Friday, June 5, 2020

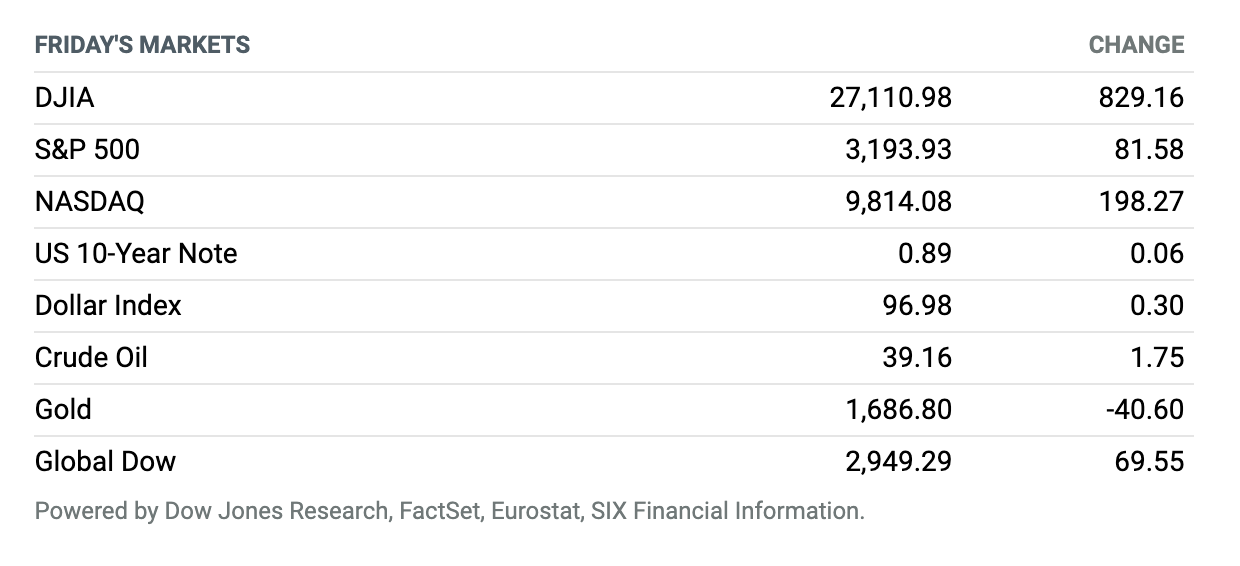

Jobs Surprise. Stocks soared Friday, with the Nasdaq Composite touching an all-time intraday high, as investors cheered a May jobs report that unexpectedly showed a 2.5 million rise in nonfarm payrolls and a fall in the unemployment rate. The Dow Jones Industrial Average rose around 829 points, or 3.2%, to finish near 27,111, according to preliminary figures, while the S&P 500 advanced around 82 points, or 2.6%, to close near 3194. The Nasdaq Composite finished 198 points higher, up 2.1%, near 9814, after earlier trading above its previous record close of 9817.18 from Feb. 19. Economists had expected the jobs report to show the U.S. economy had shed more than 7 million jobs. The unemployment rate fell to 13.3% from 14.7%, versus expectations for a rise toward 20%. Though analysts warned against reading too much into one month’s data, the magnitude of the surprise underlined expectations the economy could be poised to snap back relatively quickly as lockdowns put in place to contain the Covid-19 pandemic are lifted.

U.S. Added 2.5 Million Jobs Last Month, Defying Expectation for Huge Losses

Nonfarm payrolls rose in May—a surprise development that signals the worst of the coronavirus pandemic’s hit to the labor market has peaked and rehiring has started.

The Labor Department said Friday that payrolls rose by 2.5 million last month. That stems massive job losses that began in March as the coronavirus pandemic began to spread across the U.S. and prompt lockdown orders across the country. In April, nonfarm payrolls fell a revised 20.7 million and in March they declined 1.4 million. Rehiring pushed the unemployment rate down to 13.3% from 14.7% in April. Economists were looking for a jump to about 20%.

New Jobless Claims Continue to Slow as Lockdowns Ease

The pace of new claims for unemployment benefits continued to slow last week, underpinning investors’ hope that the coronavirus pandemic’s toll on the job market has peaked—but still reflecting staggering levels of unemployment that won’t quickly reverse.

In the week ending May 30, 1.88 million Americans filed for first-time unemployment insurance, the Labor Department said Thursday. That’s down from a revised 2.13 million a week earlier, and it marks the ninth straight weekly decline in the number of new claims.

U.S. Factory Data for May Was Better but Still Far From Normal

Many investors believe that May marked the inflection point for the U.S. economy, as businesses shut down by the coronavirus started to reopen. But a pair of manufacturing reports Monday highlight how far from normal conditions are going to remain in the coming months.

The Institute for Supply Management said its gauge of manufacturing activity in May rose to 43.1 from 41.5 in April, matching the improvement economists polled by FactSet expected. In a separate report, IHS Markit said its measure of U.S. factory activity increased to 39.8 last month from 36.1 a month earlier. While both indexes reflect improved conditions in May compared with April, the first and only full month of nationwide lockdowns, the latest figures still represent deep contractions (readings below 50 reflect contracting activity).

Chicken Company Executives Are Charged With Price-Fixing

Current and former executives at two U.S. chicken processors were charged with price-fixing on Wednesday. Price collusion is a big no-no in open markets, and stocks in several big protein producers plummeted as a result.

The Wall Street Journal reported that a federal grand jury in Colorado indicted current and former executives at Pilgrim’s Pride and privately held Claxton Poultry Farms, for alleged collusion that took place between 2012 to 2017. The companies have denied the allegations, according to the Journal. Pilgrim’s, which is controlled by Brazilian protein giant JBS, is one of the nation’s largest chicken processors. Two other publicly traded processors that aren’t part of the legal action but whose stocks were being hit on Wednesday are Tyson Foods and Sanderson Farms.

More Companies Are Taking a Stance on the Protests—Even When It Comes with Risks

Once upon a time, companies were reluctant to wade into debates over social issues for fear of alienating their customers. Today, many feel they must weigh in, although their efforts sometimes fall flat. And while they might not be rewarded for it, they don’t seem to be getting punished for it either—even when they miss the mark.

Following the killing of George Floyd last week, publicly traded companies and other popular brands issued statements denouncing racism, and some have even offered support for the Black Lives Matter movement and protesters across the country. Getting their statements right, however, hasn’t been easy, and critics on Twitter were quick to point out any miscues, especially when a company’s words didn’t match its previous actions toward employees and other stakeholders.

Airline Stocks Spike. It Looks Like Short Covering.

Airline stocks continued to soar on Friday, with some of the most beaten-down ones rallying more than 20%, following huge moves on Thursday. But analysts expressed skepticism that the big moves reflected anything more than a short squeeze, as investors who had bet against the stocks bought shares to cover their positions.

Shares of American Airlines Group surged a record 41% on Thursday to $16.72 after the carrier announced an upgraded summer flight schedule in which it plans to rebuild domestic capacity to 55% of 2019 levels and international flights to 20%. The stock continued to soar Friday, gaining more than 21% in recent trading. Other heavily shorted airline stocks also rallied, with Spirit Airlines gaining 20% and United Airlines Holdings up more than 18%.

Las Vegas Casinos Reopen for Business

Dozens of casinos in Las Vegas opened for business again on Thursday after being closed since March. Some were so anxious to get the slots spinning again that they started at 12:01 a.m.—the first legally sanctioned minute they could open.

Their success at drawing customers while keeping Covid-19 at bay will be closely watched. The disease spreads easily in crowded enclosed spaces, scientists have warned. Casino operators say their infection protocols—like frequent cleaning and temperature checks of staff—will keep their customers and staff safe.

ZoomInfo Prices IPO at $21 a Share. Stock Soars 90% on First Trade.

With every passing day, indications grow that the new offering market has reopened for business.

In a recent example, ZoomInfo Technologies late Wednesday priced an initial offering of 44.5 million class A common shares at $21, giving the company a valuation of about $8.2 billion. (Note that ZoomInfo has no connection to Zoom Video Communications, the red-hot videoconferencing company.) A few hours after the pricing, the stock opened for trading at $40, up 90%. It was trading at $36.78, up 75%, as of 1 p.m. on Thursday.

Warner Music Group Shares Surge on Debut

Shares of Warner Music Group rose sharply on their trading debut on Wednesday. The stock opened at $27 and was up about 15%, to $28.85 in midday trading that day on the Nasdaq market.

Earlier, Warner Music had priced an offering of 77 million Class A shares at $25 a share. That was in the middle of the initial public offering’s projected range of $23 to $26. The size of the offering has been expanded from an originally expected 70 million shares. All of the proceeds will go to Access Industries, a company controlled by the Russian-born, U.K.-based billionaire investor Leonard Blavatnik.

Zoom Video Earnings and Sales Blow Away Expectations

Zoom Video Communications Inc. became a household name during the pandemic, and it showed off the financial effects of its growth Tuesday—record sales and earnings, and expectations for more amid booming stock prices.

Zoom reported net income of $27 million, or 9 cents a share, compared with net income of $2.2 million, or less than a penny a share, in the year-ago quarter. After adjusting for stock-based compensation and other factors, Zoom reported earnings of 20 cents a share, up from 3 cents a share a year ago. Revenue improved 169% to $328.2 million from $122 million a year ago. Analysts surveyed by FactSet had expected adjusted earnings of 9 cents a share on sales of $230.6 million.