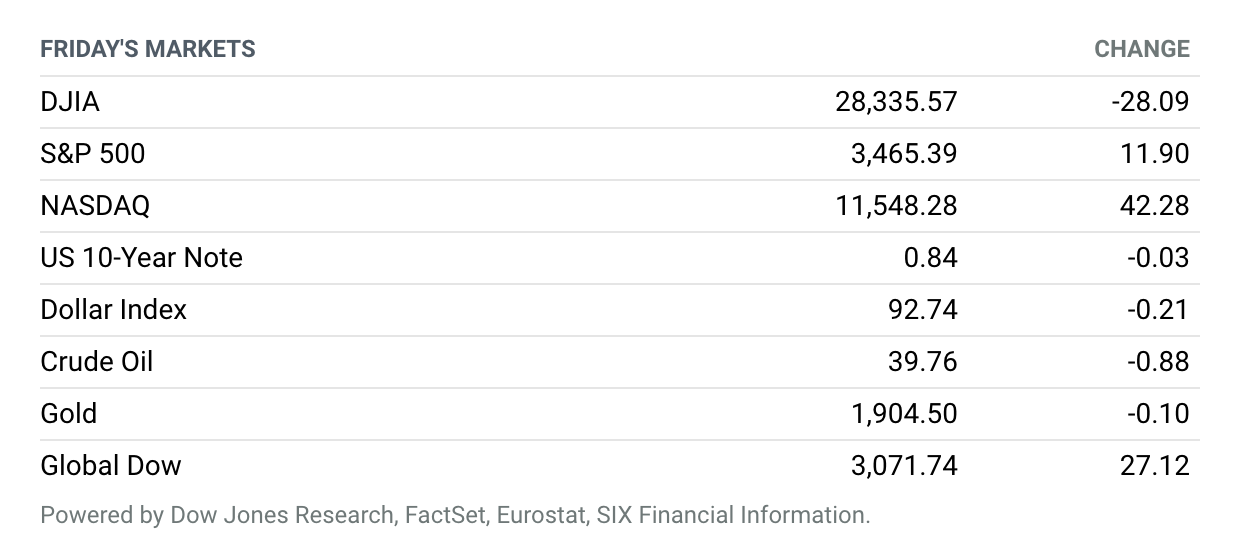

Stimulus Wait Drags On. The Dow Jones Industrial Average ended slightly lower Friday, with major benchmarks logging modest weekly declines as efforts toward a new round of coronavirus aid spending out of Washington failed to yet bear fruit. The Dow fell around 28 points, or 0.1%, to end near 28,336, according to preliminary figures, while the S&P 500 gained 12 points, or 0.3%, to close around 3465. The Nasdaq Composite ended near 11,548, up 42 points, or 0.4%. The Dow lost 0.9% for the week, while the S&P 500 was down 0.5%, and the Nasdaq lost 1.1%.

U.S. Economic Activity Picks Up While Europe’s Stalls

Economic activity in the U.S. grew at the fastest pace in more than a year and a half as businesses anticipated greater demand, an easing of coronavirus-related restrictions, and less uncertainty following November’s election, surveys of purchasing managers showed.

The U.S. survey figures are the latest sign the economy continues to recover from the shock created by the coronavirus pandemic. Worker filings for jobless benefits so far this month fell to the lowest level since the pandemic started, and existing-home sales rose 9.4% in September, a 14-year high.

The rush in optimism stands in contrast with Europe, where a resurgence of coronavirus cases and new business restrictions are threatening to halt the region’s economic recovery.

Jobless Claims Finally Drop Below 800,000

Some 787,000 Americans filed for first-time unemployment benefits this past week, far better than the 870,000 that economists had been predicting and down from a revised 842,000 the previous week. Continuing claims fell to 8.373 million, while economists had been predicting 10.02 million.

In recent weeks, jobless claims had been unable to drop below 800,000, and had started edging back to 900,000, raising concerns that the labor market had gotten as good as it could get. The current reading suggests those concerns were overblown.

Justice Department Sues Google

After months of swirling rumors, the Justice Department filed an antitrust lawsuit against Google on Tuesday, accusing the tech titan of operating several monopoly businesses related to its search services.

The Justice Department case, filed in the U.S. District Court for the District of Columbia, centers around Google’s search, alleging that it has used interlocking contracts to bar rivals from introducing competing search products on smartphones, browsers, and voice assistants. The lawsuit says that Google effectively controls or owns about 80% of the search queries in the U.S., and that competitors have no real chance to challenge the company.

Goldman Sachs Agrees to $2.9 Billion Settlement of 1MDB Scandal

Goldman Sachs Group has agreed to pay $2.9 billion to the U.S. Justice Department and regulators for its role in the 1MDB scandal, and it will claw back compensation for current and former executives.

The Wall Street bank entered into a deferred prosecution agreement with the Justice Department on Thursday, which charged the bank with conspiring to violate the Foreign Corrupt Practices Act in its dealings with officials in Malaysia and Abu Dhabi. Goldman Sachs’ Malaysian subsidiary pleaded guilty to one of the charges.

Purdue Pharma Pleads Guilty to Criminal Charges Over Opioid Sales

U.S. drugmaker Purdue Pharma pleaded guilty to three criminal charges over its intense drive to push sales of the prescription opioid OxyContin, which stoked a nationwide addiction crisis, the Justice Department announced Wednesday.

Purdue also agreed to $8.3 billion in fines, damages, and forfeitures to settle the criminal case against it, the department said. In a separate agreement, the billionaire Sackler family, which built Purdue to a pharmaceutical giant on the back of lucrative sales of OxyContin, agreed to pay $225 million to resolve civil liability charges filed by the Justice Department.

Walmart Sues Government in Pre-Emptive Move Ahead of Expected Opioid Lawsuit

Walmart sued the federal government in an attempt to strike a pre-emptive blow against what it said is an impending opioid-related civil lawsuit from the Justice Department.

The retail giant said in a lawsuit filed Thursday that the Justice Department and Drug Enforcement Administration are seeking to scapegoat the company for the federal government’s own regulatory and enforcement shortcomings in combating the opioid crisis. Walmart said the government is seeking steep financial penalties against the retailer for allegedly contributing to the opioid crisis by filling questionable prescriptions.

Remdesivir Gets FDA Approval. What It Means for the Drug’s Maker.

The antiviral drug remdesivir received marketing approval Thursday from the U.S. Food and Drug Administration as a Covid-19 treatment. For Gilead Sciences, which will market the drug under the brand name Veklury, the sales of the drug could help the company get through a period of increasing competition for its products treating HIV and hepatitis.

The FDA gave Veklury a broad approval, allowing its use in patients over the age of 12 who are hospitalized with Covid-19. A study published in October in The New England Journal of Medicine found that the drug reduced recovery times for hospitalized patients from an average of 15 days to 10. Other studies failed to find a benefit from the drug, but Gilead challenged their rigor, and the label approved by the FDA doesn’t mention them.

Why Quibi Is Shutting Down

The next big thing in entertainment could still be streamed short-form video content. But it won’t be Quibi.

Quibi Founder Jeffrey Katzenberg and CEO Meg Whitman wrote in a joint letter that the streaming service that raised around $1.75 billion will close shop. The pair pointed to the service’s timing and that its main premise may not have been “strong enough to justify a stand-alone streaming service.”

Netflix’s Subscriber Growth Disappoints

Netflix on Tuesday posted September quarter subscriber growth that fell short of both guidance and Wall Street expectations.

The streaming video giant added 2.2 million net new subscribers in the quarter, below the company’s forecast of 2.5 million, and well below recent Wall Street estimates, which in some cases topped 5 million. Revenue in the quarter was $6.4 billion, a little ahead of guidance at $6.3 billion but in line with Street estimates.

Conoco Phillips Agrees to Buy Concho Resources for $9.7 Billion

Conoco Phillips agreed to buy Concho Resources on Monday for $9.7 billion in stock, making it the largest oil and gas deal since the pandemic began. If approved, the combined company would become the largest independent producer of oil and gas in the country by far.

The merger news had surfaced in a report last week, and the price came in line with what many analysts had been expecting. The initial report last week did not specify a price, but analysts had assumed it would be a modest premium.